Dogecoin offers a buying opportunity at this price level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Dogecoin has benefited greatly in recent times from the capital flow into the altcoin market.

- Technical analysis showed the recent dip to a support level opened a pathway to another move higher.

Dogecoin [DOGE] exhibited strong social activity alongside the other popular meme coins Shiba Inu [SHIB] and Pepe [PEPE]. Yet there were some signs that the uptrend could be slowing down for DOGE and the other meme coins.

AMBCrypto’s technical analysis of DOGE noted that a long-term trendline resistance was being tested on 3rd November. Since then, this resistance has been beaten and bulls were ready to push prices higher.

Placing bullish bets on Dogecoin was feasible after its recent retest of a former resistance

The market structure on the three-day chart was bullish after the move above $0.06858. Moreover, the volatility in the hours before press time saw the same level retested as support.

Additionally, the trendline resistance can be considered to be retested as support too.

Both the pieces of evidence heightened the likelihood of DOGE posting further gains. The RSI was at 59 and still signaled strong bullish momentum.

The On-Balance Volume (OBV) has not halted its uptrend either as buying volume remained dominant. The Chaikin Money Flow (CMF) was also above +0.05 to denote buyer superiority.

To the north, the resistance levels at $0.0838, $0.095, and $0.106 were the next significant points of interest to watch out for.

Analyzing the short-term and long-term charts to gauge DOGE’s next move

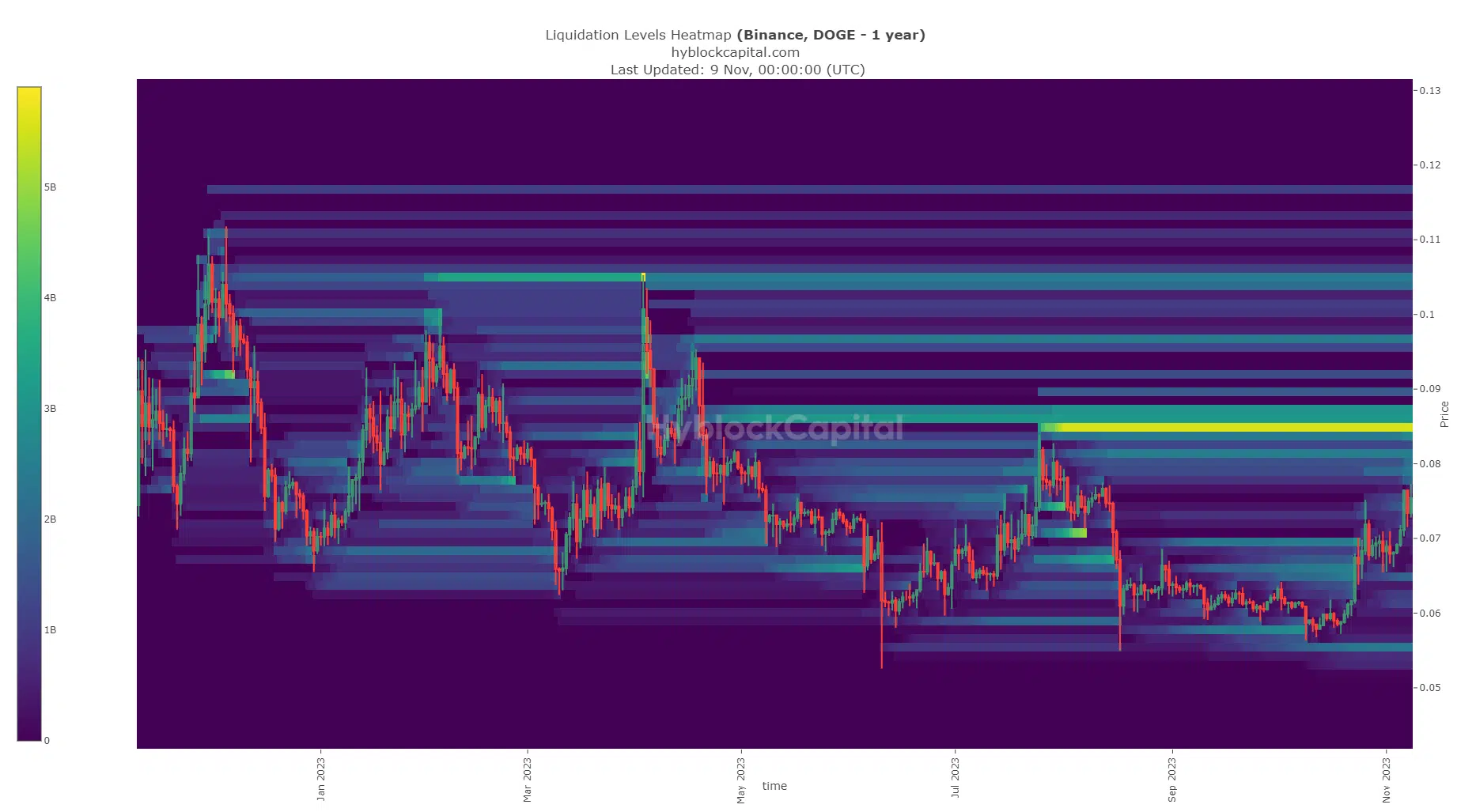

Source: Hyblock

The liquidation levels heatmap has not changed much over the past week. However, the $0.084-$0.0885 region saw more liquidations piled on.

This meant that market participants were betting that a rally beyond $0.083 was unlikely and were willing to short DOGE. This liquidity could attract DOGE prices, at least briefly, before a bearish reversal.

Source: Coinalyze

The volatility of the past few hours saw DOGE drop from $0.078 to $0.0663.

Is your portfolio green? Check the DOGE Profit Calculator

During this dump, the Open Interest (OI) fell by close to $80 million and reflected strong bearish sentiment in the lower timeframes.

It also pointed toward overleveraged longs looking to ride DOGE higher and instead were wiped out during the recent drop. The spot CVD lacked a firm trend in November, but an uptick in this metric would strengthen the bullish argument.