Can XRP rebound to December highs? Data suggests…

- XRP might descend to the $0.51 critical support.

- The price could head back to $0.70 if altcoins begin to outperform BTC.

Ripple’s [XRP] price action in the last few days has been on the opposite side of what it was on the 9th of December 2023. As of the aforementioned date, XRP’s price rallied to $0.70.

But since 2024 began, the token has failed to hit such heights. At press time, XRP changed hands at $0.54, representing a 13.65 % Year-To-Date (YTD) decrease.

AMBCrypto’s analysis of the 4-hour chart showed how the cryptocurrency had descended to the $0.53 critical support. Owing to the presence of sellers near this threshold, the recent bounce to $0.54 could be short-lived.

If the price slopes to $0.53 one more time, a plunge toward the $0.51 support could be validated.

A return is not yet here

If XRP plans to retest $0.70, which it last hit in December, it has to exit the confinement between $0.51 and $0.57. Should the price break above these levels, then its chances of reaching $0.70 could increase. If not, the token might keep trading between the said levels.

In the meantime, the Relative Strength Index (RSI) had slipped below the 50.00 midpoint. This decrease was proof of a lack of buying pressure.

Should the RSI reading continue to decrease, the Ripple token might decrease to $0.50. However, if sellers get exhausted, the price might bounce.

Depending on the level of buying pressure, XRP could hit between $0.60 and $0.70. If this happens, then the $1 predictions could become plausible.

However, the On Balance Volume (OBV) has remained around the same region since the 19th of February.

However, the OBV reading was not negative, meaning that investors were not hesitant to buy. But if XRP was to have any chance of hitting $0.70, investors need to increase accumulation.

Network activity slumps

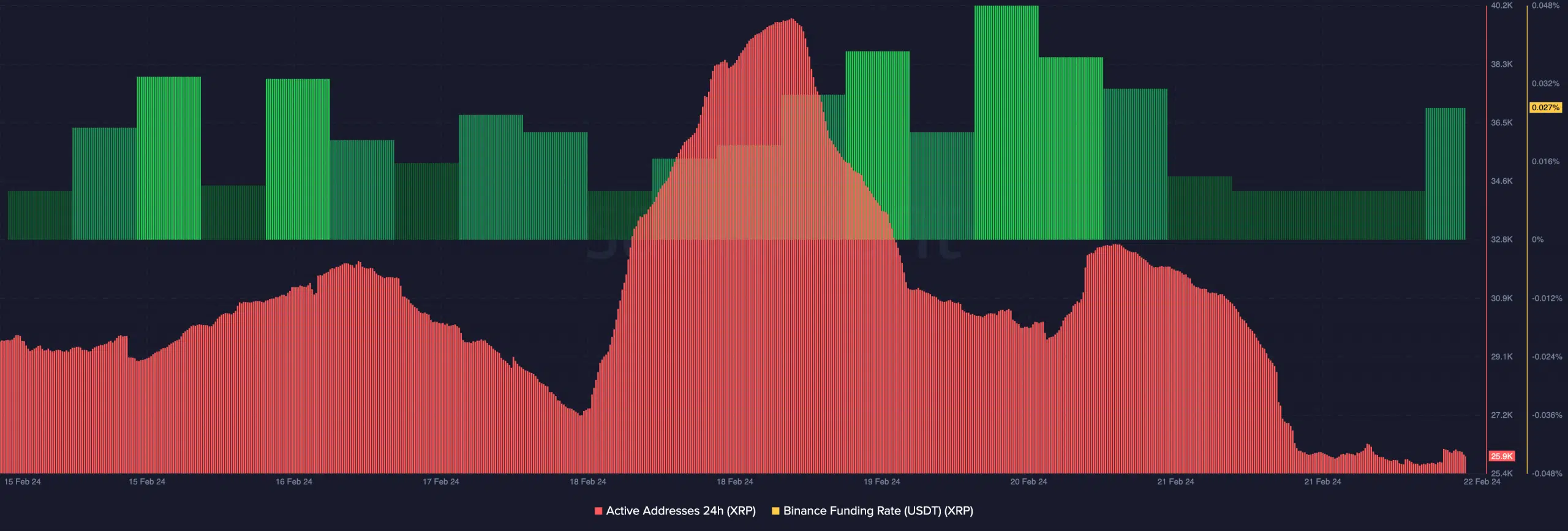

On the on-chain side of things, AMBCrypto noticed that activity on the Ripple network had fallen. On the 20th of February, the 24-hour active addresses were over 32,000. But at press time, XRP’s active addresses had decreased to 25,900.

Active addresses show the number of users sending and receiving assets on the network.

An increase in the metric suggests a heightened speculation around a token. Therefore, the decrease here implies that crowd interaction with the token had significantly decreased. When it comes to the Funding Rate, Santiment showed that it was positive.

The Funding Rate is the cost of holding an open perp position. The positive Funding Rate implies that XRP’s perp price was trading at a premium when compared to the index price.

A negative reading would have implied that the token’s perp value was at a discount.

How much are 1,10,100 XRPs worth today?

In the context of its price, the positive Funding Rate while the price moves lower indicates a bearish thesis.

In the short term, XRP’s price could slip below $0.54. But if altcoins begin to pump hard, a move to $0.70 could be plausible.