What Ethereum’s high network activity means for you

- Ethereum’s liquidation increased when its price reached the $2,270 mark.

- Most market indicators and on-chain metrics looked bearish.

Ethereum [ETH] is witnessing a massive surge in network activity of late. This happened at a time when the king of altcoins’ liquidation levels increased.

Will Ethereum’s high network activity be enough to help paint the coin’s chart green?

Ethereum’s user activity is high

Users have shown immense interest in Ethereum in the recent past, as shown by its spiking network activity.

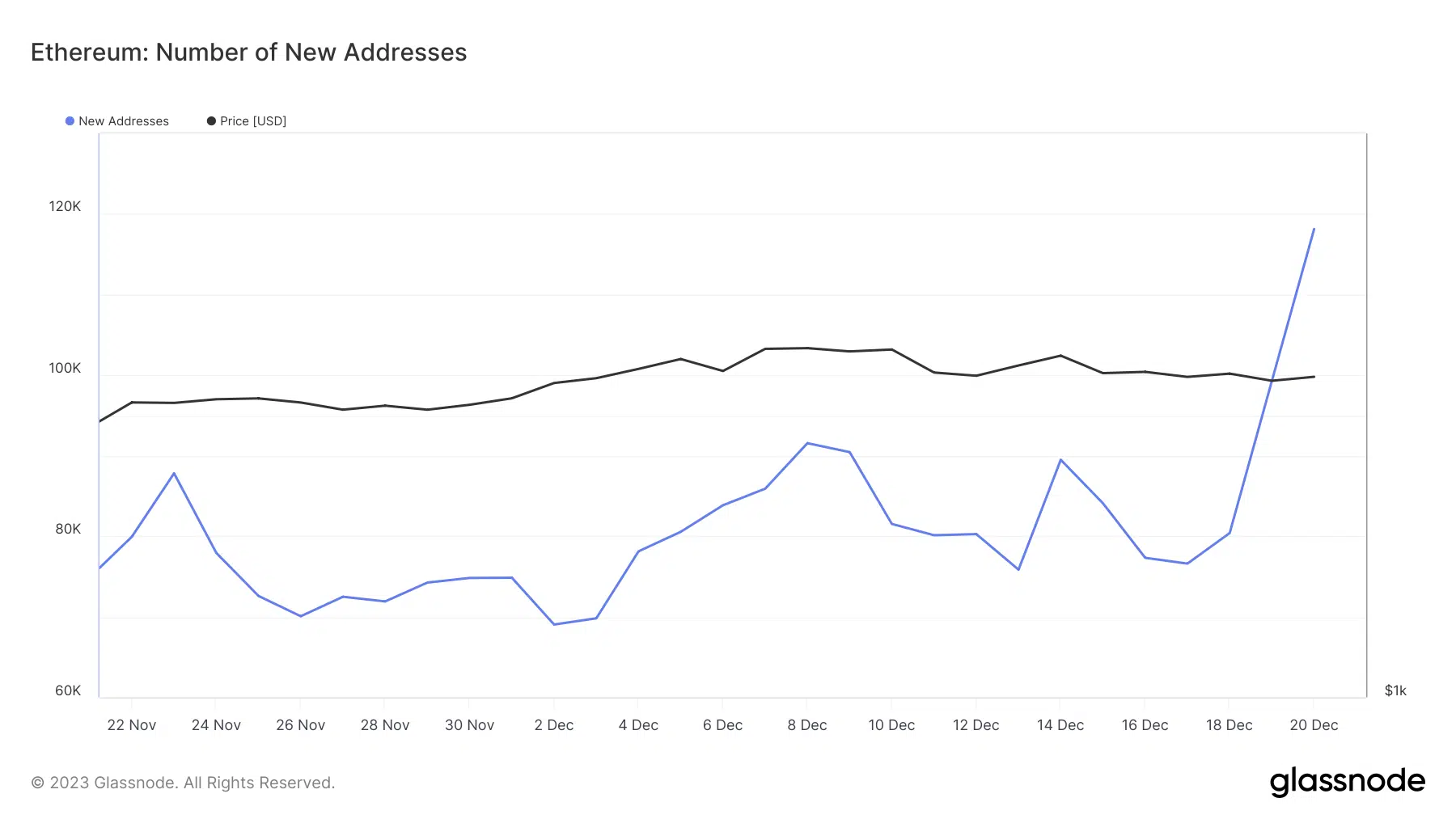

AMBCrypto also looked at Glassnode’s data, which revealed that Ethereum’s Active Addresses had gained upward momentum since the 16th of December.

The blockchain’s Number of New Addresses metric followed a similar increasing trend.

