Bitcoin ‘buy the dip’ calls surge as ATH runs out of steam

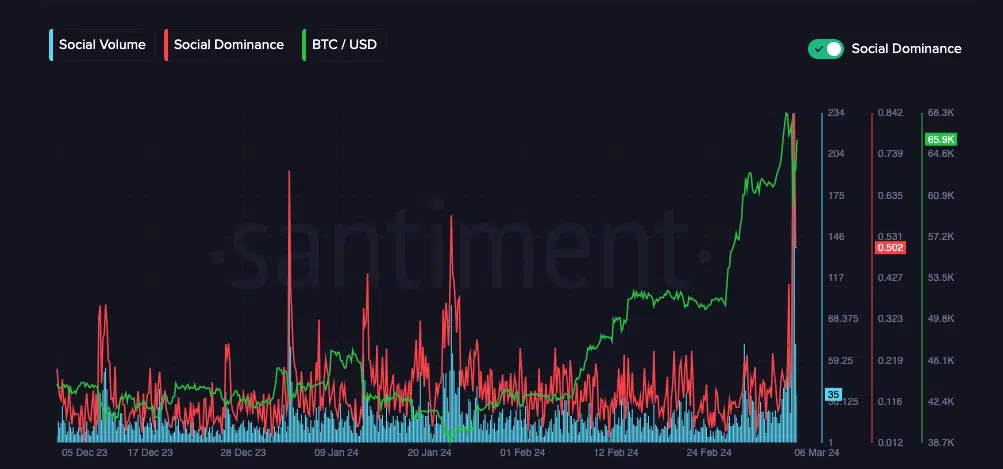

- Social data revealed that traders saw the earlier collapse as an opportunity.

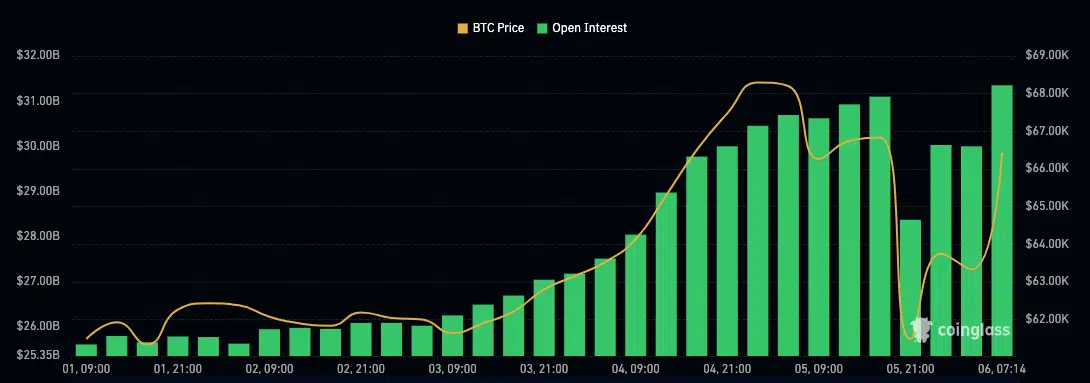

- The Open Interest increased after an initial fall as BTC jumped above $66,000.

Moments after Bitcoin [BTC] crossed the $69,000 All-Time High (ATH), the price crashed. At one point, the value of BTC on the Binance exchange slipped below $60,000 as volatility in the market heightened. Despite the nosedive, many market participants saw it as an opportunity to scoop the coin at a discount.

AMBCrypto confirmed this after assessing the market on the 5th of March. According to our analysis using Santiment’s social tool, calls to “buy the dip” reached one of the highest in the last few months.

The confidence returns

When market participants cry out this way, it means that they are confident that prices will rebound. Data also showed that traders saw the quick decline as a normal liquidity flush.

Interestingly, BTC did not disappoint. Though the coin has failed to retest the ATH, it has been able to rise to $66, 267 at press time.

Bitcoin’s new ATH came as a surprise to many market players. Previously, the coin usually hit a new high after the halving which involved supply cuts and miners’ rewards.

However, this time it was different, and AMBCrypto did well to explain the underlying factors influencing this new paradigm.

Furthermore, the price swings yesterday caused some changes in the derivatives market. For instance, the Open Interest (OI) which initially jumped, came crashing down.

The OI is the total value of unsettled contracts in the market. In the lead-up to the ATH, traders had opened long positions targeting $70,000.

But Bitcoin’s inability to tap the region caused liquidations worth over $1 billion. Also, the decline in the OI suggests that those who escaped the horrible wipeout had to close their positions.

However, press time data from Coinglass showed that the sentiment has changed. As of this writing, Bitcoin’s Open Interest has increased to $31.35 billion.

BTC’s full recovery depends on a critical resistance

The recovery implied that traders were confident that volatility had decreased. Therefore, it could be a little easier to potentially profit from BTC.

In terms of the price, a rising OI, alongside Bitcoin’s uptrend could drive a higher value. In a highly bullish case, BTC might hit its ATH or possibly move past it.

From a technical point of view, the Relative Strength Index (RSI) on the 4-hour timeframe showed that the coin was almost oversold.

However, renewed buying pressure has moved the RSI back above its midpoint. If the momentum continues to remain bullish, BTC could rise higher.

Is your portfolio green? Check the BTC Profit Calculator

Should this be the case, the price could add another 7.34% which leads it toward $72,000. However, Bitcoin might face a stumbling block around $68,220.

A close above that resistance could validate the bullish thesis. But failure to breach the price could force the price back to the $63,252 support.