AVAX’s path to $40 looks promising – Here’s how

- If AVAX rises above $37.95, the price might hit $43.85 in the coming days.

- Traders with low margin balances could be liquidated if the token hits $38.

Avalanche [AVAX], the 9th most valuable cryptocurrencsy, increased by 3.63% in the last 24 hours, CoinMarketCap showed. At press time, the token changed hands at $36.20. While the increase would have brought more gains for AVAX holders, AMBCrypto found that another uptrend could be close.

Our analysis of the AVAX/USD chart on the daily timeframe was the reason we came to this conclusion. From the technical outlook, bulls seem ready to challenge the $37.95 resistance. A successful breakout of the resistance could see AVAX rise to $43.85.

But if the token gets rejected, the price might retrace to $33.85 which was the next support zone. In the interim, the Relative Strength Index (RSI) has risen to 54.42, indicating a resurgence in the buying momentum. Should the RSI hit 60.00, AVAX’s first stop might be around $40.

Buyers have the upper hand

Further, the Awesome Oscillator (AO) was 0.60. Since rising from the negative end, the AO suggested increasing upward momentum for AVAX. Another metric AMBCrypto considered was the Directional Movement Index (DMI). At press time, the +DMI (green) was 25.41 while the -DMI (green) was 21.66.

This implies that there was more buyer aggression in the market than sellers. But for the Avalance native token to price higher, the state of the Average Directional Index (ADX) needs to change.

As of this writing, the ADX (yell0w) was 13.49. This implies a weak directional movement for AVAX.

Should the ADX reading climb above 25 while the +DMI stays above the -DMI, then AVAX’s path to $40 could be validated.

