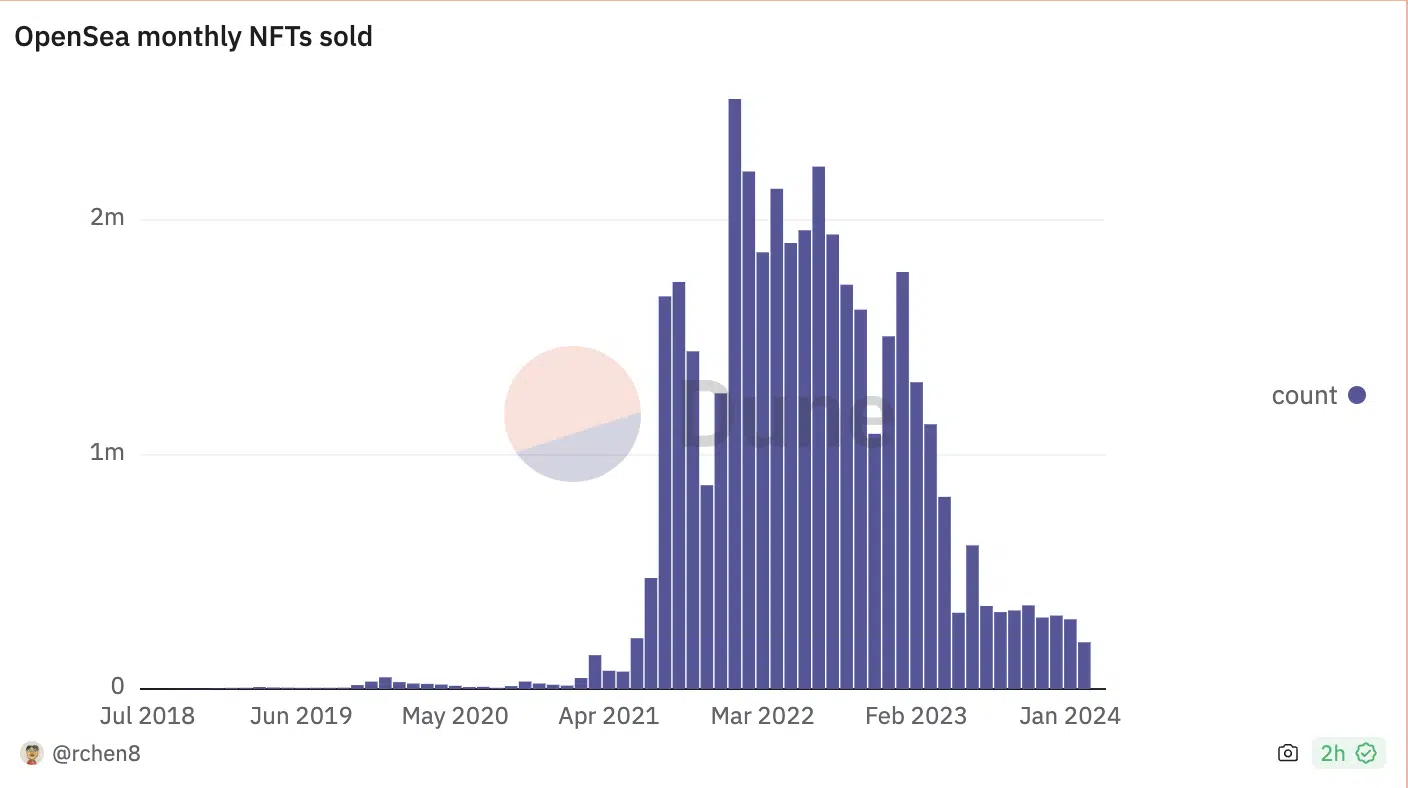

Why OpenSea NFT sales plummeted to a 3-year low in February

- In Feburary, 199,000 NFTs were sold on OpenSea.

- This is its lowest count recorded since May 2021.

Leading non-fungible token (NFT) marketplace OpenSea witnessed a significant drop in the monthly count of NFTs sold in February, reaching a three-year low.

According to data from a Dune Analytics dashboard prepared by Rchen8, the number of NFTs sold on Opensea during the 29-day period totaled 199,000.

This marked a 33% decline from the 297,000 total NFTs sold on the marketplace in January and the lowest monthly count since May 2021.

This fall may be attributable to the decline in the number of active users on the marketplace during that period.

In February, 103,000 users completed at least one sale transaction on OpenSea. This was an 18% drop from January’s 125,000 and the lowest monthly monthly users on the platform since July 2021.

