Solana: Should SOL investors be prepared for a price correction

- Solana’s market indicators revealed that the bulls were leading the market.

- SOL’s price dropped by 6% in the last 24 hours while the funding rate surged.

Solana [SOL] has showcased impressive performance over the last few weeks as it gained a substantial amount of market capitalization. In fact, Santiment also mentioned Solana in its report, highlighting the same fact.

Solana joins the top 5 club!

Santiment recently uploaded a report highlighting the performances of the top coins over the last week. As per the report, SOL appears consistently at the top from 2023-12-18 to 2023-12-24, showing it has maintained high popularity throughout the week.

Additionally, the report also mentioned that SOL witnessed a robust price hike and social volume despite facing stiff competition. Apart from SOL, Santiment also mentioned the performance of other best-performing coins, like INJ, in the report.

? This past week saw several big trending tokens that shaped #crypto. Monitoring the list of projects getting huge attention is key to optimizing your #altcoin portfolio. Read our summary of $SOL, $INJ, $AMP, and newcomers trending for the first time. ?https://t.co/QCj7ehuaTL pic.twitter.com/Zzze7JPDWW

— Santiment (@santimentfeed) December 27, 2023

As per CoinMarketCap, SOL was up by nearly 25% in the last seven days alone. The recent uptrend allowed the token to earn a spot on the top five cryptos list as it overtook XRP and BNB Chain [BNB].

At the time of writing, SOL was trading at $104.37 with a market capitalization of over $44 billion. Now, to better understand how SOL managed to achieve that, AMBCrypto checked the token’s daily chart.

As per our analysis, SOL’s Bollinger Bands pointed out that the token’s price entered a high volatility zone.

Its MACD also revealed a clear bullish advantage in the market. However, after a comfortable uptrend, SOL’s Relative Strength Index (RSI) registered a downtick from the overbought zone.

A similar trend was also seen in terms of its Chaikin Money Flow (CMF), which can cause a price correction in the days to follow. In fact, SOL was already down by 6% in the last 24 hours.

Is a further downtrend incoming?

