Arbitrum flips BSC: Where will the L2 head next?

- Arbitrum’s volumes soared over the last week.

- Revenue collected by the network grew even as overall activity fell.

Arbitrum [ARB], despite facing uncertainty over the last few months, has managed to get back on its feet. Markedly, the L2 solution’s volume rose over the last week.

Volume spikes

Recent statistics analyzed by AMBCrypto revealed a significant shift in favor of Arbitrum. The protocol crossed $2.66 billion in trading volume, surpassing Binance Smart Chain [BSC].

Notably, RamsesExchange, a decentralized exchange (DEX) operating on Arbitrum, generated a volume close to Camelot, despite having significantly lower liquidity.

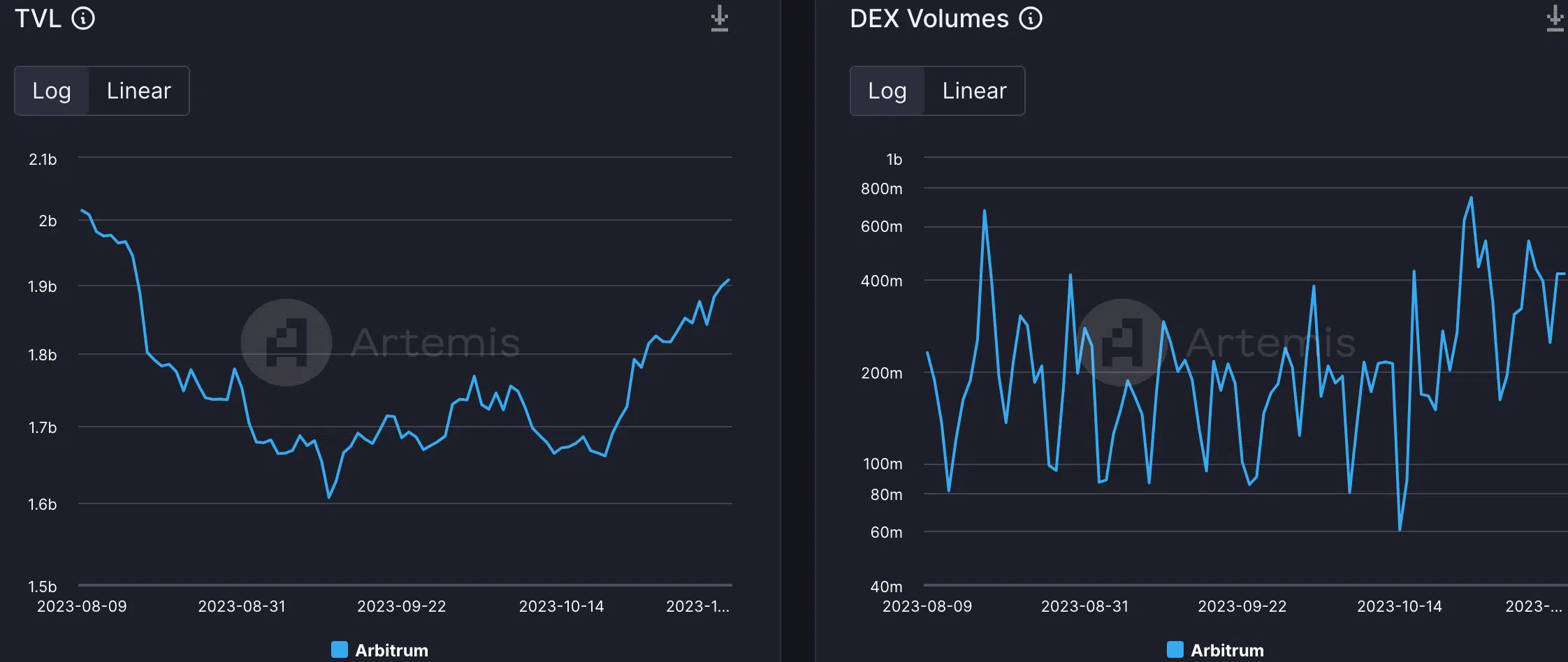

But it wasn’t just Ramses Exchange that was doing well. AMBCrypto found that as per Artemis’ data, the overall DEX volumes of Arbitrum were high, due to which the L2’s TVL (Total Value Locked) also increased.

The rise Arbitrum’s TVL indicated that more assets were being stored and utilized within the network at press time.

As TVL grows, it becomes an attractive environment for more DeFi projects and users. This, in turn, can lead to a reinforcing cycle of network growth and development.

