Hedera: Will this progress on the RWA front save HBAR from the sellers?

- Hedera to support the tokenization of Airbnb’s money market fund.

- HBAR sees a strong surge but low retail participation — Assessing its implications.

Most top blockchains have a strategy for long-term growth. For Hedera, that strategy has been leaning toward real-world assets (RWAs). Its latest announcement underscores a major step in the right direction.

Is your portfolio green? Check out the Hedera Profit Calculator

Hedera’s latest announcement revealed yet another major development. The network reportedly collaborated with a platform called Archax to tokenize Airbnb’s money market fund.

The latter is worth billions, hence this represents one of the biggest opportunities for the Hedera blockchain. This also puts Hedera in a unique position to expand its portfolio in favor of more organic utility.

#Tokenization of Real World Assets (#RWAs) is fast becoming a key use case of #web3 as enterprises, institutions, and individuals realize the transformative potential of #blockchain in bringing increased liquidity, opportunity, and efficiency to traditional finance.#Hedera… pic.twitter.com/hYjFBXZIWn

— Hedera (@hedera) October 26, 2023

The development could put Hedera ahead of its competition, as well as pave the way for other high-profile tokenization opportunities.

Why is this important? Well, as noted earlier, most top networks have been embracing different strategies for long-term growth. Some focus heavily on stablecoins and others double down on dApps.

Hedera has been aggressively pushing toward tokenization. This could potentially result in more value flowing into its native cryptocurrency HBAR, especially in the long term.

HBAR responds positively to the recent bullish dominance

The second half of October initially kicked off with HBAR gaining relative strength but the bulls still held back. The good news for long traders was that the price finally responded positively to strong accumulation. It pulled off a 14% rally in the last seven days.

The rally notably kicked off at HBAR’s short-term support level. This latest rally was also HBAR’s latest attempt at exiting its short-term range. Recent observations indicated that it was already experiencing some selling pressure within the $0.053 price level. This was the same level where it experienced resistance in September.

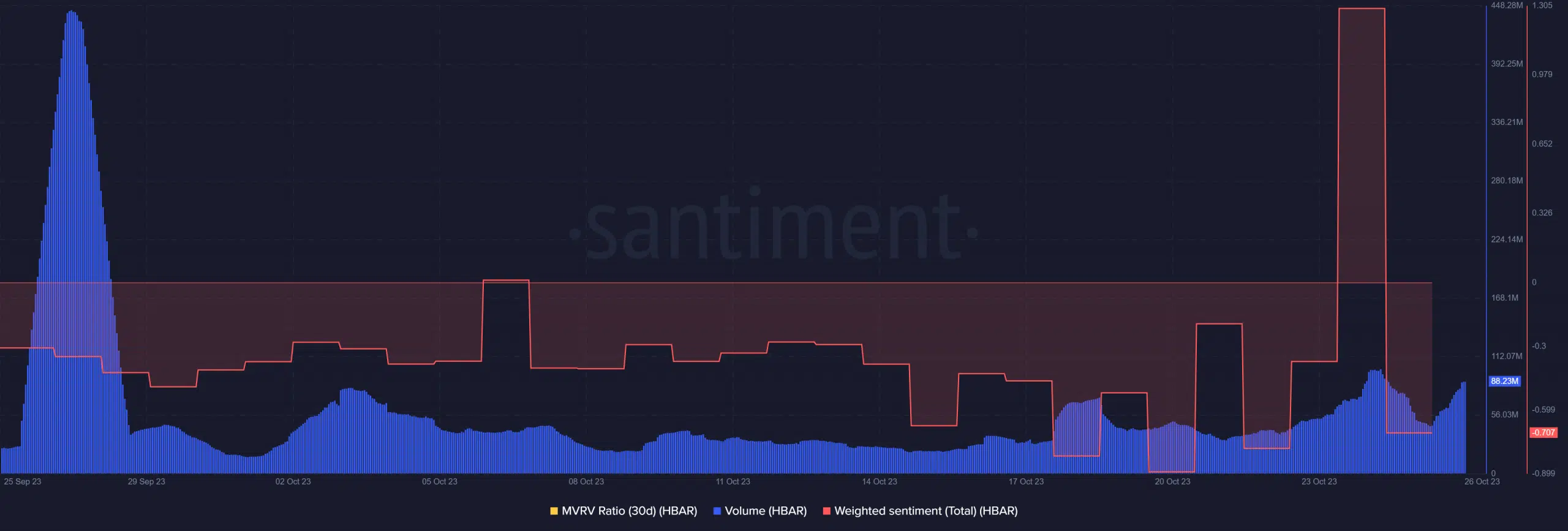

Furthermore, the selling pressure is taking place after HBAR entered into overbought territory. On-chain data also indicated that the rally was bound to be cut short. For example, the Weighted Sentiment metric soared to its highest four-week level on 24 and 25 October before quickly pulling back almost to its monthly lows.

More importantly, despite the recent surge, the volume metric only shows a slight upside in the last few days. Not even close to its highest level of the last four weeks. This could be an indication that the spike was fueled by whales and retail participation was low.

How many are 1,10,100 HBARs worth today

Low retail demand failed to sustain or support the recent rally. This might not necessarily be a bad thing. So far, HBAR has managed to hold on to its recent gains. Perhaps retail participation would have provided enough liquidity for whales to take short-term profits, potentially suppressing the price.