How NFTs became the least favorable investment bet in 2023

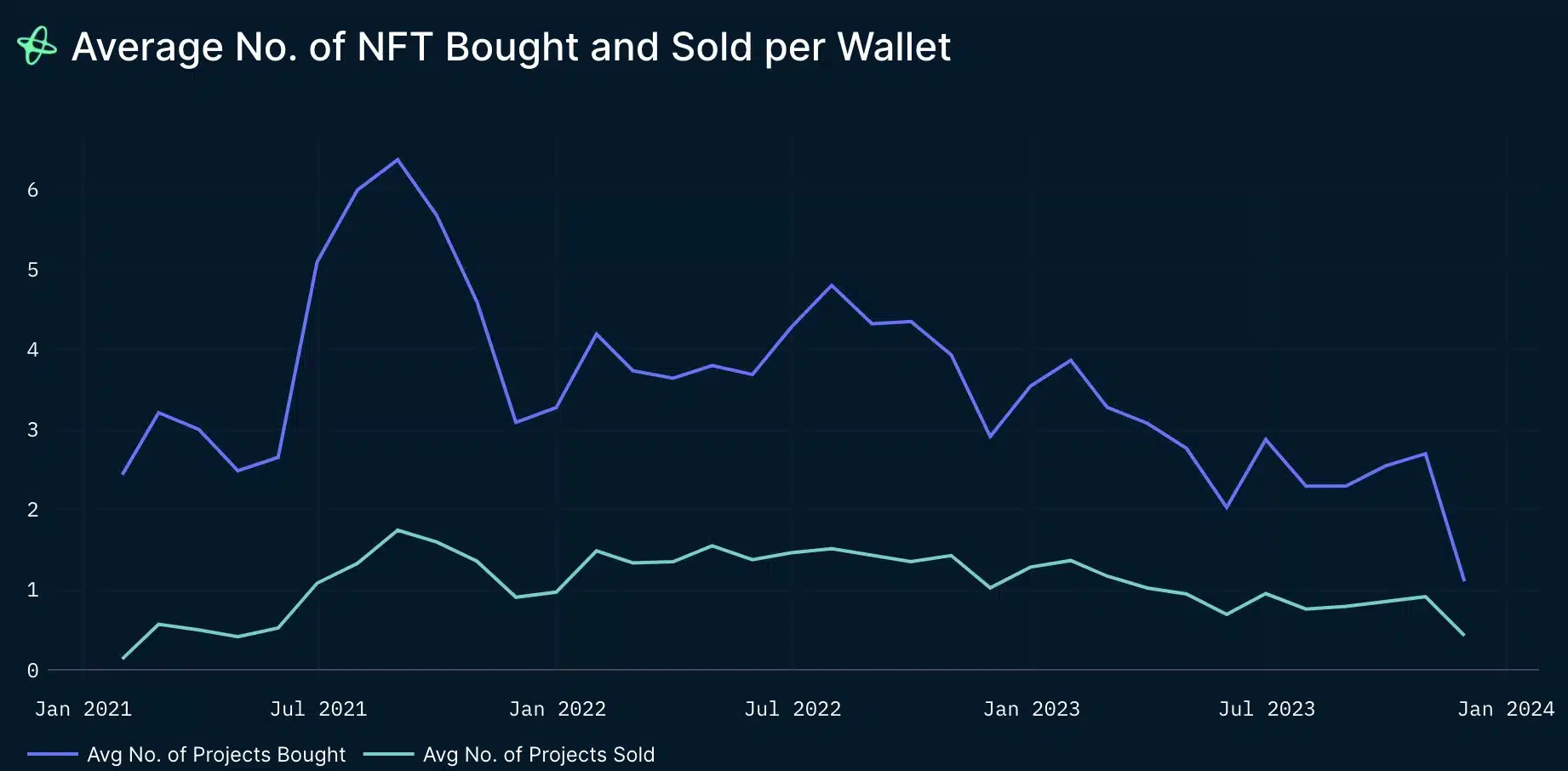

- The average number of NFTs bought and sold per wallet fell significantly in 2023.

