Another Bitcoin price surge may be bad for BTC prediction- Why?

- A rise in the UTXO in Profit may lead to a price correction.

- The STH-SOPR signals that it’s time for short-term investors to exit the market.

Bitcoin’s [BTC] good show over the last year placed many holders who suffered the bear market of 2022 in profits. However, the current state of the Unspent Transactions Output (UTXO) in Profit might have put BTC’s price in danger, AMBCrypto discovered.

The UTXO in Profit represents the percentage of coins whose value was lower when it was created compared to the current value. On the other hand, UTXOs in Loss are the coins with a lower value than it was when it was created.

For the uninformed, these metrics can be crucial in identifying market tops and bottoms. At press time, CryptoQuant data showed that the UTXO in Profit had increased to 88.63%.

More gains mean more downside

In past cycles, when the UTXO in Profit hits 95%, the Bitcoin price corrects. So, if the coin price rises and places more UTXOs in gains, a notable drawdown might occur. This notion was also corroborated by SimonaD, an on-chain analyst.

SimonaD, who published her analysis on CryptoQuant, noted that:

“The last time the market had the metric in a high state indicating over 95% of UTXOs being in profit, it was during the 2021 top bull market. This means that we should pay close attention to this area if it will be touched and crossed in the next period.”

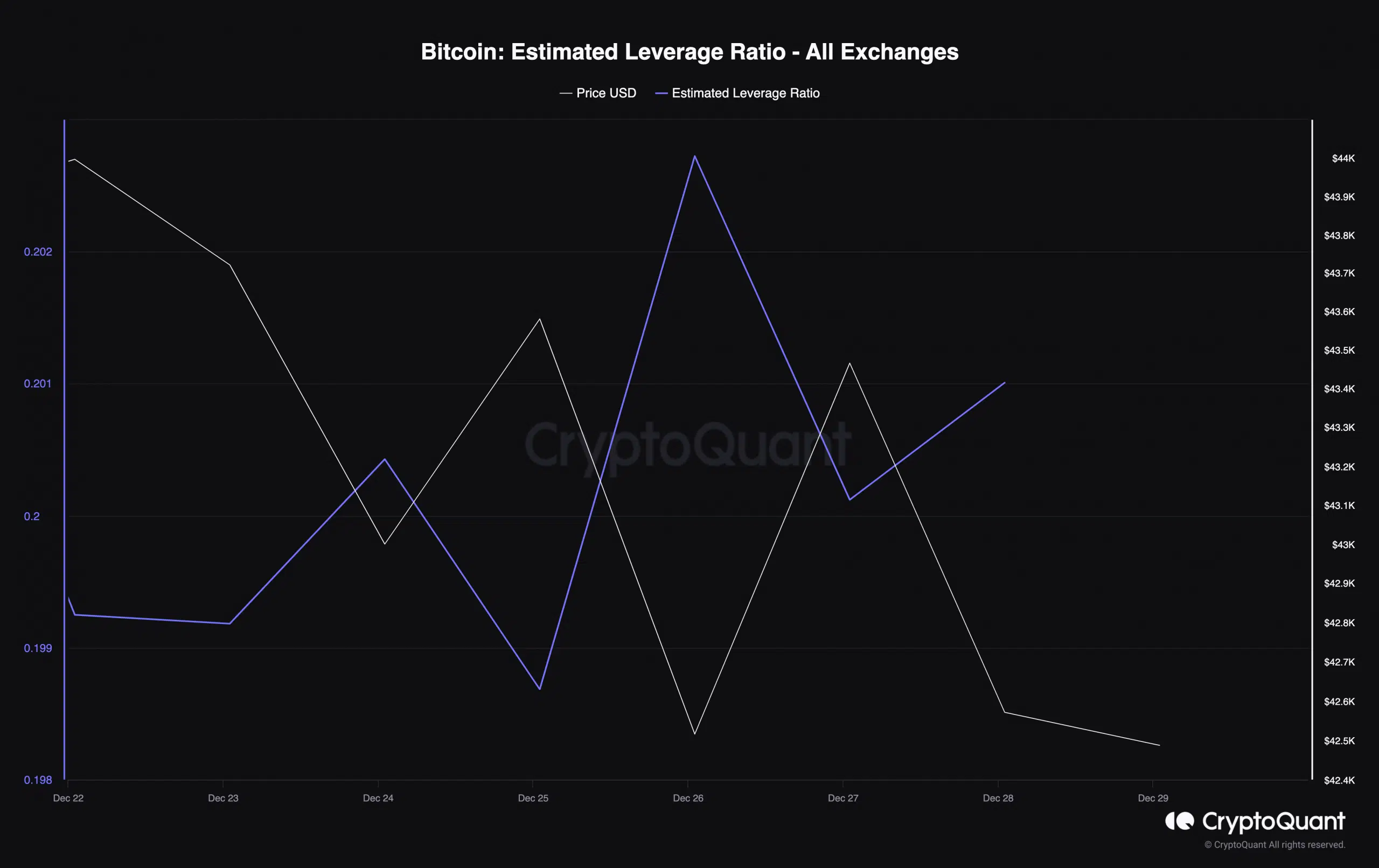

