Will USDT end 2023 on a winning note?

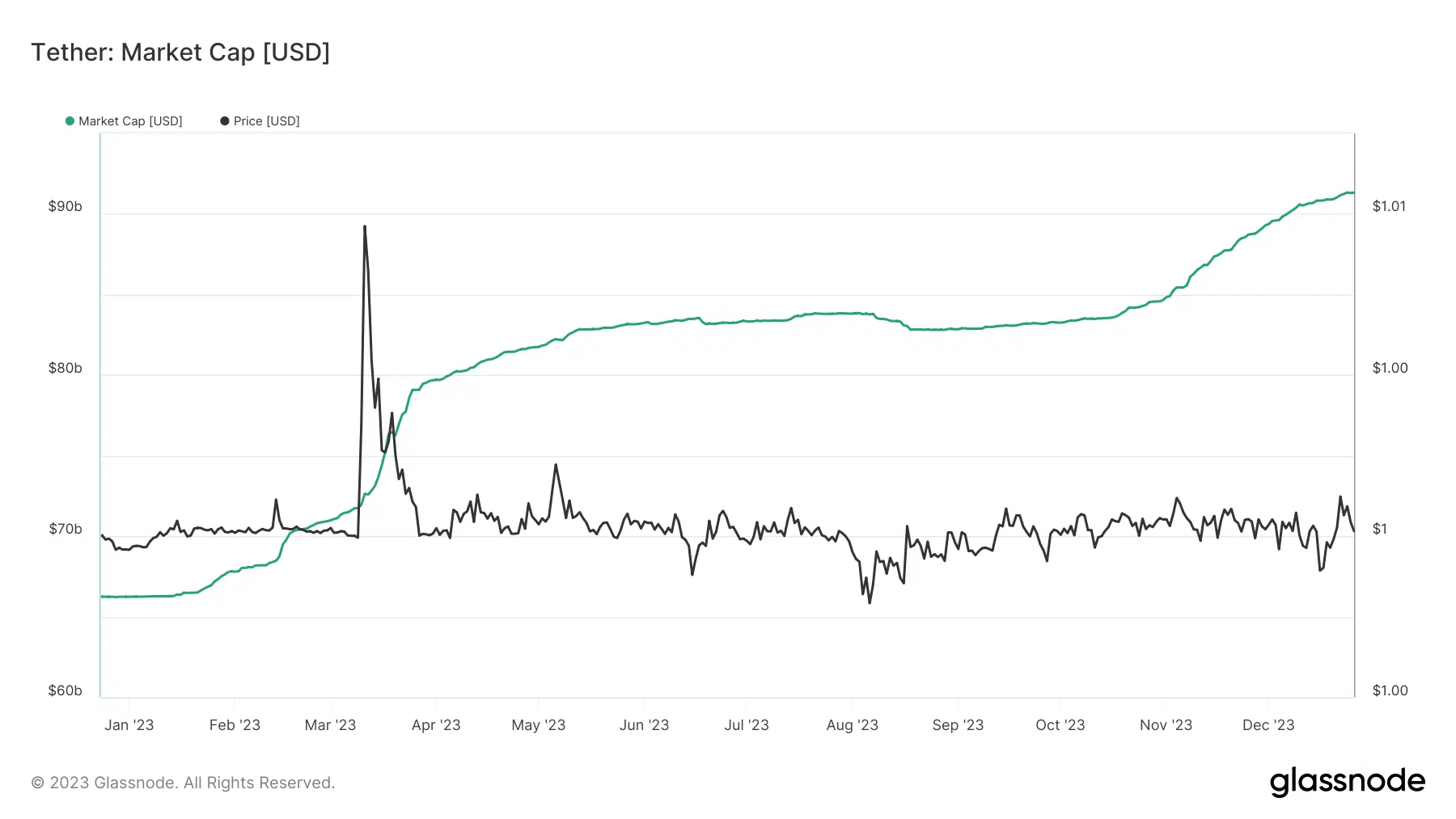

- USDT’s market capitalization increased 37% YTD to $91 billion.

- USDT added 4 billion in its excess reserves throughout 2023.

Tether [USDT] negotiated 2023’s bear market with great aplomb to solidify its position as the largest and most popular stablecoin.

USDT’s market capitalization increased 37% year to date (YTD) to $91 billion, as investors reposed their trust in the face of unfavorable signals from other stablecoins.

USDT maintains its shine

Barring the odd incident, USDT held firm to its value of $1 even as some top players like USD Coin [USDC] and DAI witnessed their worst depegs this year.

