Bitcoin flirts with $35,000 – Is a big breakout on the way?

- Over 78% of BTC holders were realizing profit on their investments.

- The crucial $35,000 level held the key to Bitcoin’s next direction.

Bitcoin [BTC] flirted with the $35,000 mark lately, indicating a fierce battle between the bulls and the bears at the key level.

As per on-chain analytics firm IntoTheBlock, the level was breached twice over the last week. While BTC was trading slightly lower at the time of writing, the prospect of a large breakout was boosted by certain bullish on-chain signals.

Bitcoin in a state of profit

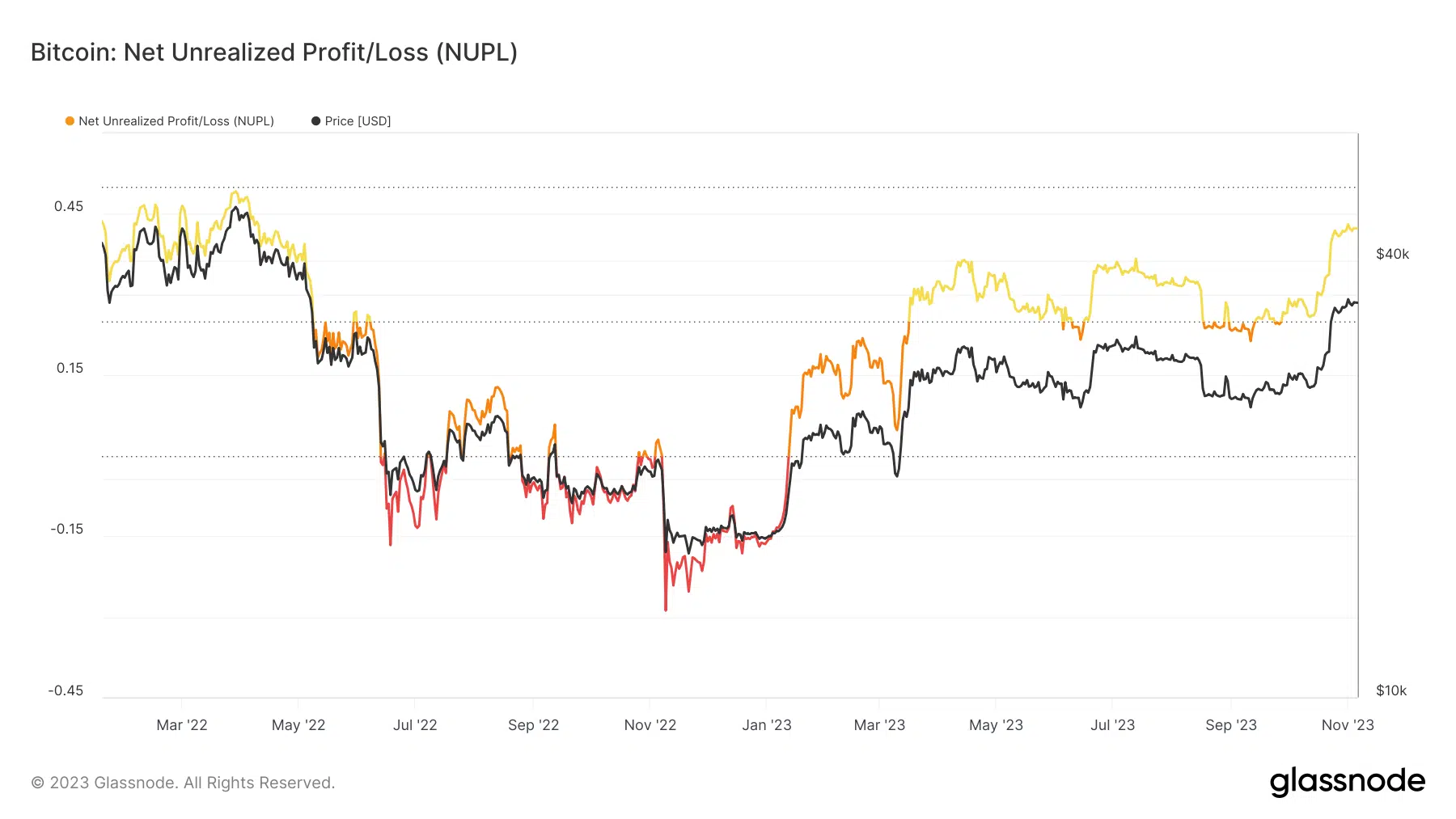

IntoTheBlock stated that over 78% of BTC holders were realizing profit on their purchases. This assertion made sense after AMBCrypto scrutinized the popular NUPL indicator from Glassnode.

Typically, values above zero indicate a state of net profit. Moreover, the numbers suggested that market sentiment was tilting towards optimism.