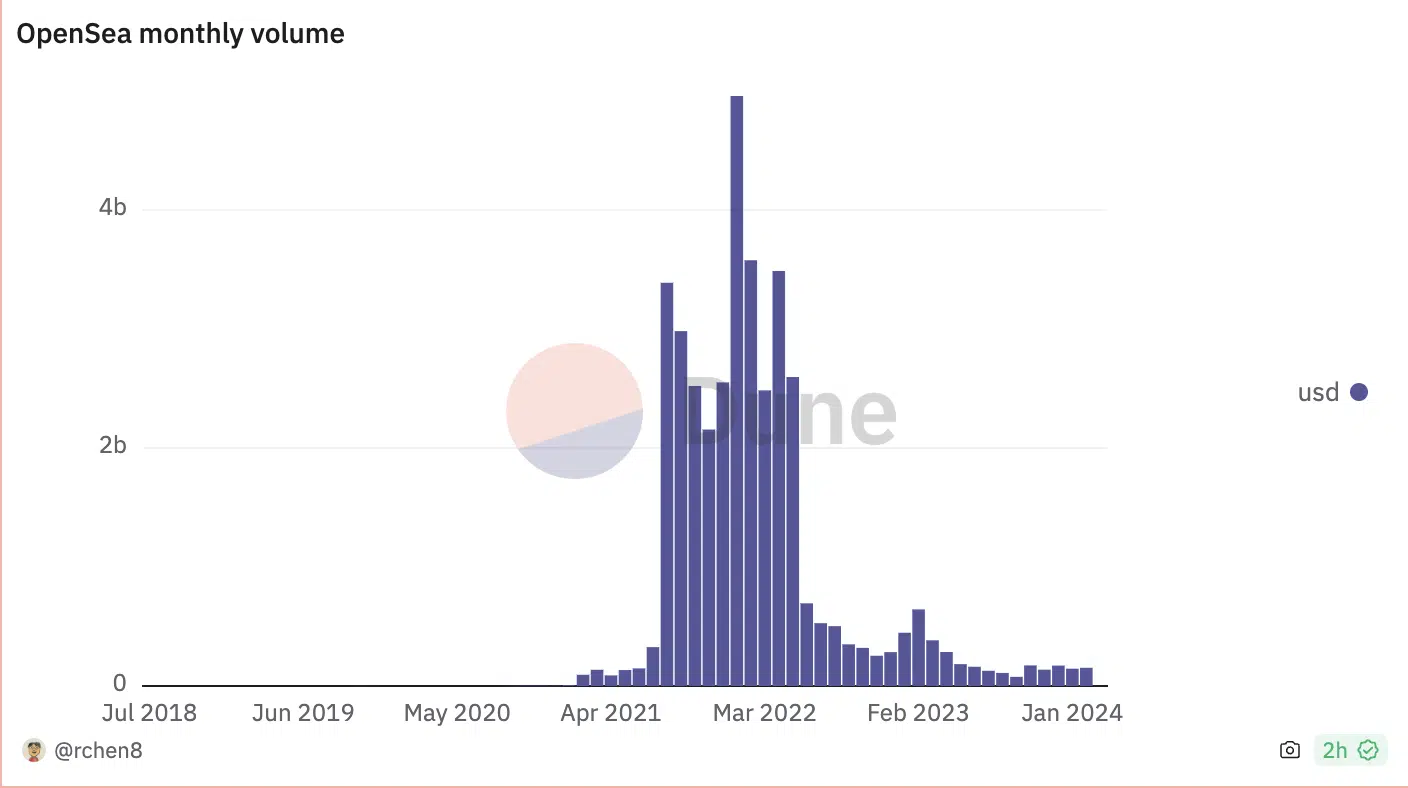

Interestingly, while OpenSea witnessed a decline in the number of NFTs sold in February, sales volume spiked by 5%. Information from the dashboard showed that NFT sales volume on the marketplace for the month of February was $153.03 million, which represented a two-month high.

As a result of the uptick in sales volume on OpenSea, monthly fees derived from primary transactions and royalties both rose by 3%. During the 29-day period, platform fees amounted to $3.2 million, while fees made from royalties totaled $3.5 million.

Blur continues to outpace OpenSea

According to data from DappRadar, trading volume on NFT aggregator and marketplace Blur plummeted by 16% in the last month.

However, despite this decline, the transaction volume on the platform exceeded $500 million, towering over OpenSea by a whopping 306%.

Similarly, while OpenSea saw a decline in its active users in the last month, Blur recorded growth. Per DappRadar’s data, during the 30-day period, the count of NFT traders on Blur increased by 13%. 60,000 traders completed 237,000 NFT sales transactions.

Regarding the general market’s performance, there was a noticeable growth in the floor prices of several NFT collections. This was evident in the last month’s double-digit rise in NFT market capitalization.

According to data from NFTGo, the prices increased 36% to total $11.4 billion at press time.