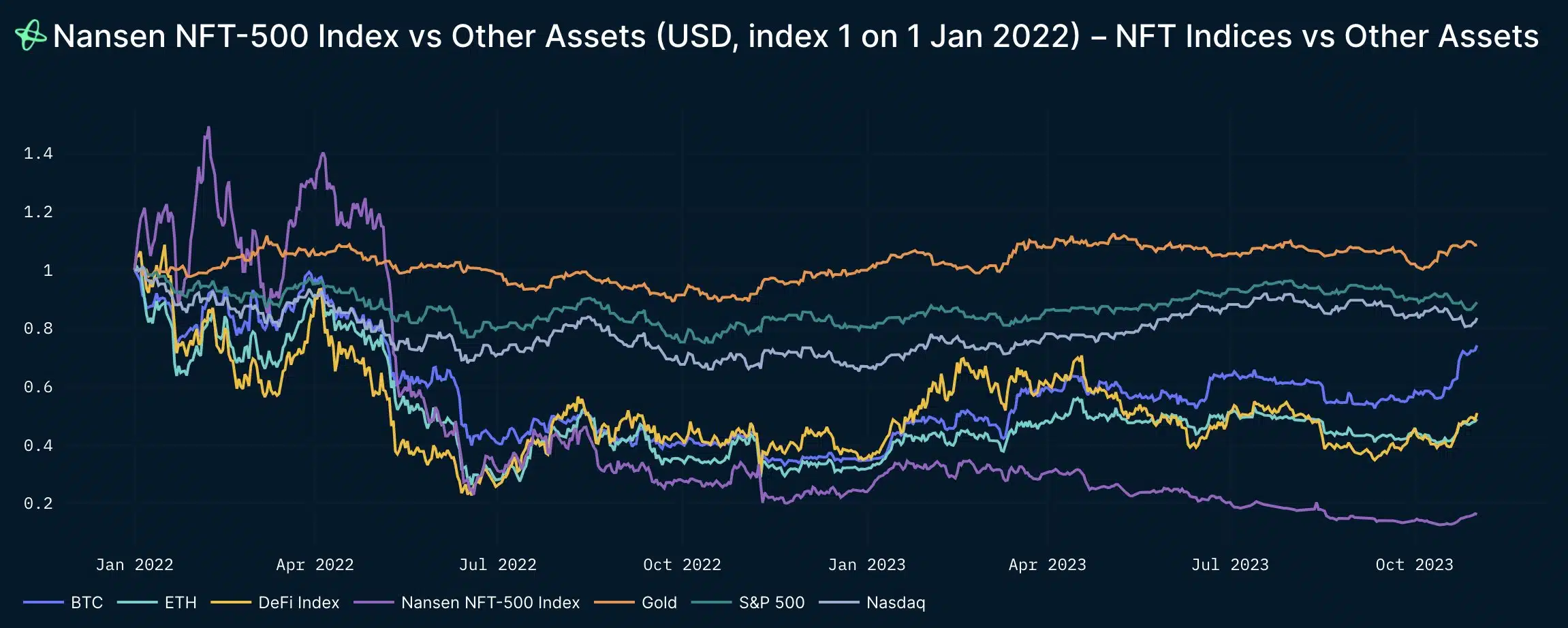

- NFT market underperformed major crypto and traditional assets.

The non-fungible token (NFT) sector was one of the worst-performing Web3 verticals in 2023, registering a sharp drawdown from its 2021 peaks.

NFT market taken over by the bears

The total NFT market cap plunged to 2.63 million Ethereum [ETH] as per a 2 November post by popular on-chain research firm Nansen.

At going market prices, this amounted to about $4.7 billion, a steep fall from the $3 trillion valuation clocked during the bull run of November 2021.

The fall could be primarily attributed to the broader bearish market conditions which triggered a sharp decline in crypto prices, including ETH.

