What Bitcoin’s 2024 predictions say about the king coin’s prices

- Bitcoin miners have started reducing their exposure to the king coin.

- BTC has been struggling to reach $50,000 for quite some time now.

With Bitcoin’s [BTC] price facing significant resistance at the $44,000 price level, miners on the network have reduced their exposure towards the tail end of 2023.

An assessment of BTC’s Miner to Exchange Flow on a 30-day moving average revealed a 60% uptick in the last month.

Bitcoin miners move away?

The Miner to Exchange Flow metric measures the amount of BTC that is flowing from miners to exchanges. When this metric rallies, miners sell more BTC than they are mining.

This is a sign that miners are bearish on the price of BTC and are mostly interested in selling their holdings.

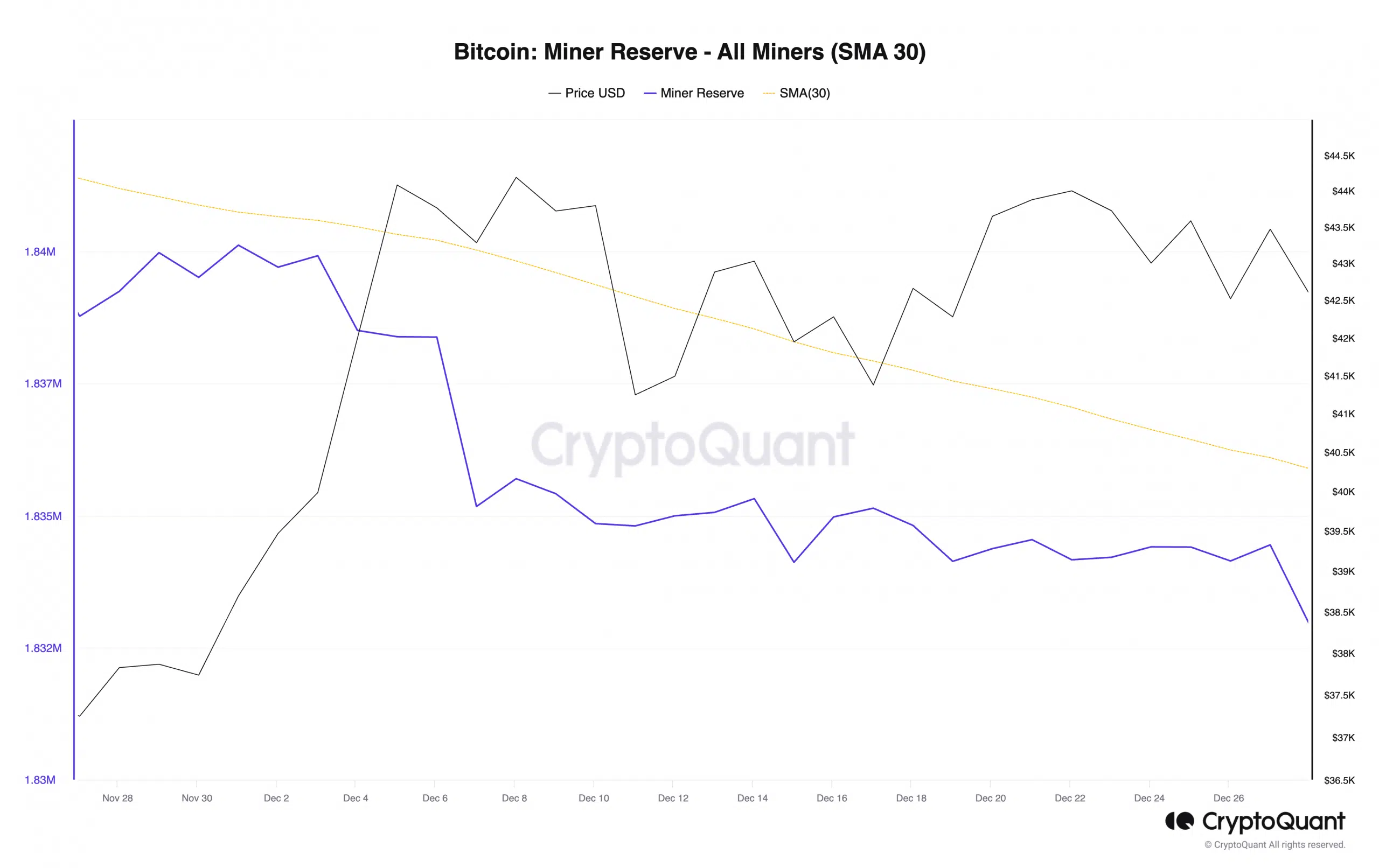

Also, BTC’s Miner Reserve, which measures the number of coins held in affiliated miners’ wallets, confirmed coin exits from miners’ wallets within the period under review.

In the last 30 days, this metric has declined by 1%, according to data from CryptoQuant.

