Hedera’s Q3 defies crypto market downturn

- Hedera recorded significant success in Q3.

- The value of its native coin, its DeFi TVL, and NFT trading activity all increased.

Public-permissioned Proof-of-Stake (PoS) blockchain network Hedera Network [HBAR] witnessed significant ecosystem growth in the third quarter of the year, on-chain analytics firm Messari found in a new report.

How much are 1,10,100 HBARs worth today?

Hedera’s tale of success

A significant growth recorded within the Hedera ecosystem during the quarter under review was an uptick in its native coin’s market capitalization.

In Q3, the broader crypto market recorded a modest decline despite the positive legal outcomes from the Ripple and Grayscale cases. The overall crypto market shrunk by 5.8%, with leading coins Bitcoin [BTC] and Ethereum [ETH] witnessing respective drops of 7.5% and 10.0%, respectively.

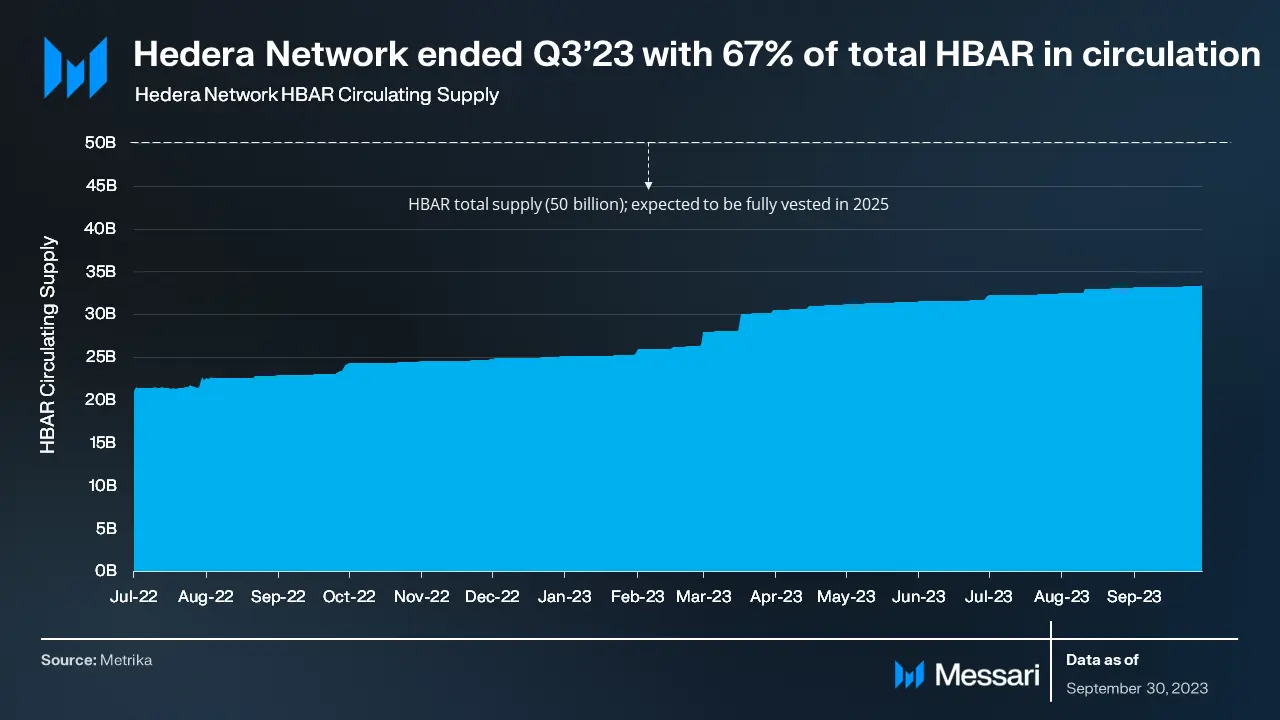

HBAR, on the other hand, diverged and recorded an 8% growth in its circulating market capitalization. Likewise, its fully diluted market capitalization rose by 3% to reach $2.5 billion by the close of September.