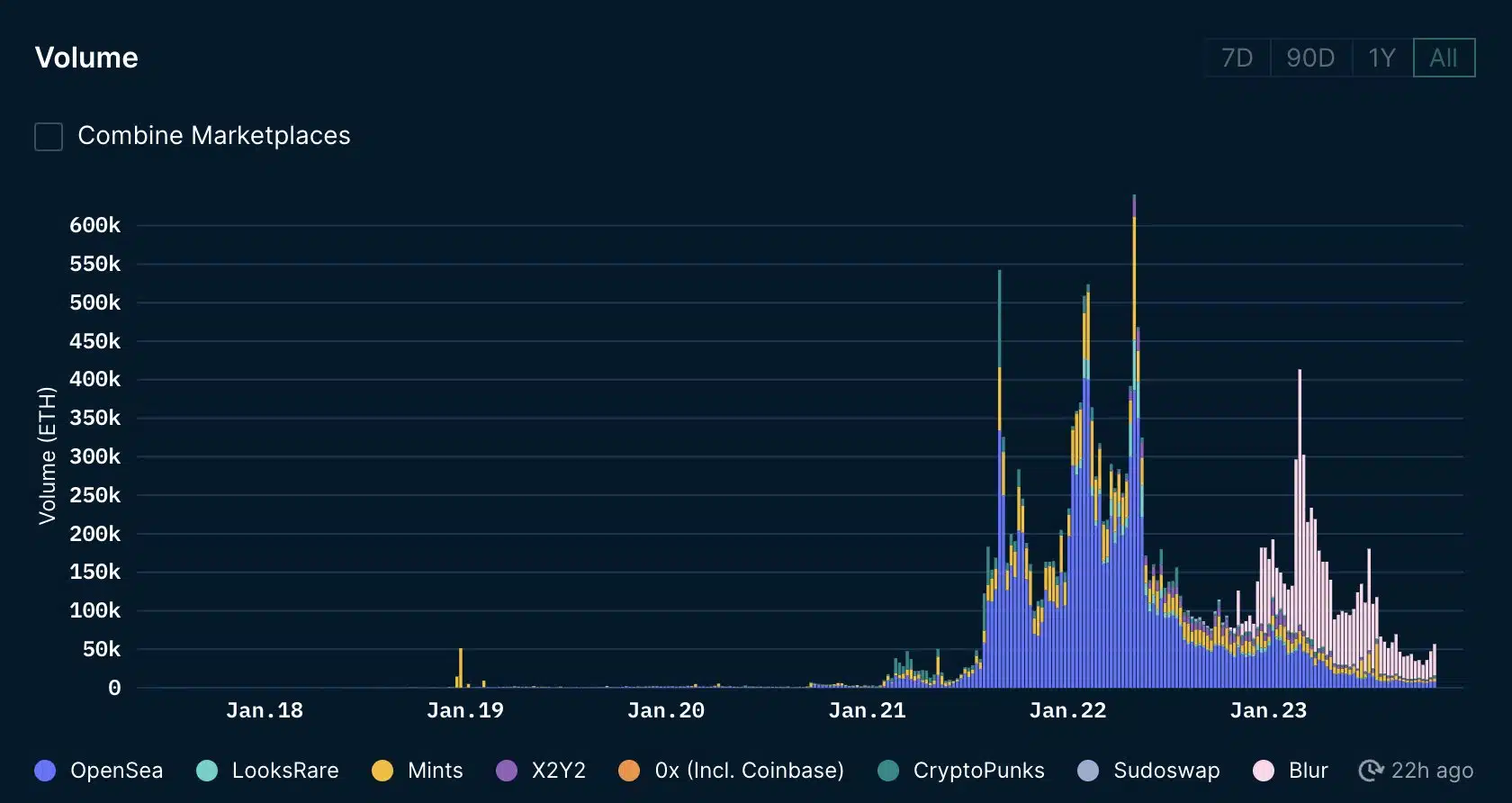

After hitting yearly peaks in February, the sales volumes have gone downhill. The downfall intensified right through the second and third quarters, with no signs of a recovery in sight.

Traders became conservative as the average number of NFTs bought and sold per wallet fell significantly since 2021.

Thes findings were backed up by Cryptoslam data which highlighted a steep fall in the number of unique buyers and sellers.

The month of October saw a total of just 535k buyers and 496k sellers. In contrast, over a million traders in both segments were active in January 2022.

Blue-chip collections see dip in floor prices

The NFT winter froze popular blue-chip NFT collections.

As per AMB Crypto’s analysis of NFT Floor Price data, Bored Ape Yacht Club’s (BAYC) floor price tumbled to 29 ETH at press time. This represented a massive decrease of 76% from all-time highs of May 2022 and a 56% decline year-to-date (YTD).

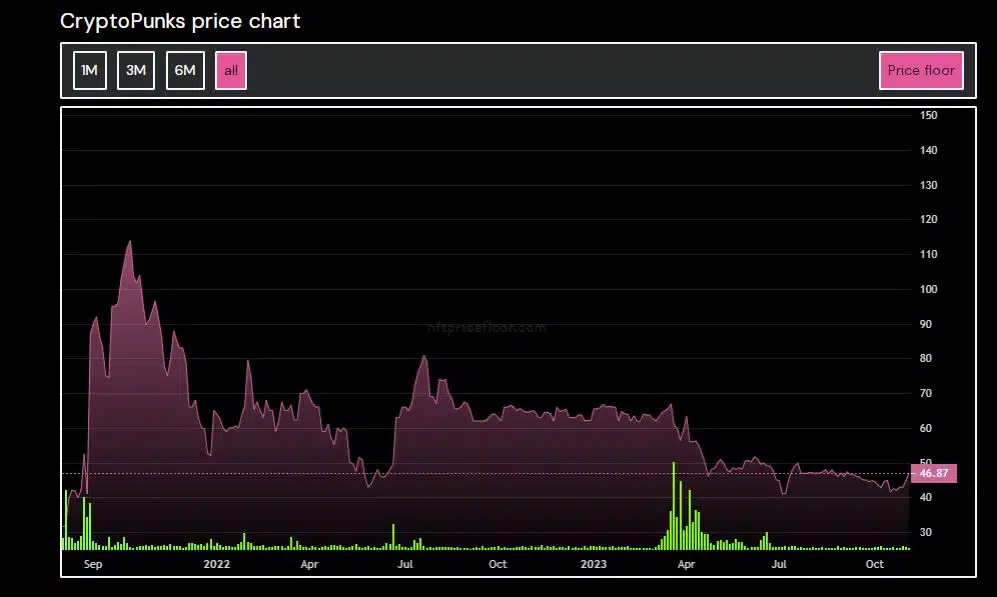

CryptoPunks, the collection with the largest market cap, also caught severe cold. Floor prices started to go downwards from March, bucking the stability that was on show since July 2022.

As of this writing, the Yuga Labs-owned collection’s floor value was down 25% since the start of the year.

NFT’s not the best investment bet at the moment

Indeed, the NFT landscape was in need of a turnaround. Nansen’s benchmark NFT -500 index underperformed not just major crypto assets like the Bitcoin [BTC] and Ethereum [ETH], but bellwethers of traditional market as well.

In fact, the NFT index saw the most consistent decline of all asset classes. These grim developments suggested that the NFT winter was far from over and spring would have to wait a bit more.