Ethereum: Rising whale interest means this for ETH’s future

- Influential whales showed keen interest in Ethereum and accumulated large amounts of ETH.

- Ethereum experienced a large price surge, coupled with increased network growth.

Amid prevailing uncertainty surrounding the crypto market, Ethereum [ETH] became the focus of significant attention from influential whales.

Whale move in

Insights from Lookonchain shed light on a substantial whale transaction. This whale withdrew a considerable 9,705 ETH ($22.9M) from Binance [BNB], subsequently depositing the funds into Compound.

In a strategic move, the whale borrowed 12M Tether [USDT] to further accumulate ETH. The trading activity involved three ETH transactions, two of which resulted in profits, accumulating roughly $5M.

The whale’s decisive actions introduce a spectrum of implications for ETH. On one hand, the substantial investment signals a level of confidence in ETH’s future potential, bolstering positive sentiment within the market.

Conversely, the increased incentive for profit-taking introduced an element of risk, potentially impacting short-term price stability.

Analyzing ETH’s price movement

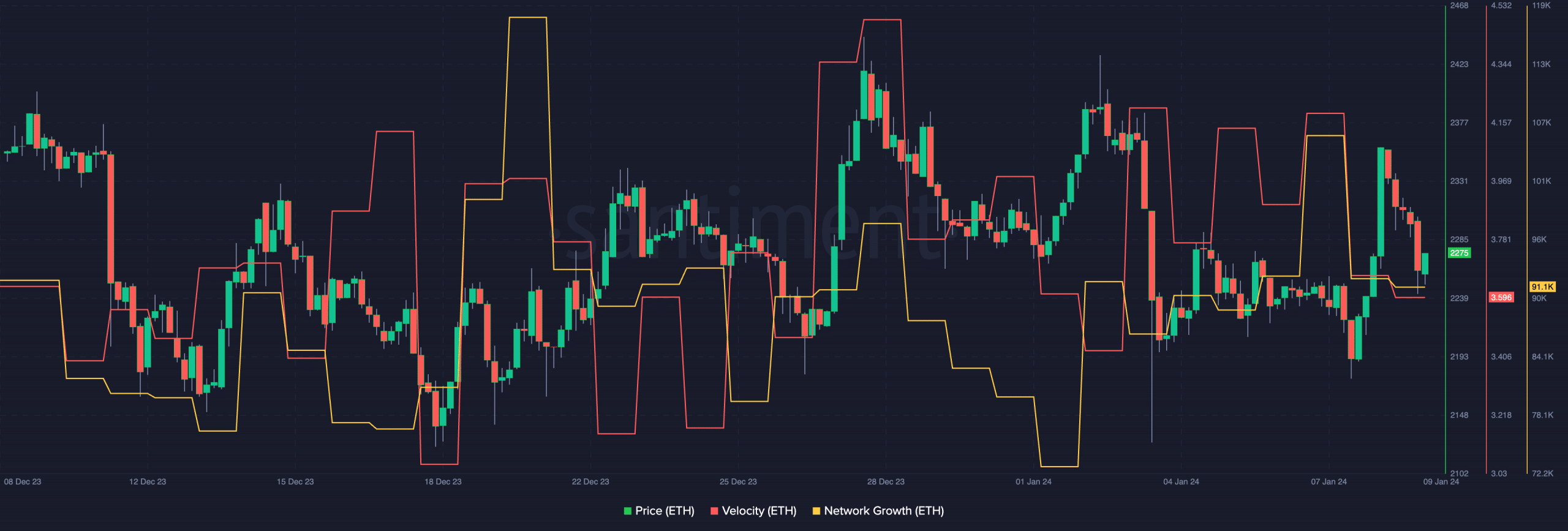

As of the latest data, ETH was trading at $2,415.34, reflecting a positive growth of 5.07% in the last 24 hours. Crucially, metrics such as network growth and velocity experienced a surge.

This indicated heightened interest from new addresses and an increase in token movements, collectively contributing to a positive outlook for ETH’s future.