AMBCrypto then went ahead to check if traders were applying caution. However, the Estimated Leverage Ratio (ELR) indicated otherwise. The ELR shows the average leverage used by traders in the market.

A decreasing ELR suggests traders are taking low-leverage risks. However, at press time, Bitcoin’s ELR had increased. This increase indicates that traders were betting big on the price action.

Not a good season to buy

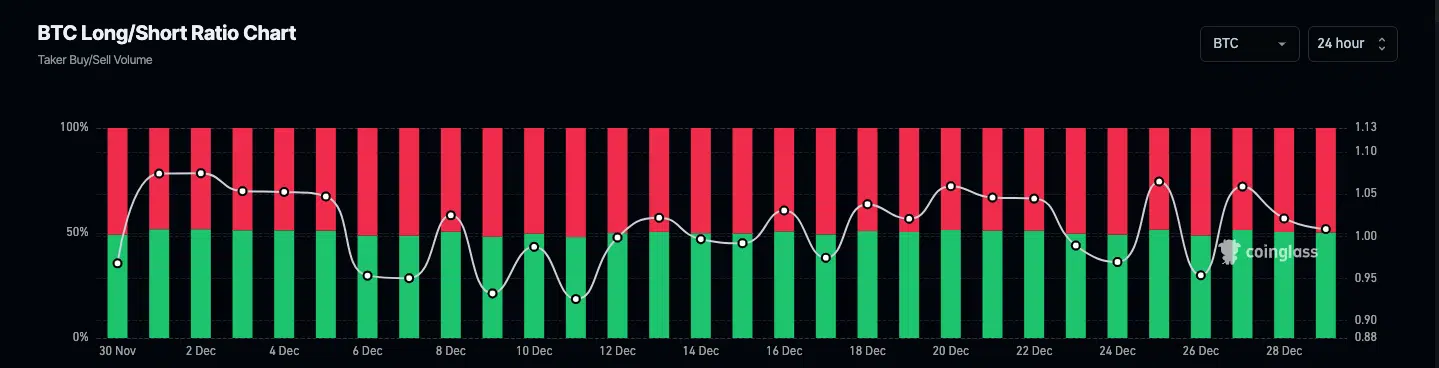

But are these traders taking long or short bets? Well, the Long/Short Ratio reading at the time of writing was 1.08 as of the writing. The data shown by the metric revealed that 50.21% of Bitcoin traders opted to open a position predicting a price increase.

On the other hand, 49.79% of the 24-hour open positions were shorts. A scenario like this indicates that traders are uncertain about the direction BTC might move. As it stands, BTC may continue to trade sideways, leaving longs and shorts at the risk of liquidation.

How about Short-Term Holders (STH)? Data evaluated from Glassnode showed that Bitcoin’s STH-SOPR had risen to 1.02.

The STH-SOPR assesses the behavior of short-term investors using the sentiment shown within 155 days. Values of the STH-SOPR below 1 suggest a good entry for buyers.

Is your portfolio green? Check the BTC Profit Calculator

So, the Bitcoin STH-SOPR at press time, indicates that it could be time to exit the market. For the time being, the Bitcoin price might drop to $42,000.

However, there is widespread anticipation of a 2024 bull market that could send the price to a new All-Time High (ATH).