Litecoin prices struggle to push through, but here’s the silver lining

- Litecoin underperforms by recent bullish standards as some whales secure exit liquidity.

- Litecoin achieves a new historic hash rate as miners adjust to spike in transactions and profitability.

Litcoin [LTC] maximalists hoping for a recovery during the latest rally are somewhat disappointed. October is about to come to its conclusion after an impressive two weeks but LTC underperformed.

Is your portfolio green? Check out the LTC Profit Calculator

Like most top cryptocurrencies, Litecoin entered a low liquidity zone between August and October. Short term support and resistance underpinned the same zone.

Most top cryptocurrencies managed to push out of that zone during the last two weeks when bullish momentum made a comeback. However, Litecoin notably struggled to exit the same range even though it achieved some upside.

LTC bulls stopped in their tracks at the short-term resistance range and have even retraced slightly since its recent peak. Speaking of, the price managed to rally as high as $72.85 after a 21% upside from its current October lows.

Are whales holding back the LTC bulls?

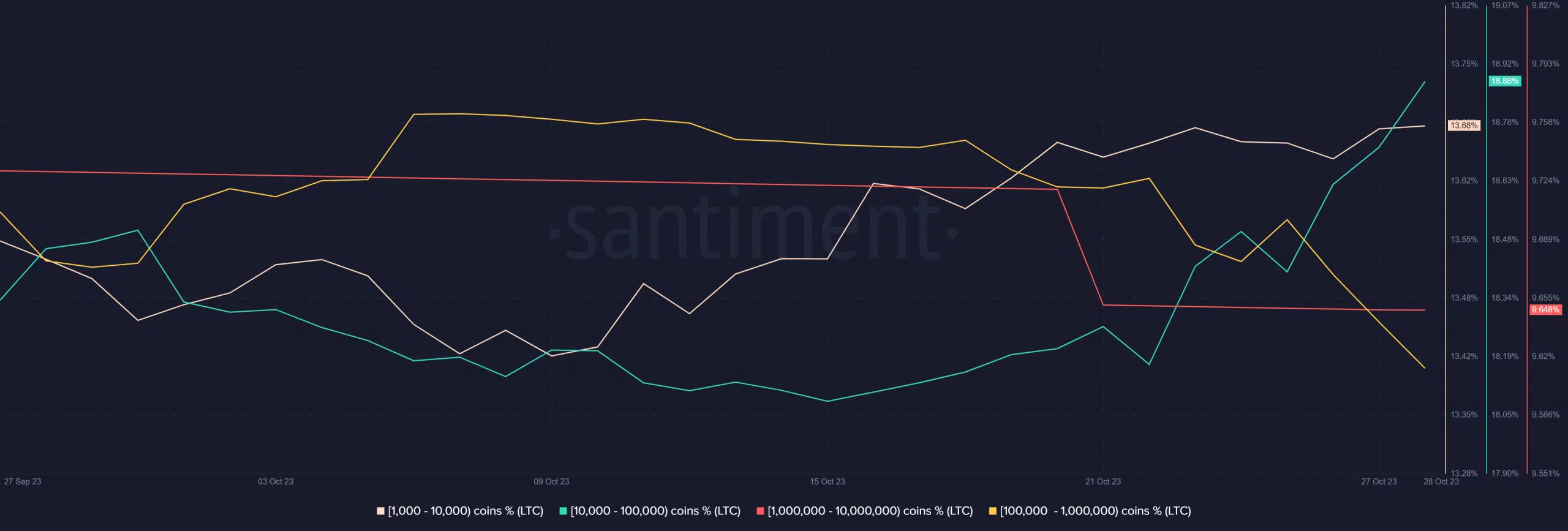

The above observation suggests that Litecoin demand was not quite to the level of most of its top rivals. A quick glance at the supply distribution reveals a potential reason for that outcome.

It turns out that LTC top whales have been subduing the bulls by contributing a significant amount of sell pressure during the bullish phase. As a result, some of the demand was watered down.

