A look at how Avalanche fared in Q3

- User activity and fees fell on Avalanche C-Chain and subnets in Q3.

- NFT sales volume was “quiet” during the quarter under review.

Proof-of-stake- blockchain network Avalanche [AVAX] saw a significant decline in network activity and revenue between July and September, Messari found in a new report.

Realistic or not, here’s AVAX’s market cap in BTC terms

In the report titled “State of Avalanche Q3 2023,” the on-chain data provider found that the last quarter was marked by a general decline in user activity and protocol revenue for the Layer 1 (L1) network.

Low user activity and network fees

While the network is made up of the P, X, and C-Chains, the C-Chain is considered to be the most important chain in the Avalanche network because it allows users to create and interact with decentralized applications (dApps).

According to Messari, during the period under review, the average count of daily active addresses on Avalanche C-Chain totaled 99,729. This represented a whopping 59% decline from the 243,813 recorded in average daily active addresses count between April and June.

Regarding daily transactions on the network, Avalanche recorded an average daily transaction count of 900,000 across its C-Chain and its 14 subnets in Q3. These subnets are custom blockchains that are built on top of the Avalanche network. They are created by a group of validators who agree to run the subnet and validate transactions.

On its C-Chain, the number of daily transactions fell by 29%, while on its subnets, it saw a 50% drop in daily transactions.

Moreover, USD-denominated fees paid to process transactions on Avalanche decreased in Q3. However, in AVAX terms, fees paid increased by 61% in Q3 compared to Q4 of the previous year.

According to Messari:

“Part of the QoQ decrease likely came from the aforementioned LayerZero-dominance of network activity, as transaction fees associated with LayerZero or Stargate contracts accounted for 43% of fees paid in the quarter.”

The DeFi and NFT verticals

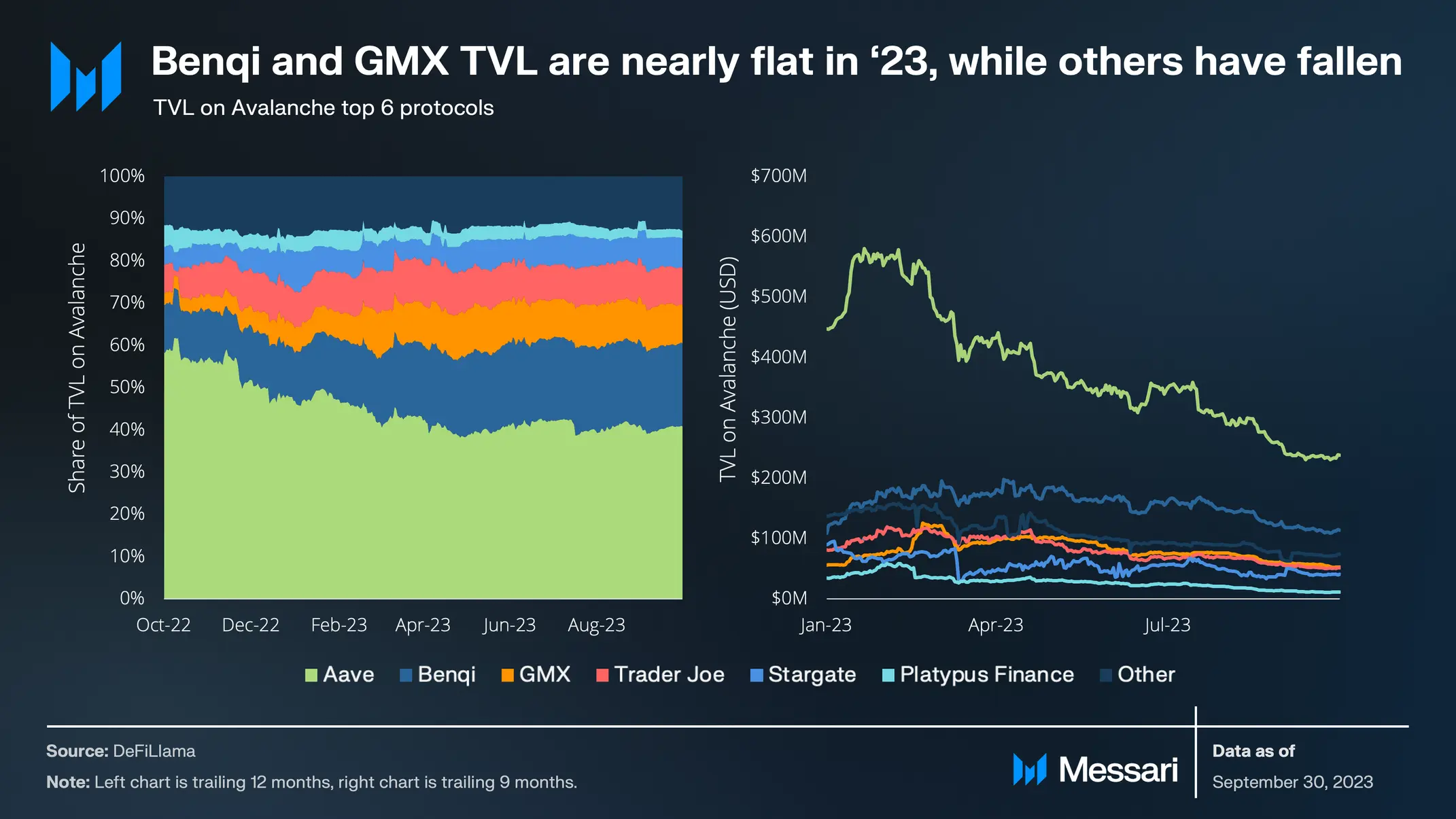

Messari assessed the performance of the decentralized finance (DeFi) protocols housed within Avalanche and found that during the period under review, decentralized crypto lending platform Aave remained the top protocol on the chain despite the TVL decline it witnessed in Q2.

It noted further that liquid staking platform Benqi came in second place, although it saw a 3% TVL drop in Q3.

Is your portfolio green? Check out the AVAX Profit Calculator

Messari added:

“Avalanche welcomed some EVM behemoths in Q3, with Uniswap and Balancer launching on the chain. The two bring competition to the DEX space, where Trader Joe reigns supreme with over $50 million in TVL.”

As for activity around the NFT projects on Avalanche, the chain “had its quietest quarter for NFT volumes in USD terms, despite a second consecutive quarter of rising sales,” the report stated.