Litecoin sheds value despite high activity, here’s why

- LTC’s daily chart turned red, and market indicators were bearish.

- Most indicators suggested a further downtrend.

Litecoin [LTC] has witnessed a massive surge in its network activity of late, reflecting a hike in its adoption and usage. Though at first glance, this incident looked optimistic, the coin’s price failed to react positively.

Litecoin’s network activity remains promising

Ali, a popular crypto analyst, recently posted a tweet highlighting the fact that Litecoin’s network activity has risen in the recent past.

On December 20, #Litecoin witnessed its biggest surge in new $LTC address creation in over two years! A staggering 1.27 million #LTC addresses were generated in just one day. pic.twitter.com/REVeVQzwdQ

— Ali (@ali_charts) December 24, 2023

As per the tweet, on the 20th of December, Litecoin witnessed its biggest surge in new LTC address creation in over two years. This was the case as the blockchain registered 1.27 million addresses being created in just a single day.

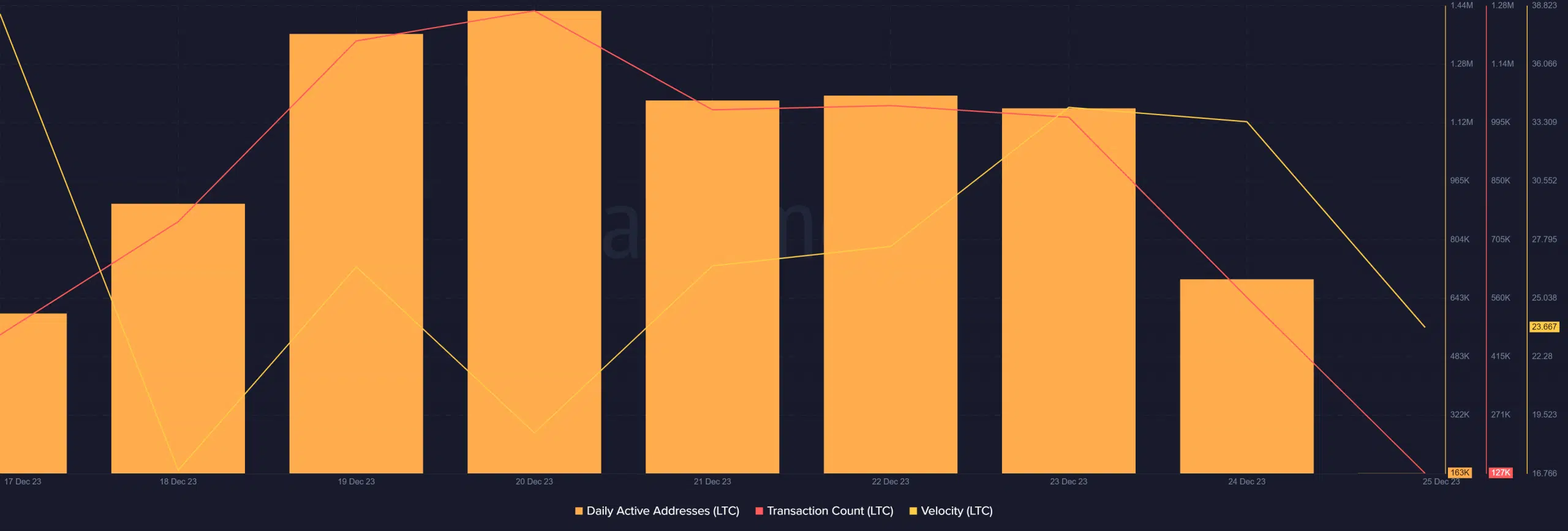

AMBCrypto then took a look at Santiment’s data, which affirmed that Litecoin’s Daily Active Addresses remained high in the last week, as did its transaction count.

Its velocity was also up, meaning that LTC was used in transactions more often within this time frame.

Was LTC affected?

