Will SUSHI investors remain profitable in January

- SUSHI was up by more than 2.5% in the last seven days.

- Market sentiment remained bearish, but a few metrics supported the bulls.

The prices of several cryptocurrencies plummeted last week. However, SushiSwap [SUSHI] acted differently as its value surged. Considering the market condition, should investors expect SUSHI’s price to rise in the coming days?

SushiSwap investors are in profit!

The last week was bullish for SushiSwap as its price action remained in investors favor.

According to CoinMakretCap, SUSHI was up by more than 2.5% in the last seven days. At the time of writing, SUSHI was trading at $1.11 with a market capitalization of over $258 million. This price uptick helped investors enjoy more profits.

In fact, Ali, a popular crypto analyst, pointed out an interesting development. As per his tweet, over 82% of SUSHI holders were currently ‘out of the money.’ This also meant that SUSHI might be undervalued.

Despite continuous development on #SushiSwap, the bear market's impact is evident to investors. Data from @intotheblock reveals that over 82% of $SUSHI holders are currently 'out of the money.' This also implies that #SUSHI might be undervalued! pic.twitter.com/6br3fqG7Ys

— Ali (@ali_charts) January 15, 2024

Is SUSHI awaiting another uptick?

To understand whether this means a further uptick in price, AMBCrypto took a closer look at SUSHI’s state.

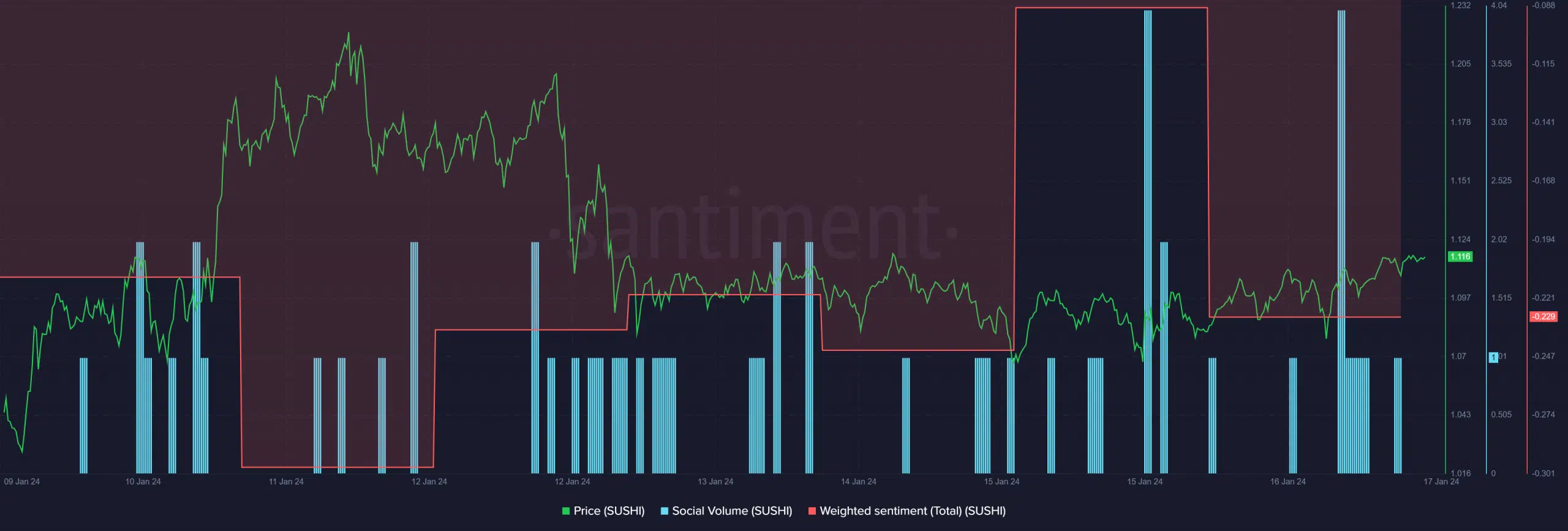

An analysis of Santiment data revealed that SUSHI’s social volume spiked last week, which meant the token’s popularity increased in the crypto space.