According to data sourced from CoinMarketCap, at press time, Hedera ranked as the 31st largest crypto protocol based on the market capitalization of its native token.

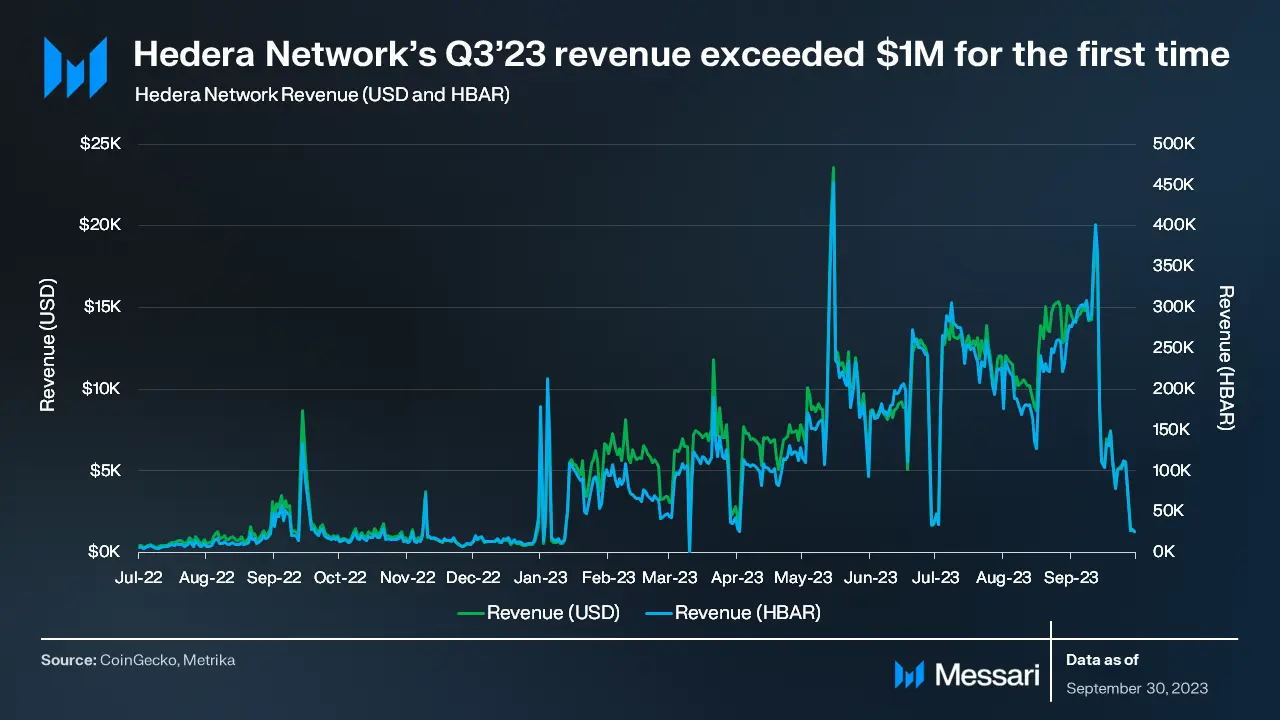

Further, Hedera’s revenue crossed $1 million for the first time ever since its launch during the quarter under review. Notably, the protocol’s revenue derived from transaction fees surged by 30% between July and September.

According to Messari:

“This rise in revenue was attributed to a 37% quarterly growth in transactions. Dominating this transaction activity was the Hedera Consensus Service, which accounted for more than 99% of total transactions and, consequently, was the principal source of the Hedera Network’s revenue growth.”