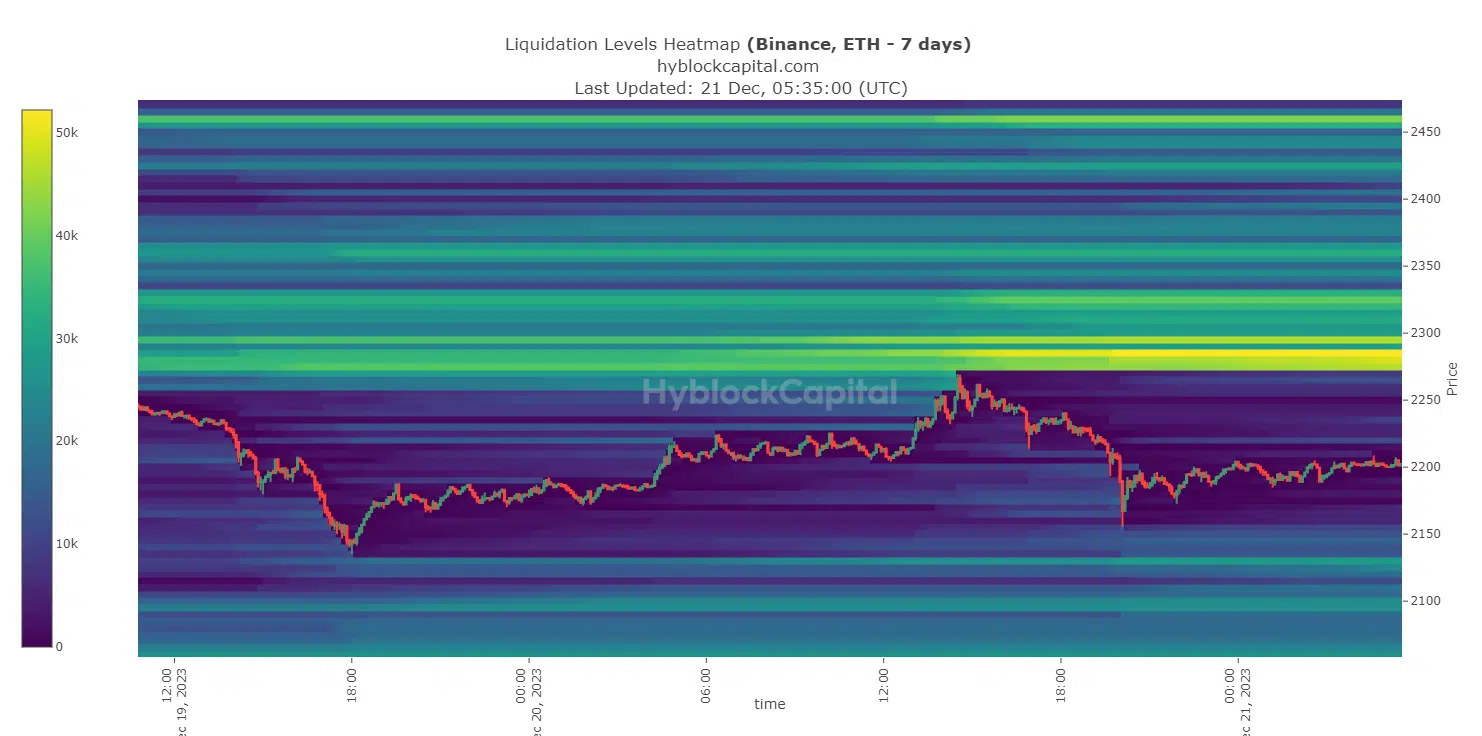

However, while the blockchain’s network activity was on the rise, the token witnessed a sell-off. AMBCrypto’s look at Hyblock Capital’s data pointed out that ETH’s liquidation increased substantially near the $2,270 mark.

The hike in liquidation resulted in a price correction as the token’s price sank.

According to CoinMarketCap, ETH was down by nearly 3% in the last seven days. At the time of writing, it was trading at $2,193.67 with a market capitalization of over $259 billion.

A bearish signal was ETH’s hike in volume, which legitimized the token’s price downtick.

Ethereum has concerns to address

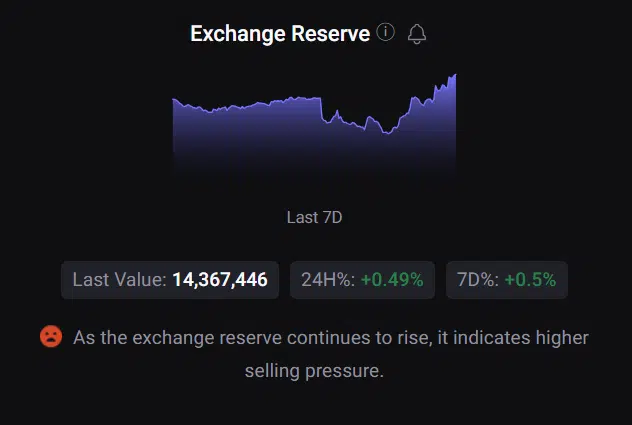

As ETH’s price dropped, several on-chain metrics turned bearish on the token. For example, AMBCrypto found that selling pressure on Ethereum was high, evidenced by its rising Exchange Reserve at press time.

Moreover, investors in the US and Korea seemed to have been selling their holdings. This was apparent from CryptoQuant’s data, which revealed that both the Coinbase Premium and Korea Premium were red.

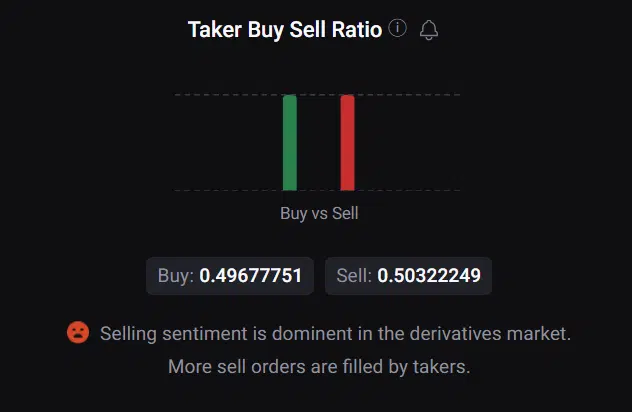

Things on the derivatives side of the market also remained negative. Notably, ETH’s Taker Buy Sell Ratio was red, meaning that selling sentiment was dominant in the Futures market.

Apart from metrics, several market indicators, like the MACD, looked bearish on the king of altcoins at press time. Its Money Flow Index (MFI) also went southward and was headed below the neutral mark.

Is your portfolio green? Check out the ETH Profit Calculator

Another bearish indicator was ETH’s Chaikin Money Flow (CMF), which waned slightly.

Considering the aforementioned datasets, it seemed likely that investors might have to wait longer to witness ETH’s bull rally, despite a rise in network activity.