Why Ethereum traders should be careful over the next few days

- A major player sold Ethereum worth millions of dollars in the last few days.

- A few market indicators looked bullish and suggested a possible trend reversal.

Ethereum [ETH] investors were having a hard time as the king of altcoins’ price continued to plummet. The token registered a double-digit price drop in the last seven days, and the latest dataset suggested that the ETH price could touch $2,100 soon.

Is confidence in Ethereum dwindling?

Ethereum’s price witnessed a massive price correction last week, as its value dropped by more than 13%.

In the last 24 hours alone, its value sank by over 5%. This pushed the token’s price under $2,300. At the time of writing, ETH was trading at $2,224.49 with a market capitalization of over $267 billion.

Caleb Franzen, a popular crypto analyst, recently posted a tweet highlighting the reason behind this price plummet. As per the tweet, ETH failed to test a pattern, resulting in the price drop.

The downtrend hinted that the king of altcoins’ price might touch $2,135 in the days to follow.

Ethereum $ETH analysis:

• Failed base breakout

• Failed megaphone breakoutWhen bullish structure fails to produce bullish outcomes, that's bearish. I know that's a simple conclusion, but it's important.

All eyes on the AVWAP range from October 2023 lows & the prior base. pic.twitter.com/u88JAOyLP3

— Caleb Franzen (@CalebFranzen) January 23, 2024

Meanwhile, a major player in the crypto space has been selling ETH.

Lookonchain’s data revealed that Celsius once again sold Ethereum worth more than $40 million. This clearly indicated that selling pressure on the token was high.

Historically, whenever Celsius has sold ETH, most of the time the token’s price has declined soon after the transaction.

The #Celsius wallet deposited 18K $ETH($40M) to #Coinbase again 12 hours ago.#Celsius has deposited a total of $280,760 $ETH($621M) to #Coinbase, #FalconX, and #OKX since Nov 13.

And #Celsius currently holds 540,029 $ETH($1.2B).https://t.co/3gGOucC9gY pic.twitter.com/cNxa0Wgd73

— Lookonchain (@lookonchain) January 24, 2024

What to expect from Ethereum

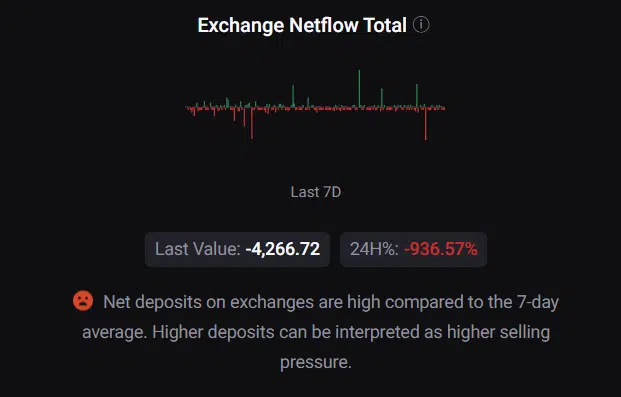

Since Celsius deposited a substantial number of ETH, AMBCrypto checked ETH’s on-chain metrics. Our analysis revealed that ETH’s net deposit on exchanges was high compared to the last seven-day average, indicating high selling pressure.

However, upon closer inspection, we found that investors were still holding their ETH. This was evident from the fact that Ethereum’s supply outside of exchanges remained considerably higher than its supply on exchanges.

At press time, ETH’s supply on exchanges was 10.51 million, while its supply outside of exchanges stood at over 121.7 million.

Since investors were willing to hold their assets, we checked ETH’s daily chart to see if there were any chances of a recovery in the short term.

Read Ethereum’s [ETH] Price Prediction 2024-25

The analysis revealed that Ethereum’s price touched the lower limit of Bollinger bands, which indicated a possible price rebound.

Additionally, its Money Flow Index (MFI) was also headed towards the oversold zone. If it enters that zone, buying pressure on ETH might increase.