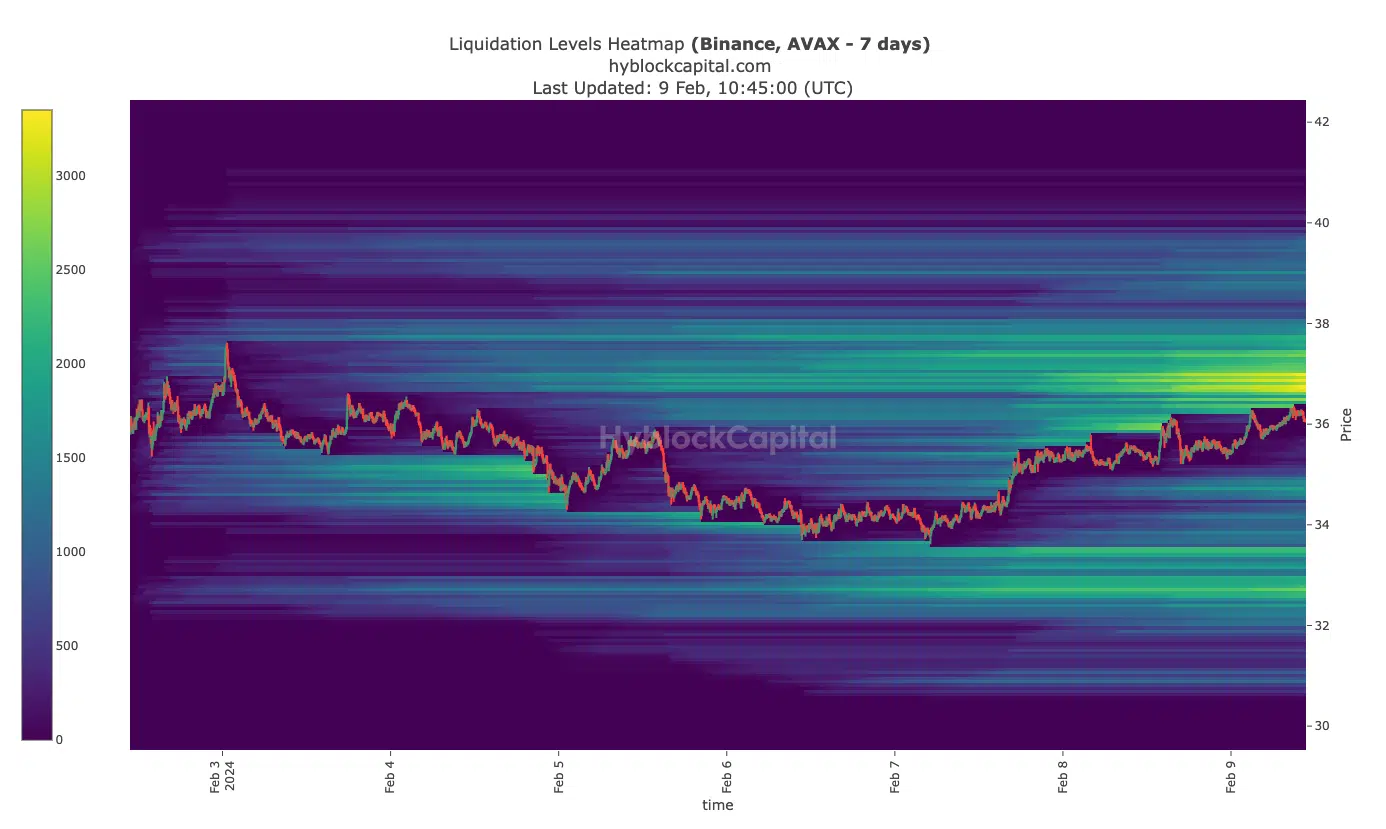

In terms of the Liquidation Heatmap, AMBCrypto noticed that AVAX’s potential move to $40 could face some hurdles. The Liquidation Heatmap calculates the liquidation levels based on market data and different margin sizes.

Big bets are at risk

The result of this gives an estimate of price levels where large-scale liquidation events might occur. According to Hyblock’s data, large-scale liquidations might happen once AVAX hits $37.

As such traders with high leverage and low margin balance could lose funds. Also, the same might happen if AVAX continues growing and approaches $38.

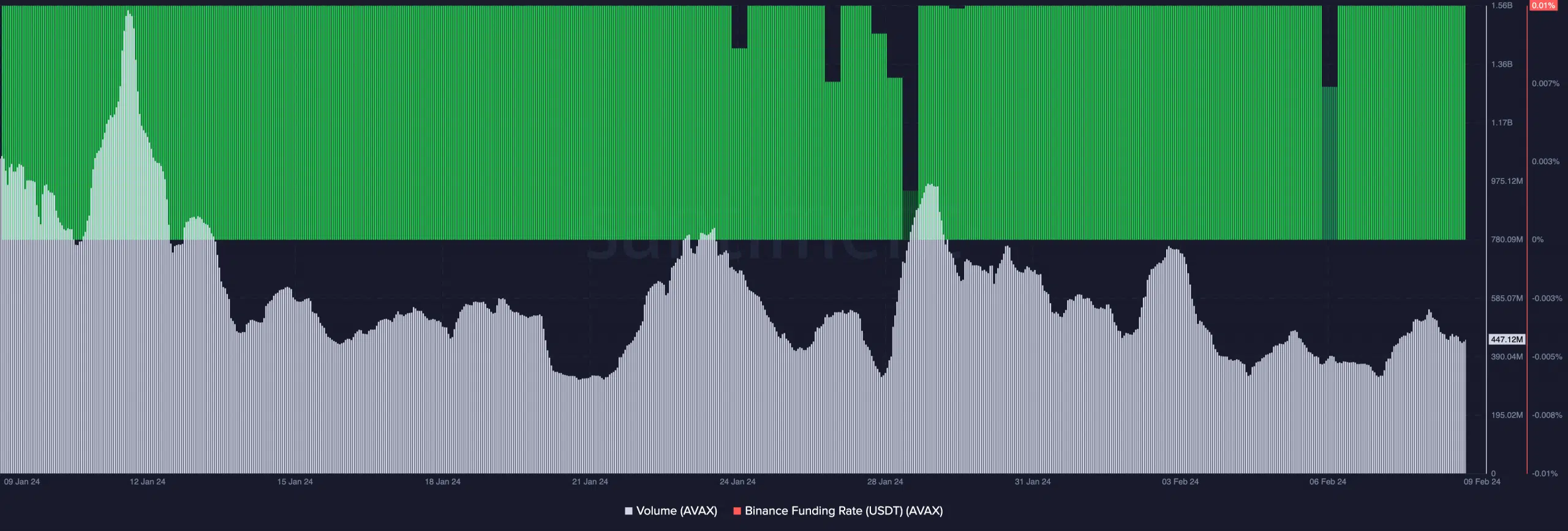

In addition, Avalanche’s volume rose to 547 million on the 8th of February. At press time, the volume had reduced. If AVAX’s price continues to increase while the volume decreases, a pullback might happen.

On the other hand, a resurgence in the volume followed by a price increase might send AVAX higher. If this is the case, the price might get close to $50 like it did some months back.

Is your portfolio green? Check the AVAX Profit Calculator

Concerning the Funding Rate, on-chain data showed that it was positive. The positive reading implies that longs are paying shorts a funding fee.

Conversely, a negative Funding Rate implies that shorts are paying longs a funding fee. In AVAX’s case, the positive Funding Rate is potentially bullish for the token.