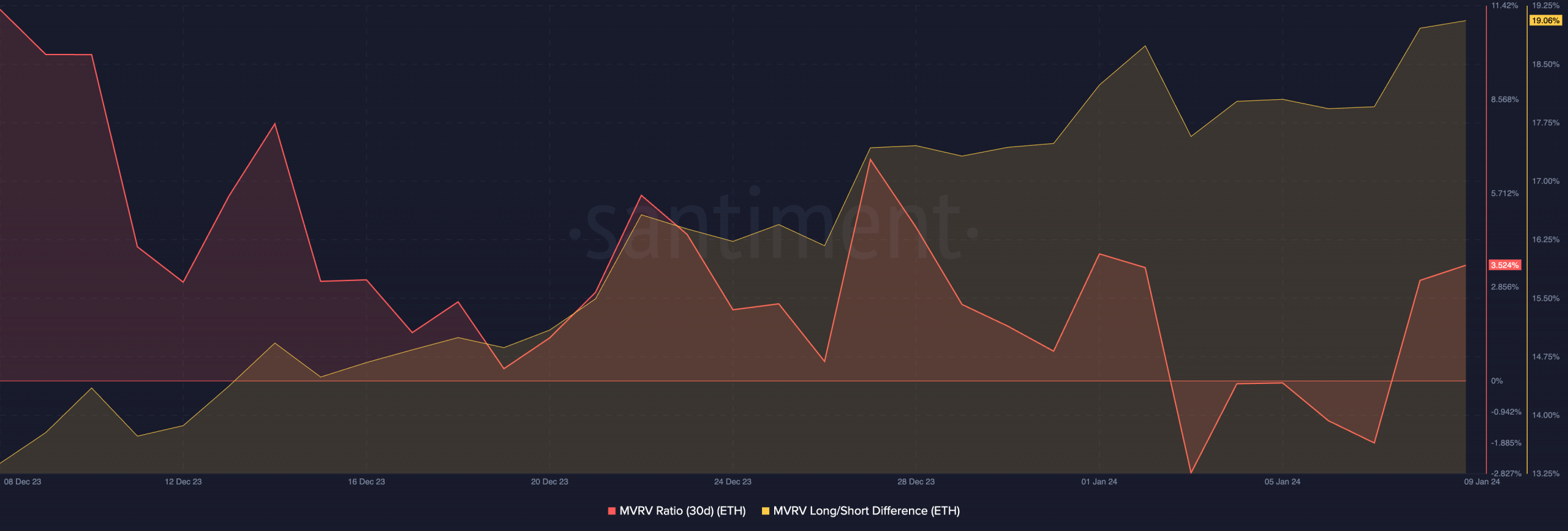

The MVRV ratio, a metric gauging the profitability of ETH addresses, expanded in tandem with the recent surge in price.

While this points to increased profitability for ETH holders, it also raises the specter of potential sell-offs, which could exert downward pressure on prices.

Counterbalancing this, the rising long/short ratio, indicative of a prevalence of long-term addresses over short-term ones, suggests a greater inclination toward holding rather than selling.

How much are 1,10,100 ETHs worth today?

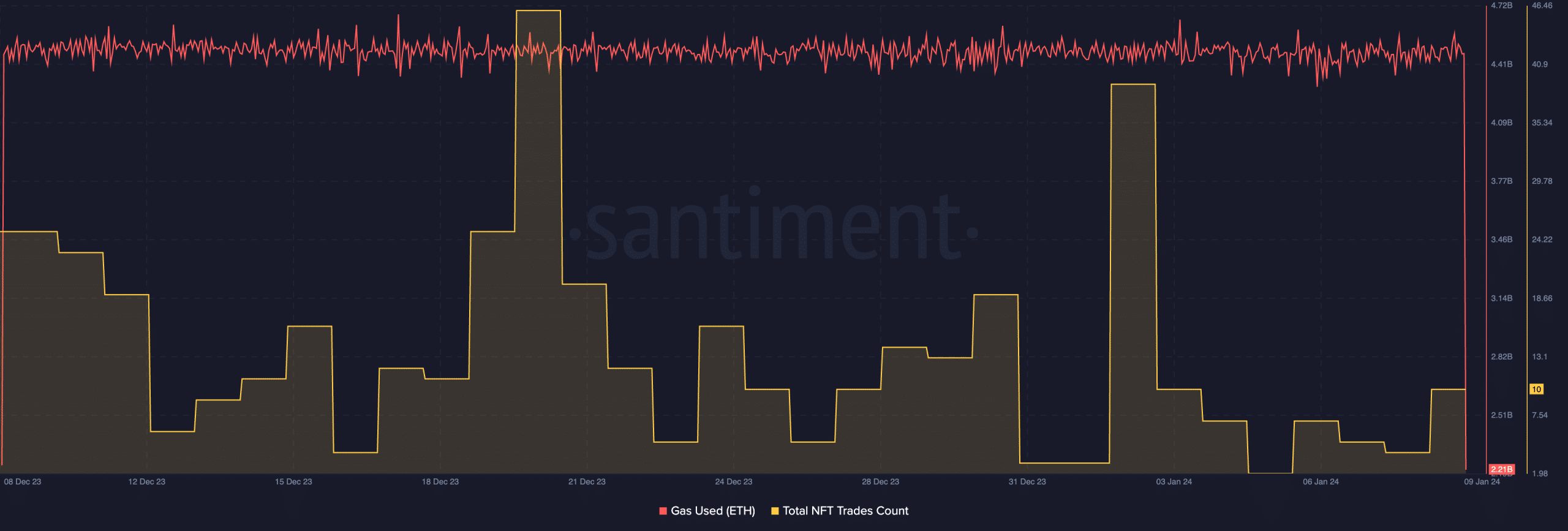

A holistic view of Ethereum’s network revealed consistent gas usage, a critical metric for measuring transaction activity. However, a concerning decline in NFT trades on the network raises questions about overall network vitality.

The reduced engagement with NFT transactions may signify a shift in user preferences or potential challenges faced by the NFT sector within the Ethereum ecosystem.