However, despite the price uptick, the token’s weighted sentiment remained on the negative side. This suggested that bearish sentiment around SushiSwap was dominant in the market.

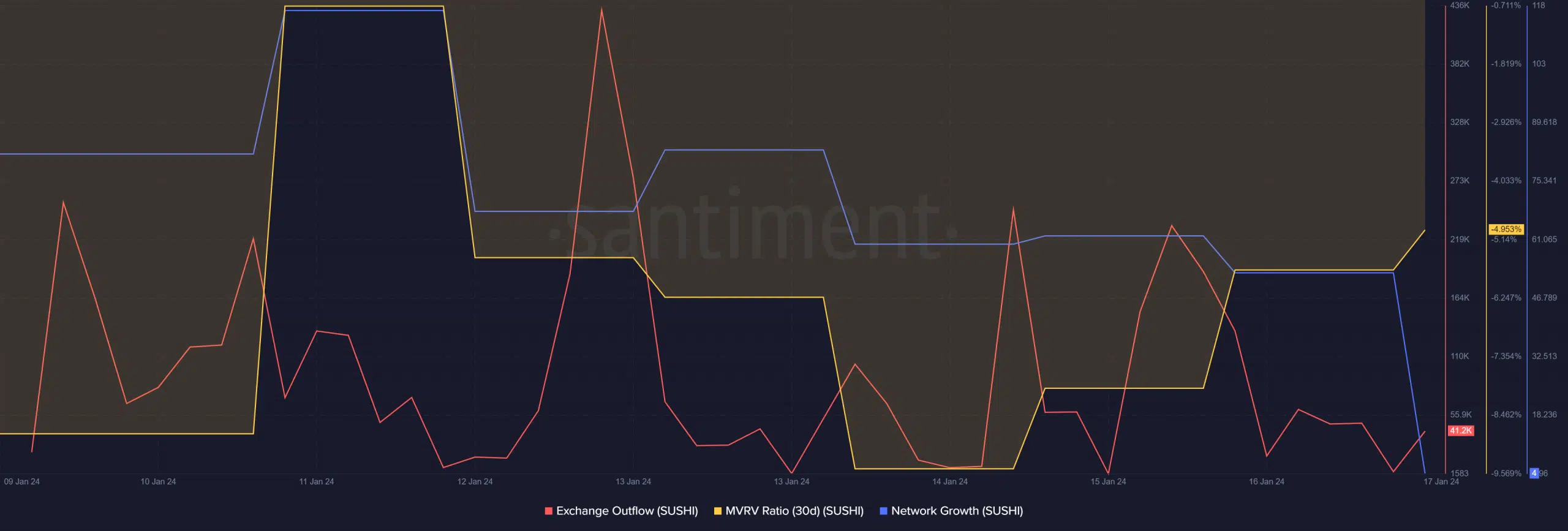

The token’s exchange outflow also spiked last week. This clearly meant that buying pressure on the token was high, which can be considered to be a bullish signal.

Though SUSHI’s MVRV ratio remained low, it did register a slight improvement, which can help SUSHI sustain its price uptick.

Nonetheless, its network growth declined last week, meaning that fewer new addresses were created to transfer the token.

A look at SUSHI’s daily chart revealed that the bulls might soon overtake the beers as the MACD graphs were closely knit.

Realistic or not, here’s SUSHI market cap in BTC‘s terms

The token’s Relative Strength Index (RSI) registered a slight uptick and was headed towards the neutral mark, increasing the chances of a continued price uptick over the days to follow.

However, the Chaikin Money FLow (CMF) continued to remain bearish as it moved southwards in the recent past.