Moreover, Hedera’s DeFi ecosystem saw its total value locked (TVL) increase by 29% in Q3. At press time, the network’s TVL was $30 million, rising by 30% on a year-to-date (YTD), according to data from DefiLlama.

Messari added:

“The rise in TVL during a bear market is attributed to the debut of new protocols. SaucerSwap, the first to launch, has retained its lead in the Hedera ecosystem. By the end of the third quarter, SaucerSwap’s TVL was $27 million, making up 87% of the Hedera Network’s total TVL. Following SaucerSwap, HeliSwap had a TVL of $4 million, and Pangolin registered at $110,000.”

Read Hedera’s [HBAR] Price Prediction 2023-24

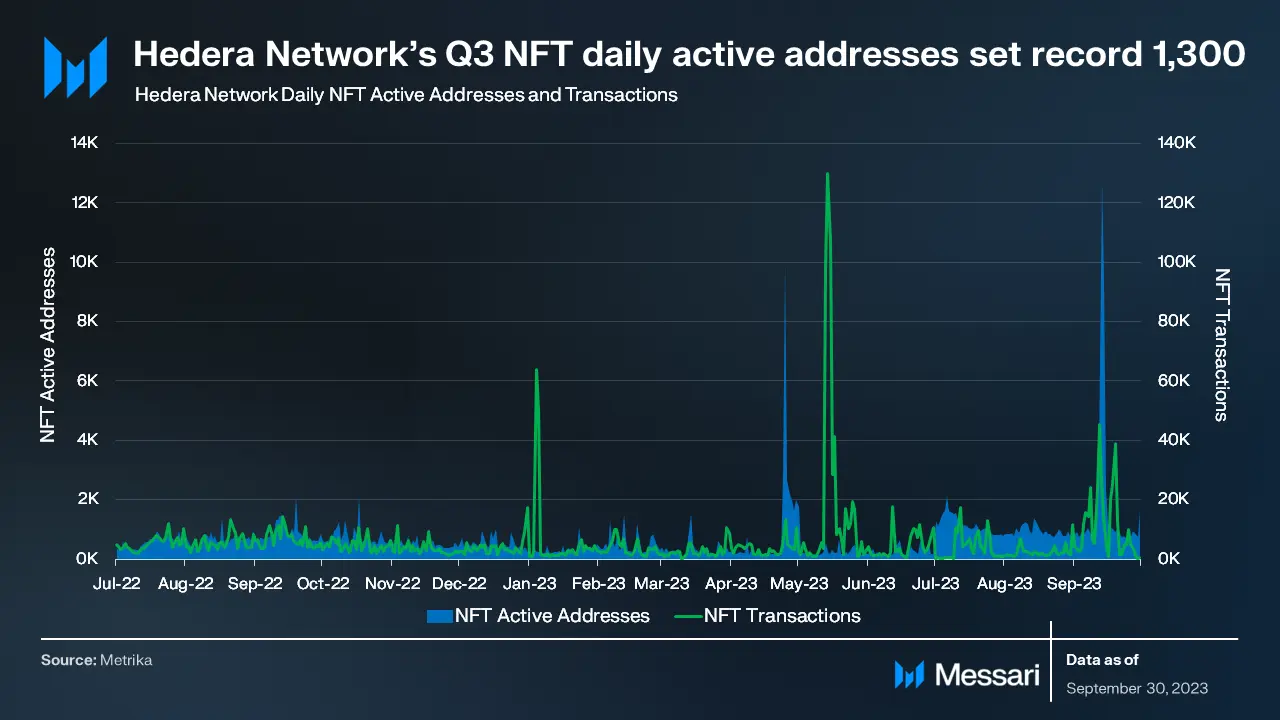

Also, while the general disinterest in digital collectibles led to a decline in NFT trading activity on other chains, Hedera saw a surge in NFT trades in Q3.

The average daily count of active addresses that traded NFTs on Hedera grew by over 150% between July and September. However, during the same period, the volume of NFT transactions declined by 33%.