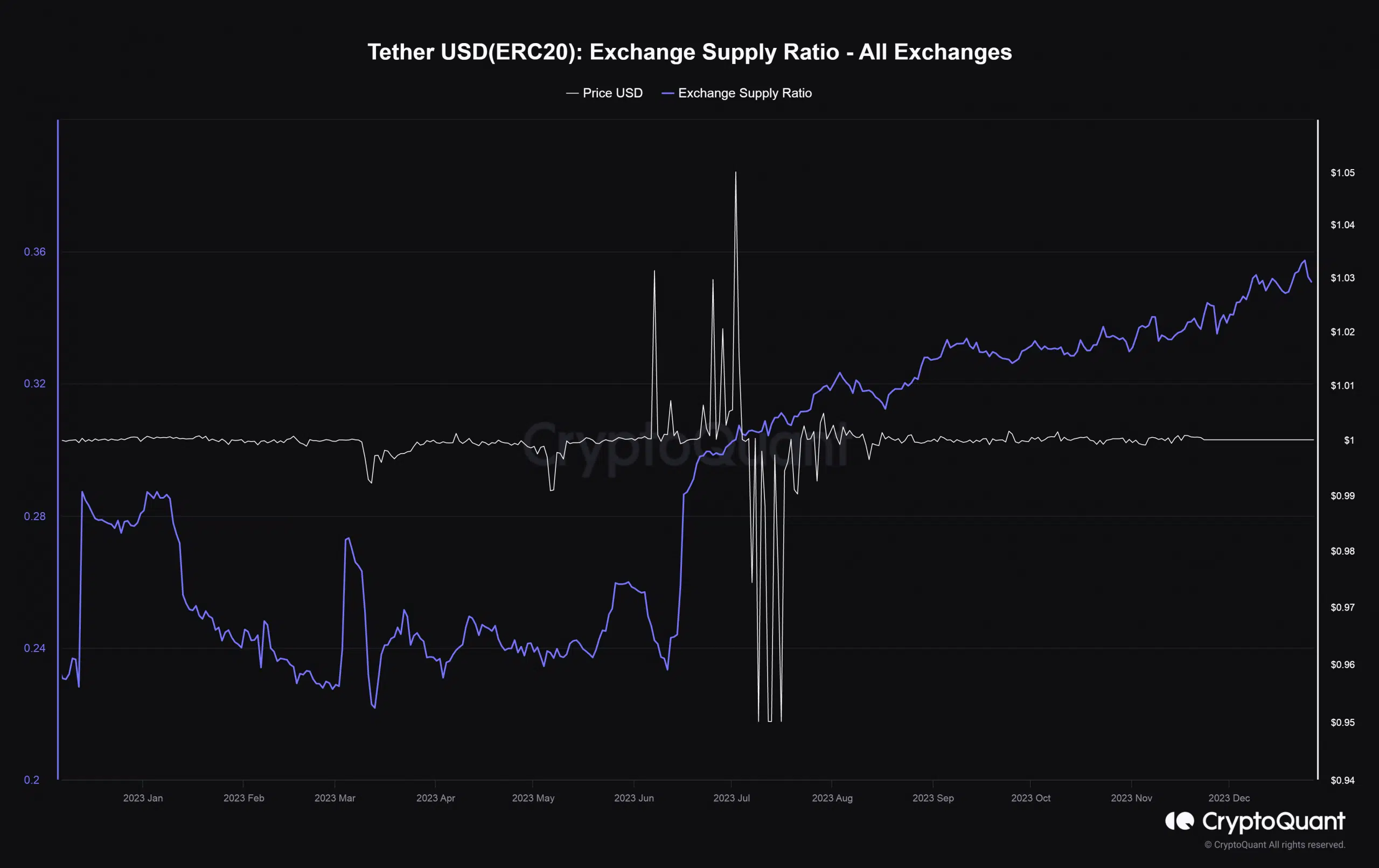

Moreover, USDT’s exchange supply ratio steadily increased in the second half of 2023, AMBCrypto observed using CryptoQuant’s data.

For the uninitiated, the metric measures the ratio of tokens reserved in exchange wallets relative to the total supply of the token.

Typically, a spike in stablecoin exchange reserves indicates strong buying pressure and bullish sentiment in the market. This is because most traders would use stablecoins to enter and exit trades on exchanges.

Upon further analysis using DeFiLlama, Tron [TRX] was found to be the biggest home for USDT, accounting for nearly half the supply.

With over 40% of USDT supply, Ethereum [ETH] was the second-largest network.

CEO divulges on important developments

Apart from this, USDT added 4 billion in its excess reserves throughout 2023, Tether CEO Paulo Ardoino revealed on X (formerly Twitter).

As explained by himself, excess reserves are the company’s undistributed dividends, which it keeps on top of the 100% reserves that Tether maintains to back the different tokens it offers.

Tether uses this capital cushion to provide “further stability and resiliency” to the ecosystem.

Moreover, the CEO talked about a myriad of projects that Tether invested in, using a portion of its profits. Some key projects outlined were Holpunch, Synonym, Northern Data, and Tether Energy.

Tether Energy, especially, has taken giant strides in the Bitcoin [BTC] mining industry. The CEO said that significant investments have been made into sites in emerging markets across the globe.