FET surges 4% in 24 hours – start of a bull run?

- Buying pressure on Fetch.ai was high at press time.

- Though metrics looked bullish, market indicators supported the bears.

Fetch.ai [FET] failed to register massive gains over the last week, a move which may have upset investors. However, a bullish pattern had formed on FET’s chart at press time, suggesting that the token’s price might shoot up soon.

Fetch.ai might surprise investors!

Despite the bullish crypto market, FET remained relatively dormant. According to CoinMarketCap, FET’s value only increased by 2% over the last seven days. However, things had started to change at press time, as its price climbed nearly 4% in just the last 24 hours.

While its price surged, its volume shot up by over 70%, acting as a foundation for the price uptick. At the time of writing, FET was trading at $0.3802 with a market capitalization of over $308 million. To see how FET compares with other leading AI crypto projects, our comprehensive list offers a clear perspective.

AMBCrypto took a look at Fetch.ai’s metrics, which revealed quite a few reasons behind this surge. As per CryptoQuant, FET’s exchange reserve was green, meaning that it was not under selling pressure.

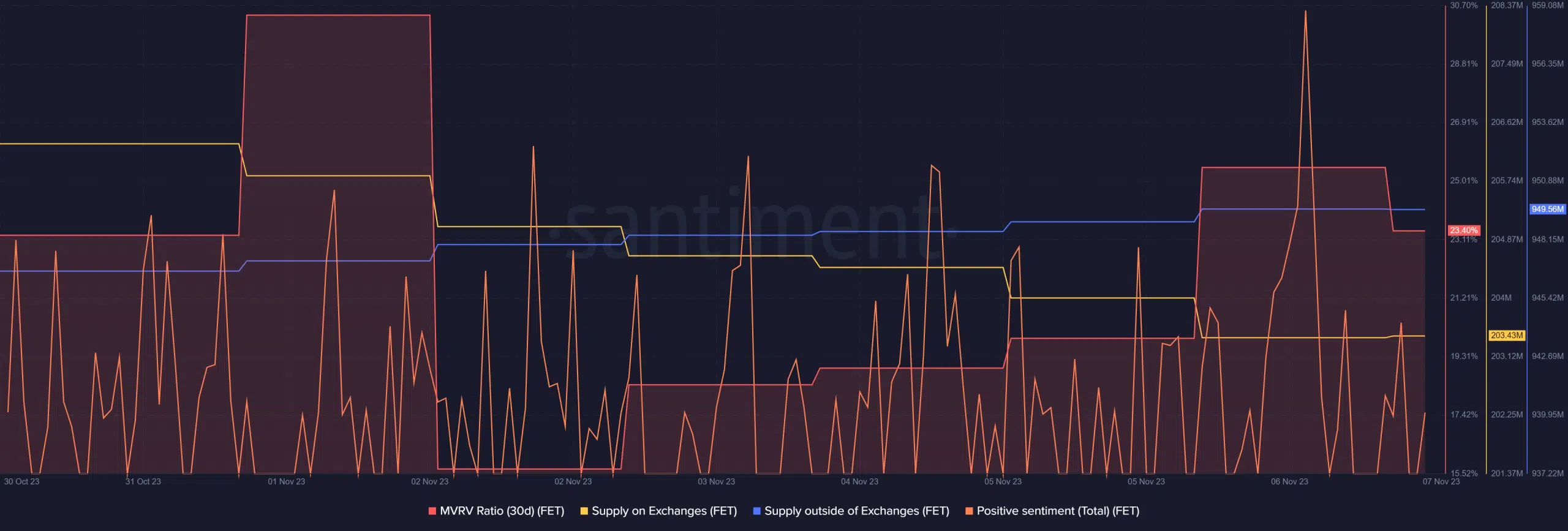

This fact was further proven upon further analysis as FET’s Supply on Exchanges dropped while its Supply outside of Exchanges increased over the last few days. The token’s MVRV ratio also rose in the recent past.

Moreover, positive sentiment around the token spiked on the 6th of November, meaning the investors had high hopes for FET.

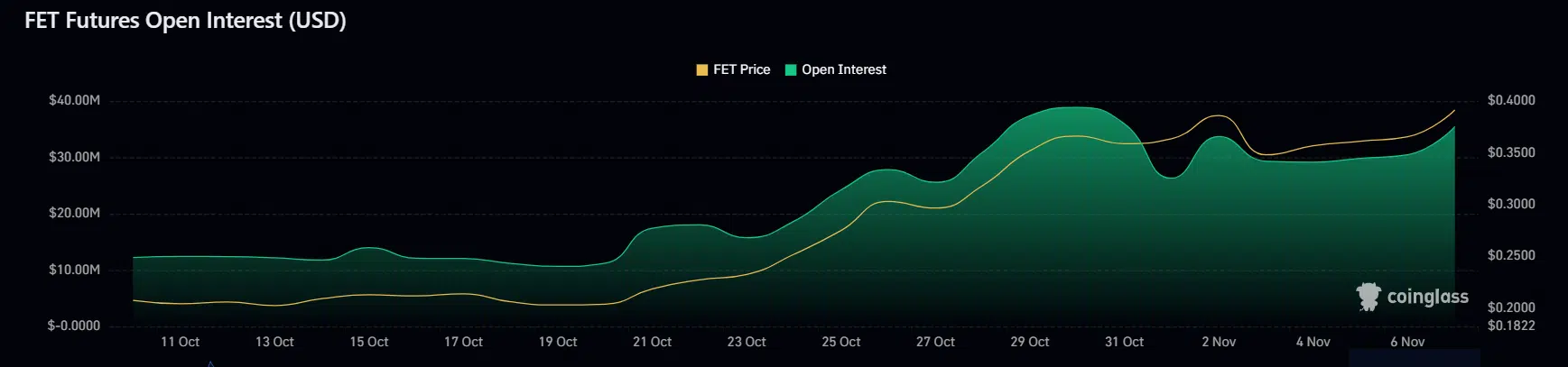

FET’s derivatives metrics looked bullish as well. According to Coinglass, the token’s Open Interest rose alongside its price.

When Open Interest increases, it usually means new money is coming into the market. Therefore, it increases the possibility of a continuation of the current price trend.

Fetch.ai’s Funding Rate also remained in the green at press time, meaning that Futures investors were buying the token at its higher price.

How much are 1,10,100 FETs worth today?

Will the uptrend sustain?

While the aforementioned metrics looked promising, a look at CryptoQuant’s chart revealed that FET’s Relative Strength Index (RSI) was in an overbought position. This was worrying, as it was a sign of increasing selling pressure.

Other indicators also looked bearish, such as the Money Flow Index (MFI), which declined. Additionally, the MACD displayed the possibility of a bearish crossover in the coming days.