Though miners reducing their exposure can ring alarm bells for some investors, there could be more trouble in store.

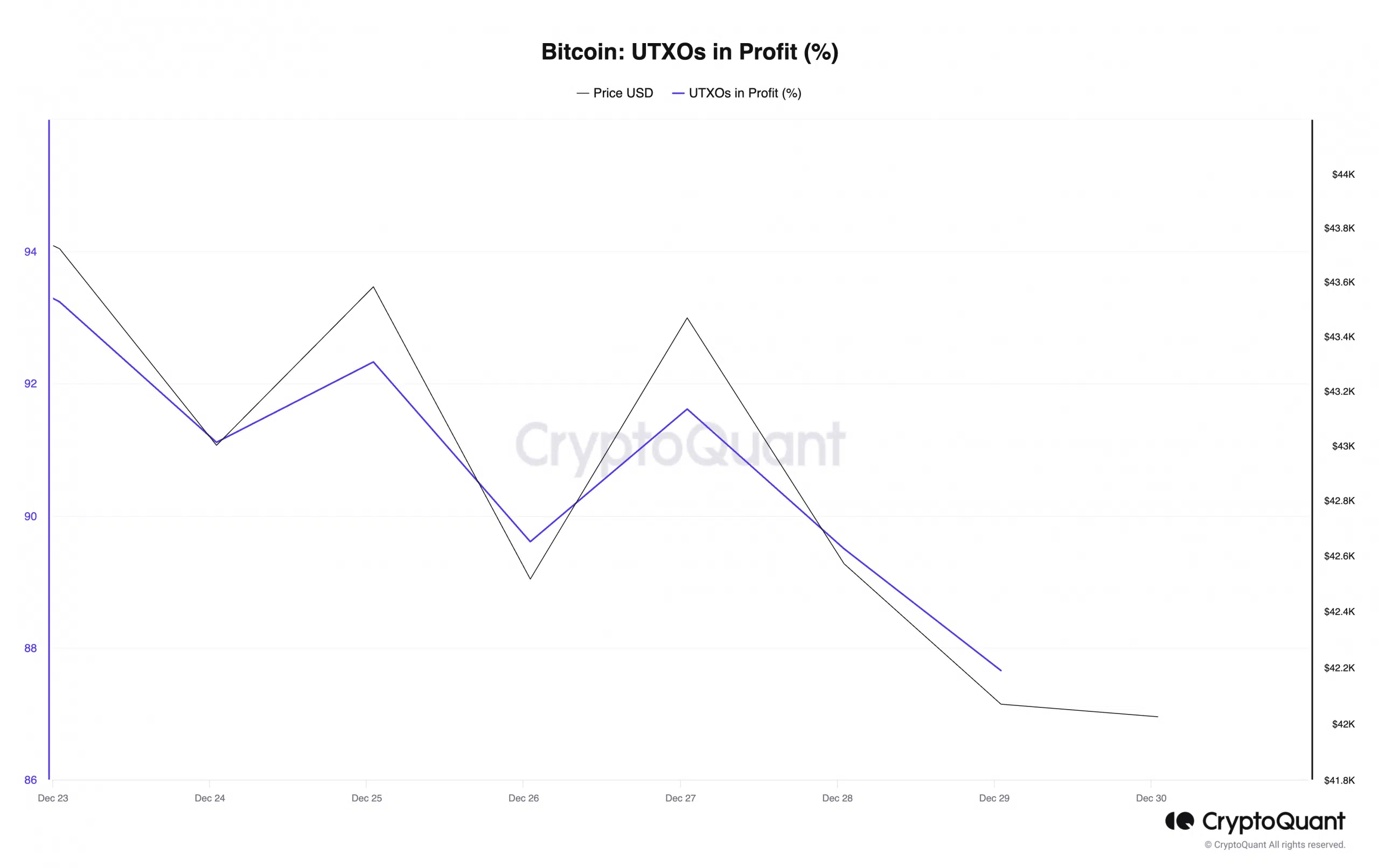

As per CryptoQuant analyst Simona D, a spike in Bitcoin’s Unspent Transaction Outputs (UTXOs) in profit puts it at risk of a sharp correction in 2024.

BTC UTXO is a metric that tracks the amount of the cryptocurrency in a wallet address left untouched after a transaction is completed.

A UTXO is deemed to be “in profit” if the current market price of BTC is higher than the price at which the UTXO was created.

AMBCrypto noted that in an earlier report, BTC’s UTXO stood at over 88%. However, at the time of writing, the percentage of the number of UTXOs being in profit among total UTXOs has fallen slightly, to nearly 87%.

Read Bitcoin’s [BTC] Price Prediction 2023-24

This showed that many BTC holders continued to sit on unrealized gains, but the possibility of a price correction caused by an increase in this metric could wane — a spot of positive news.

The last time this metric was close to such high levels was during the bull market in 2021, when 95% of all UTXOs were held in profit.