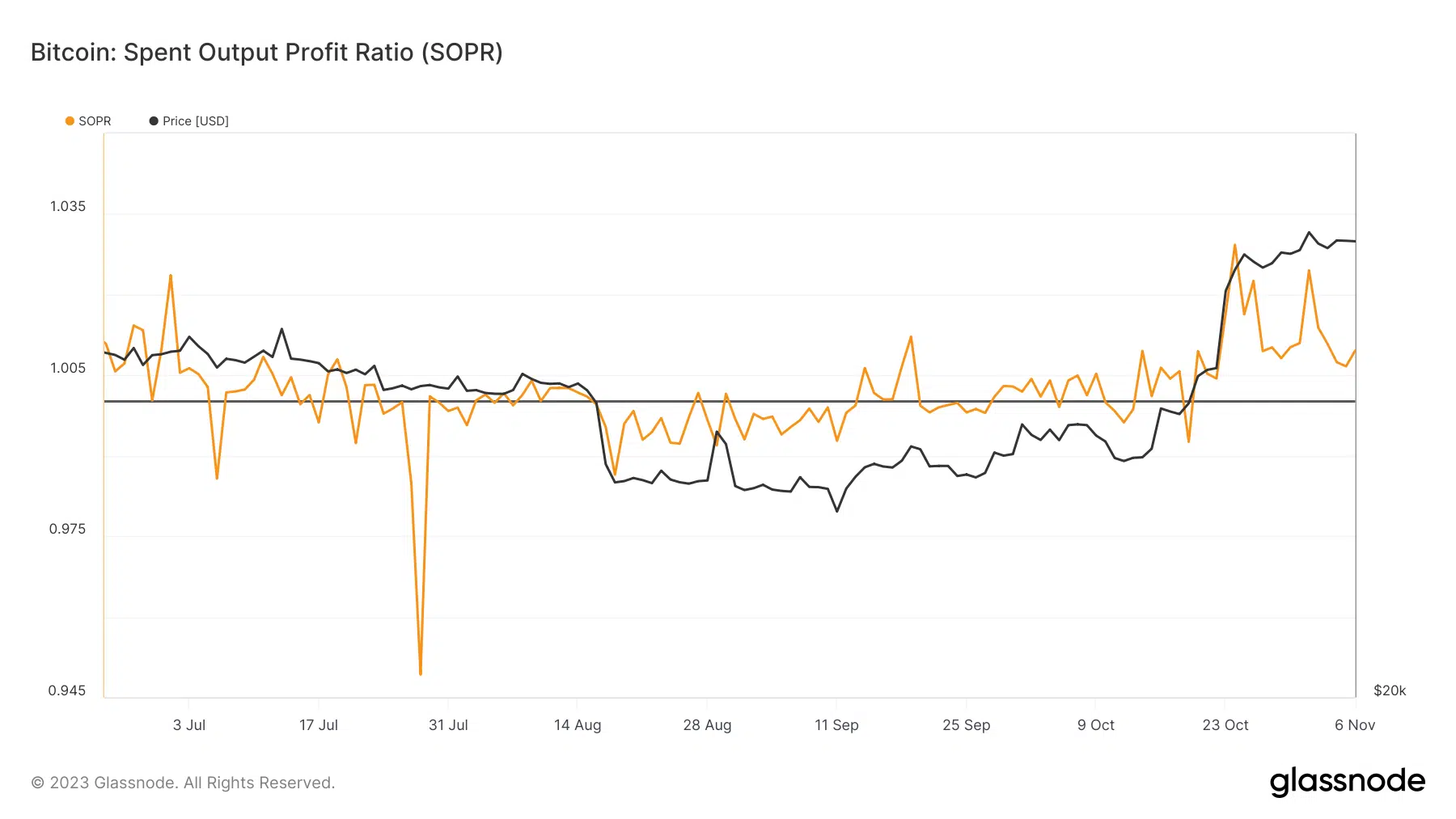

Another way to assess market profitability was by examining the Spent Output Profit Ratio (SOPR). Note that unlike the NUPL that tracks unspent supply, SOPR looks at coins that have actually moved on-chain.

The SOPR indicator was trending higher, suggesting that coins on average were being sold at profits. Additionally, this sounded like a possibility of an increase in liquid supply in the near term, a chance for many prospective buyers to get their hands on BTC.

Bulls cheer on-chain signals

Digging further into the importance of the $35,000 mark, IntoTheBlock mentioned that as many as 1.94 million addresses purchased BTC at the level.

If the king coin managed to stay steady, bulls might have secured a “massive victory”, the analytic firm noted.

Bullish tendencies were discovered upon technical analysis as well. Popular on-chain sleuth Will Clemente shared his interpretation of the Relative Strength Indicator (RSI) on social platform X.

Read BTC’s Price Prediction 2023-24

According to him, it emitted a positive signal and a return of strength into the market.

1W RSI on $BTC getting into overbought territory for the first time since February 2021.

Shorter term may not be the best thing to see, but on a cycle-cycle basis, this is positive because it signals that there is finally some strength back in this market. pic.twitter.com/B8xr7UaoWr

— Will (@WClementeIII) November 7, 2023

Bitcoin holders were turning greedy as per Hyblock Capital, meaning they were in the mood to buy more. Typically, the index assumed that greed boosts asset values in the near term.