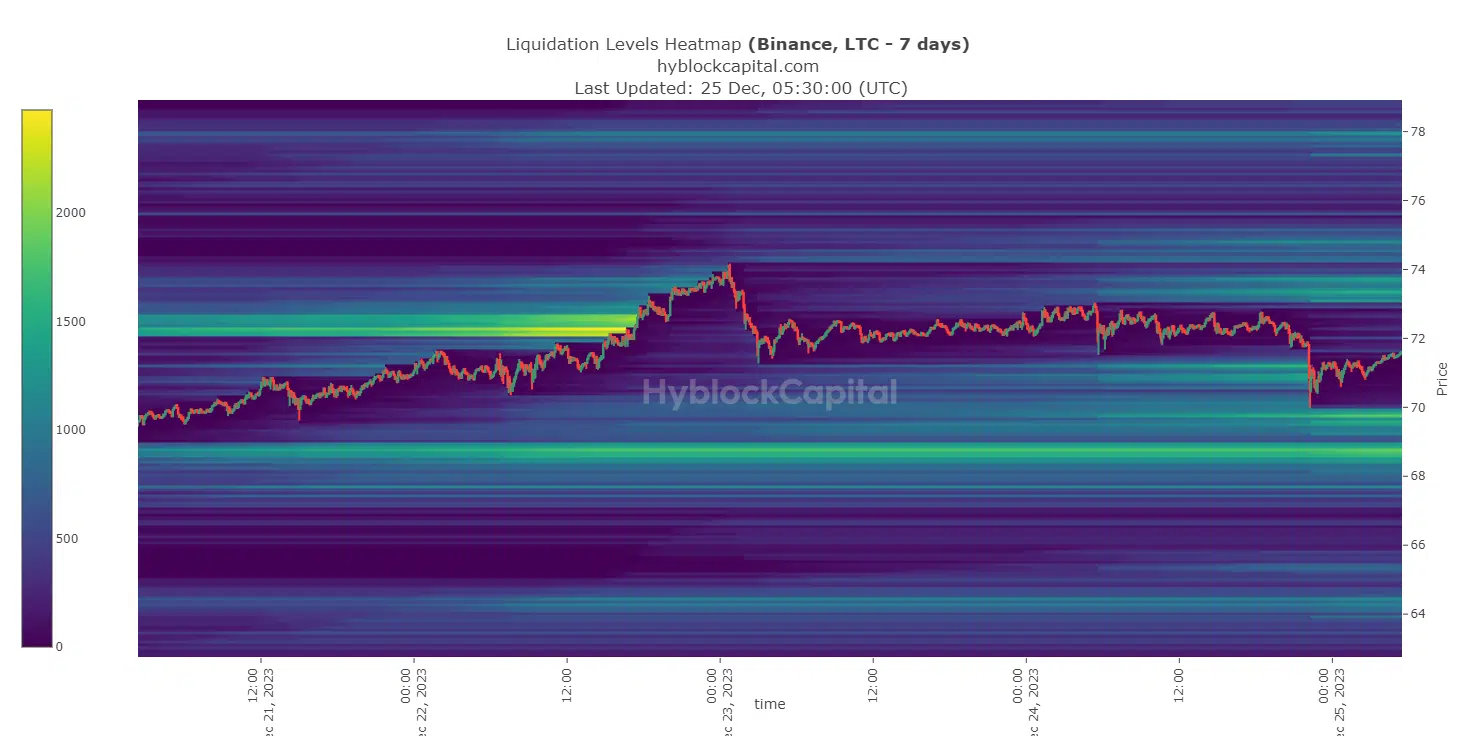

The hike in network usage did not have a major impact on how investors behaved in the recent past. For instance, LTC’s liquidation levels remained relatively low.

The coin only witnessed a high number of sell-offs near the $72 mark, but its price continued to rise.

Nonetheless, the growth momentum slowed down, as its daily chart recently turned red. According to CoinMarketCap, LTC was down by more than 1% in the last 24 hours.

At the time of writing, it was trading at $71.60 with a market capitalization of over $5.2 billion, making it the 18th largest crypto.

To better understand what was going wrong with Litecoin, AMBCrypto checked Santiment’s data. As per our analysis, after spiking on the 22nd of December, LTC’s MVRV Ratio dropped slightly.

Its Price Volatility 1w also took a sideways path, justifying its sluggish price action. Moreover, derivatives investors were actively buying LTC at press time, increasing the chances of a continuous sideways price movement.

Read Litecoin’s [LTC] Price Prediction 2023-24

To add to the misery, Litecoin’s MACD displayed a clear bearish advantage in the market. Its Chaikin Money Flow (CMF) also registered a drop, meaning that the possibility of a further downtrend was high.

Nonetheless, the Money Flow Index (MFI) turned bullish as it registered a slight uptick from the neutral mark.