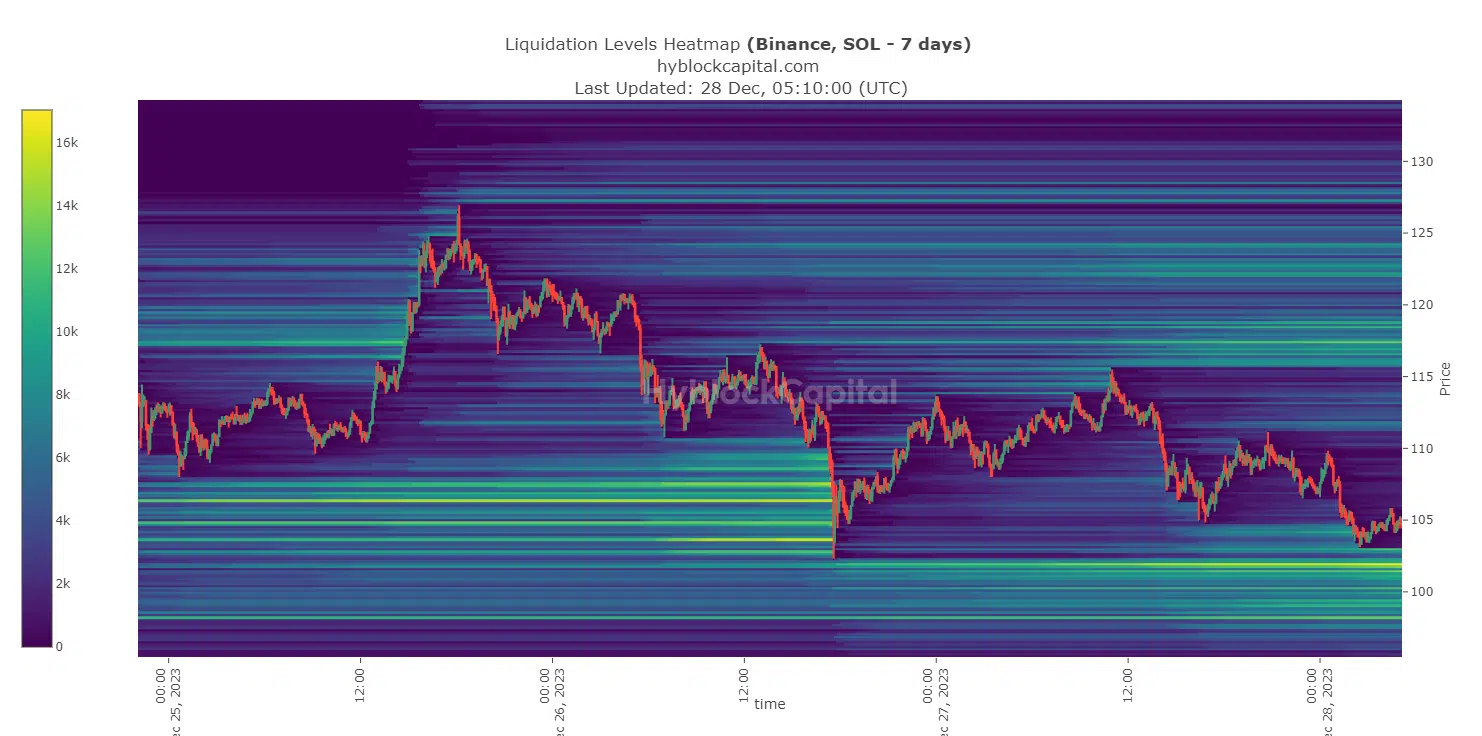

Our analysis revealed that Solana witnessed an increase in sell pressure when its price reached the $127 mark. Soon after that, SOL started to go down and reached its lowest point of $109 this week.

Read Solana’s [SOL] Price Prediction 2023-24

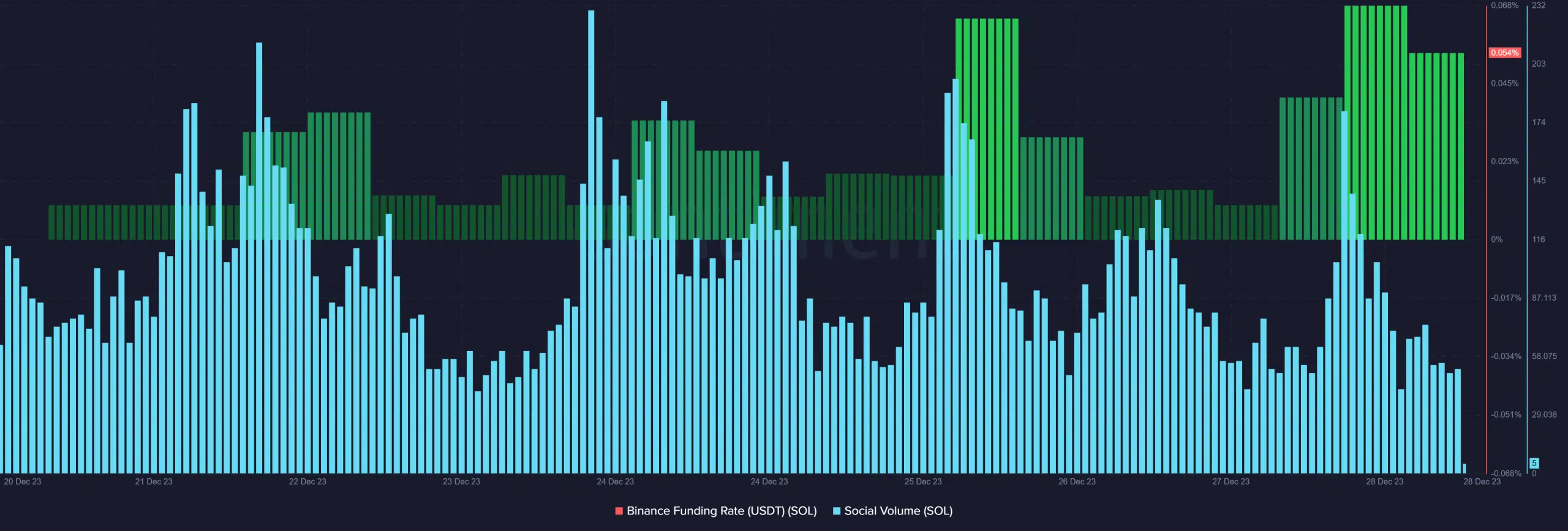

The bad news was that while the token’s price dropped, its Binance funding rate increased. This meant that derivatives investors were actively buying SOL at its lower cost.

Nonetheless, the token’s social volume remained consistently high last week, reflecting its popularity in the crypto market. Whether Solana manages to maintain its spot on the top five list despite these setbacks will be interesting to keep an eye on.