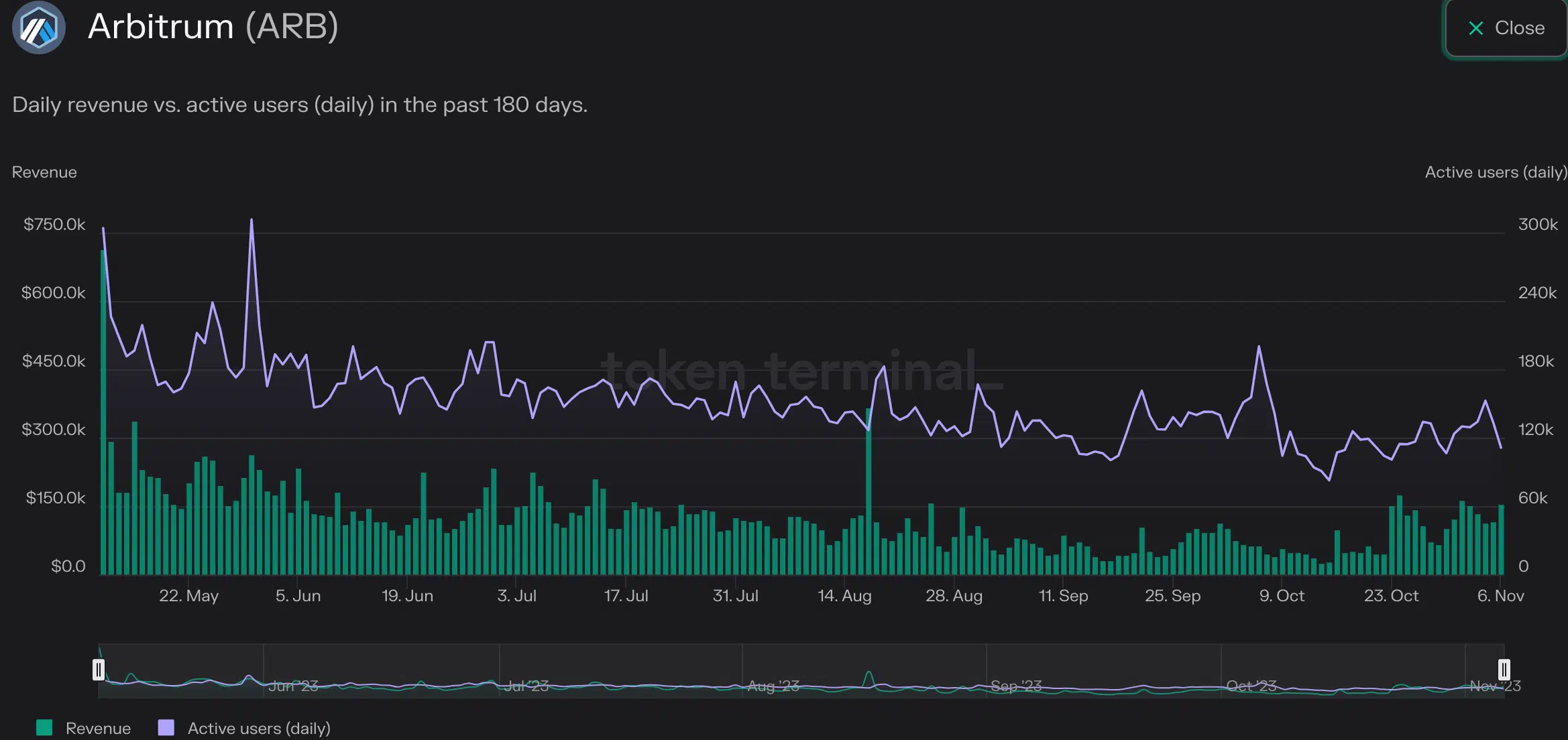

Additionally, the revenue generated on Arbitrum had also grown by 34.8% over the last month. However, the number of daily active users on the protocol had fallen by 33.4%.

Realistic or not, here’s ARB’s market cap in BTC’s terms

The increase in revenue was a positive sign for Arbitrum, indicating that the protocol was generating more income. This could attract more users and investors, thus boosting the platform’s growth. It may also signal that users were finding value in the protocol’s services.

However, the decrease in daily active users was a concerning signal. It’s important for a blockchain network to have an engaged user base for its long-term success. Only time will tell whether the drop is an anomaly, or if it is a signal of something more worrisome.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)