ETH turns traders ‘extremely greedy’ as BTC falls short

- ETH reclaimed the $2,500 level and its weekly returns stood at an impressive 14.5%.

- Nearly 66% of all whale positions on ETH were long.

While Bitcoin [BTC] proved to be a dampener since the official clearance of its spot ETFs, the focus shifted to Ethereum [ETH], which clocked double-digit gains over the past week.

ETH comes to the market’s rescue

The second-largest cryptocurrency reclaimed the $2,500 level, and its weekly returns stood at an impressive 14.5% as of this writing, according to CoinMarketCap.

Well-known technical analyst Ali Martinez dissected ETH’s weekly trajectory in an X (formerly Twitter) post and its optimistic chances of even reaching $3,400.

Remember that #Ethereum broke out from an ascending triangle on the weekly chart. Despite the short-term volatility, $ETH continues to target $3,400! pic.twitter.com/kQ2ncLuFjL

— Ali (@ali_charts) January 14, 2024

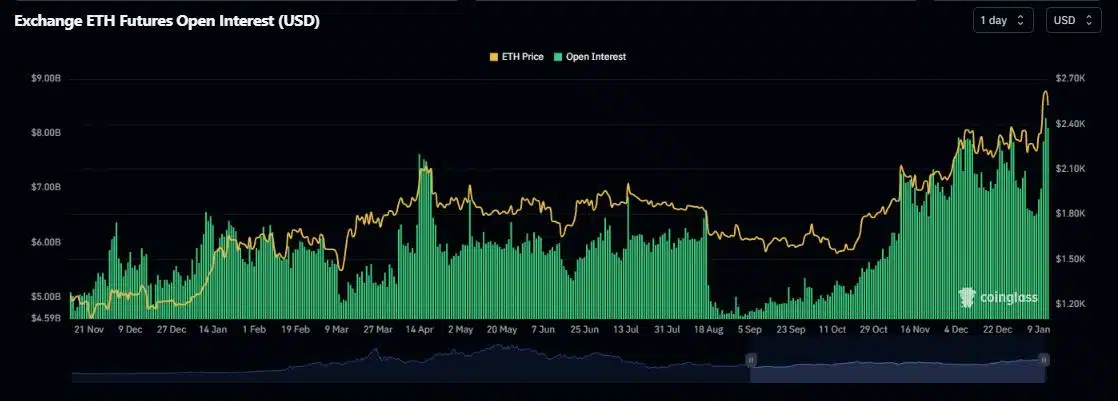

ETH’s demand also shot up in the derivatives market. According to AMBCrypto’s analysis of Coinglass data, the Open Interest (OI) spiked above $8 billion on the 12th of January, the first such occurrence since April 2022.

When new money is invested into a coin’s derivatives, it indicates a strong bullish sentiment.

Whales bullish on ETH

Moreover, the number of traders holding long positions exceeded those holding shorts in the past 24 hours, the reading of the Long/Short Ratio chart revealed.

AMBCrypto examined further and turned to Hyblock Capital to ascertain the sentiment of whale investors on ETH.

It was discovered that nearly 66% of all whale positions were long on Binance as of this writing. Notably, whales have been increasing their long exposure over the past three months.

Since whales are considered to be an experienced user cohort, their bullish bets for ETH held significance.

Traders becoming greedy

The best part was that the party might have just started. There was a glaring FOMO in the market, with many traders wanting to get their hands on ETH.

The market sentiment was one of greed, with one day last week experiencing “extreme greed.” Typically, it is assumed that greed drives an asset’s price upward with more buying pressure.

Is your portfolio green? Check out the ETH Profit Calculator

With Bitcoin spot ETFs now operational, market participants have become hopeful of a spot Ethereum ETF as well.

Around seven companies have applied for the investment vehicle, which would track the spot prices of the world’s second-largest cryptocurrency. The final deadline for VanEck’s Ethereum ETF falls on the 23rd of May.