Addresses holding between 100,000 and 10 million LTC (red and yellow) have been offloading some of their holdings. These whales currently control roughly 45% of LTC’s circulating supply.

In the meantime, addresses holding between 1,000 and 100,000 LTC have been buying the dip.

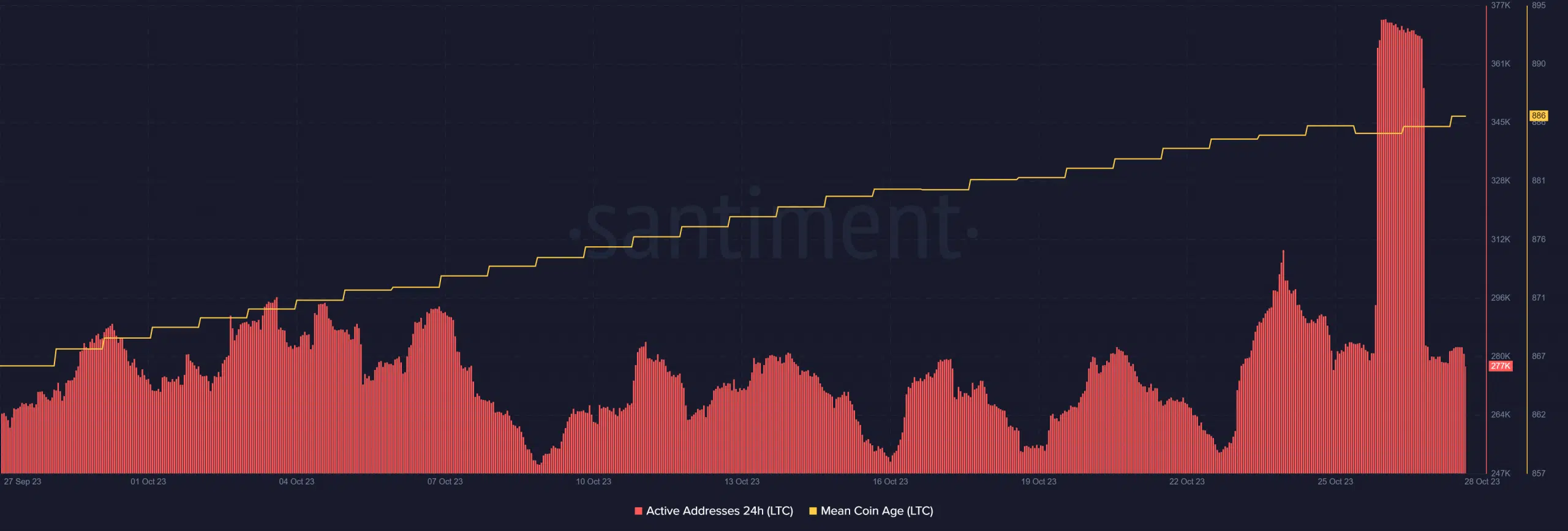

The bullish hype that we saw in the last 2 weeks is now dying down. This is as seen in Litecoin’s daily active addresses which peaked on 26 October and have since dipped back to the normal monthly range.

Despite the end of the spike, the amount of LTC hodled remains high. This is indicated by the mean coin age which recently reached a new 4-week high.

Litecoin’s hash rate top out at new monthly high

Litecoin bulls may have failed to yield a strong run but the network still managed to achieve a win somewhere else. It turns out that the latest bullish phase triggered a surge in Litecoin’s hash rate to a new historical high.

BREAKING: Litecoin's Hashrate just hit a new ALL TIME HIGH today at over 1.1 PH/s! ??? pic.twitter.com/hyh8g8zDsn

— Litecoin (@litecoin) October 27, 2023

Read about Litecoin’s price prediction for 2024

The rising Litecoin hash rate was predominantly because the bullish outcome meant there were more transactions, hence higher miner profitability.

This may have encouraged more miner participation and underscores the network’s ability to adjust to dynamic demand and supply conditions in the market.