Ethereum down to $2.3K – Is recovery really coming up?

- Ethereum showed bearish sentiment in the Futures market.

- The large bids at $2300 could keep the bears at bay for now.

Ethereum [ETH] prices dropped by nearly 12% from 16th January to the 22nd. The $2310 support level was tested, and at the time of writing hasn’t given way.

Data from the derivatives markets showed that the market participants were cautious and doubtful of another ETH rally in the short term.

The drop in the validator count as the Bitcoin [BTC] spot ETF news arrived has begun to recover. This led to fewer missed blocks as more validators came online.

The Ethereum Coinbase Premium Gap decreased to reflect a shift in sentiment among US-based ETH investors.

Investigating the state of the Ethereum market

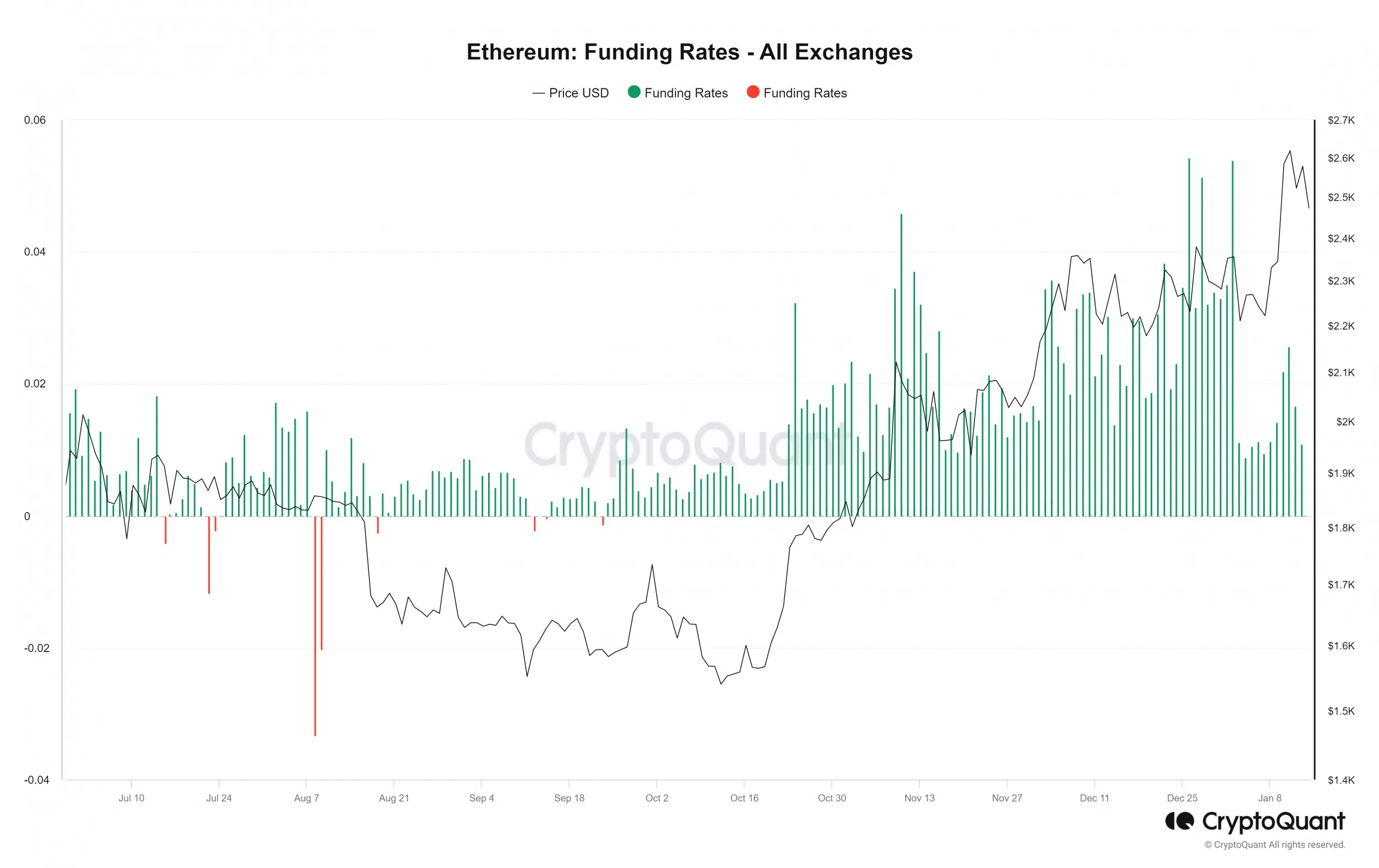

Apart from the price action, valuable information can be gleaned from analyzing the derivatives markets. Ethereum has trended downward in the past ten days alongside Bitcoin.

The fall below the $2400 support level was significant. A month ago, the bulls fought hard to drive prices past this mark.

Hence, the drop reflected bearish dominance. A look at the Ethereum Funding Rates showed that the strong bullish sentiment of late December and early January was replaced by skepticism.

On the 3rd of January, the Funding Rates plummeted from six-month highs to reach +0.0105%.

The positive rates showed more participants were willing to go long than short, but it wasn’t indicative of strong bullish sentiment.

Source: CryptoQuant

The rally from $2.2k to $2.7k saw an uptick in the funding rate as speculators scrambled to re-enter long trades. The rejection at the $2.7k mark on the 12th of January saw the funding rates drop once more.

The Open Interest has trended downward since the 2nd of January. This showed that despite the move to $2.7k in mid-January, futures traders did not believe that further gains were nearby.

Source: CryptoQuant

The past ten days saw both the price and the OI decline together. This underlined bearish sentiment in the short term.

How far south are Ethereum prices headed?

AMBCrypto analyzed the order book data from MobChart. It showed $2.71k ETH limit buy orders at the $2300 mark. Another $2.89k ETH of limit orders was present at the $2.2k level.

Source: MobChart

Therefore, these are the two levels where a reversal could commence. To the north, the $2.6k and the $2.5k levels had a large number of ETH sell limit orders.

Source: Hyblock

To better understand the short-term bias of ETH, AMBCrypto went through the liquidation levels data from Hyblock.

Notably, the Cumulative Liq Levels Delta was hugely negative. This showed that short liquidation levels far outweighed the long ones.

As a consequence, a jump in ETH prices would drive more liquidations than a continued drop. In turn, this showcased the likelihood of a bounce being higher than further losses.

Is your portfolio green? Check out the ETH Profit Calculator

To the north, the $2440 and $2490 levels have an estimated $80 million worth of liquidations.

Combined with the buy wall at $2.3k and the sell wall just under $2.5k from the order book heatmap, it appeared that a bounce to $2490 was likely.