Institutional crypto custody sees an uptick amidst safety concerns

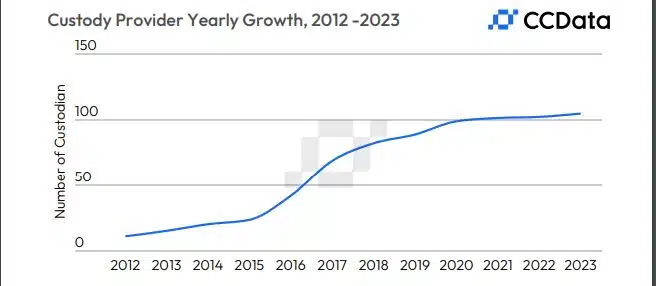

- The number of institutional crypto custodians has steadily risen in the past four years.

- The growing adoption of cryptocurrencies presented a significant commercial potential for custodians.

Despite their remarkable growth, safe custody of cryptocurrencies remained one of the biggest stumbling blocks to investors looking to entrust their capital in this burgeoning sector.

Challenges with exchange custody

The stunning collapse of crypto exchange FTX [FTT] in November last year started a debate around the safety of third-party crypto custody. A large chunk of the users’ funds, including both institutional and retail investors, were stuck on the fallen exchange.

The recovery process was still going on at the time of publication.

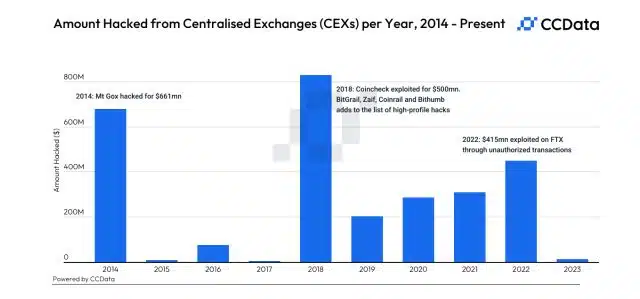

Although the FTX case grabbed the most media attention, security concerns with crypto exchanges were not new by any stretch of the imagination.

In fact, nearly $2.4 billion in cryptos have been lost in exchange hacks since 2014, according to a report by crypto market data provider CCData. Premier exchanges like Binance [BNB] and Upbit have all been victims of such coordinated attacks.

The need for institutional custody

Amidst the atmosphere of FUD, the narrative of self-custody started gathering a lot of steam. However, the report underlined specific challenges associated with them as well, including human error, physical risk linked to cold wallets, and operational complexities.

The problem gets compounded for large institutional investors who want to participate in the market. Owing to these shortcomings, there has been a steady increase in demand for specialized crypto custody service providers.

From just around 50 in 2017, the number of regulated third-party custodians has soared to 100 at the time the report was published.

Exploring the institutional custody landscape

Broadly, the institutional custody industry can be classified into three groups – custodial technology providers, hybrid custodians, and regulated custodians.

Custodial technology providers offer the necessary technological infrastructure like security, transfer and settlement, and other wallet-related services for clients. But since these organizations won’t have access to client’s funds, they are free from regulatory oversight.

In other words, they are not actually custodians, but rather enable customers to build their own self-custody solutions. Some well-known companies in this realm are Fireblocks, Ledger, and Qredo.

Hybrid custody providers, as the name suggests, are a combination of custodians and technology providers. This meant that apart from providing technology solutions, they control clients’ private keys and manage their digital assets.

Clients also have the option to opt for self-custody, in which case these companies start to function just as a tech partner. U.S.-headquartered BitGo, Copper, and Hong Kong’s Hex trust are some prime examples.

Lastly, there exist regulated custodians whose primary responsibility is to protect customer funds by safely storing their private keys. As they exercise complete control over assets, they are subject to strict regulatory laws based on the jurisdiction.

Custodial services provided by Coinbase remain one of the popular services in this category. In fact, the world’s largest asset manager, BlackRock, chose Coinbase as the Bitcoin [BTC] custodian for the proposed spot ETF.

As regulations play a critical role in ensuring security for the entrusted assets, the location where the custodian operates becomes of paramount importance. Typically, jurisdictions with stricter compliance rules would attract users.

Big opportunity ahead?

The report underscored the need for institutional custodians to keep up pace with the phenomenal growth in crypto adoption. Indeed, the number of unique Bitcoin and Ethereum [ETH] wallets have spiraled over the last eight years.

While this presented a huge business opportunity, custodians also needed to be proactive in reacting to these changes.