What are MATIC’s chances of reaching $2?

- MATIC grew significantly in the last week.

- Polygon zkEVM rose in terms of popularity as well, causing a surge in TVL.

Polygon’s [MATIC] price has escalated over the past few days, helping the altcoin reach $1.17, its highest valuation since April 2023.

The surging price could be a result of MATIC’s consistent pattern of higher highs and higher lows of late, which signified sustained upward momentum.

This trend indicated a positive trajectory in the market sentiment, attracting potential investors and reinforcing the token’s bullish outlook.

The concurrent growth in the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) further strengthened the case for MATIC’s positive momentum.

An increasing RSI implies heightened buying interest, potentially leading to extended upward movements, while a rising CMF suggests an influx of capital, bolstering the overall liquidity and strength of the token.

How did the Polygon network react?

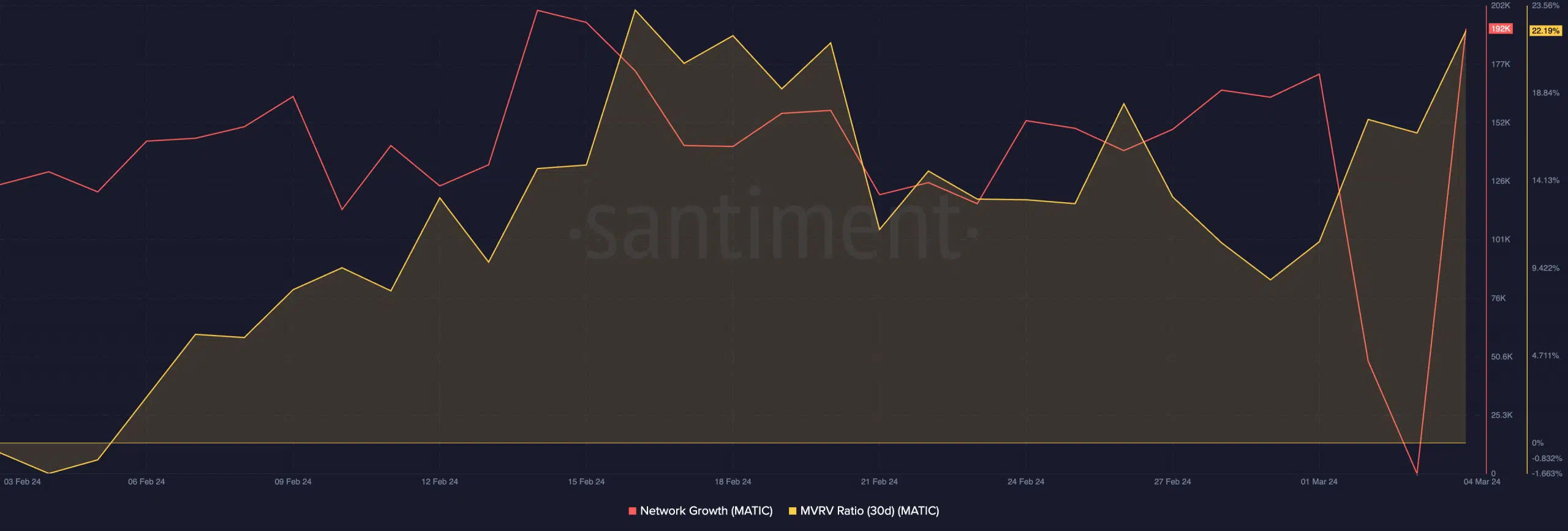

MATIC’s Network Growth experienced a notable surge recently, pointing towards a renewed interest from new addresses.

Its MVRV (Market Value to Realized Value) ratio witnessed a rise as well, indicating that existing holders were in a profitable position at press time.

This profitability could incentivize holders to consider selling their holdings, potentially introducing selling pressure to the market. However, it could also signal a potential negative impact on the token’s price.

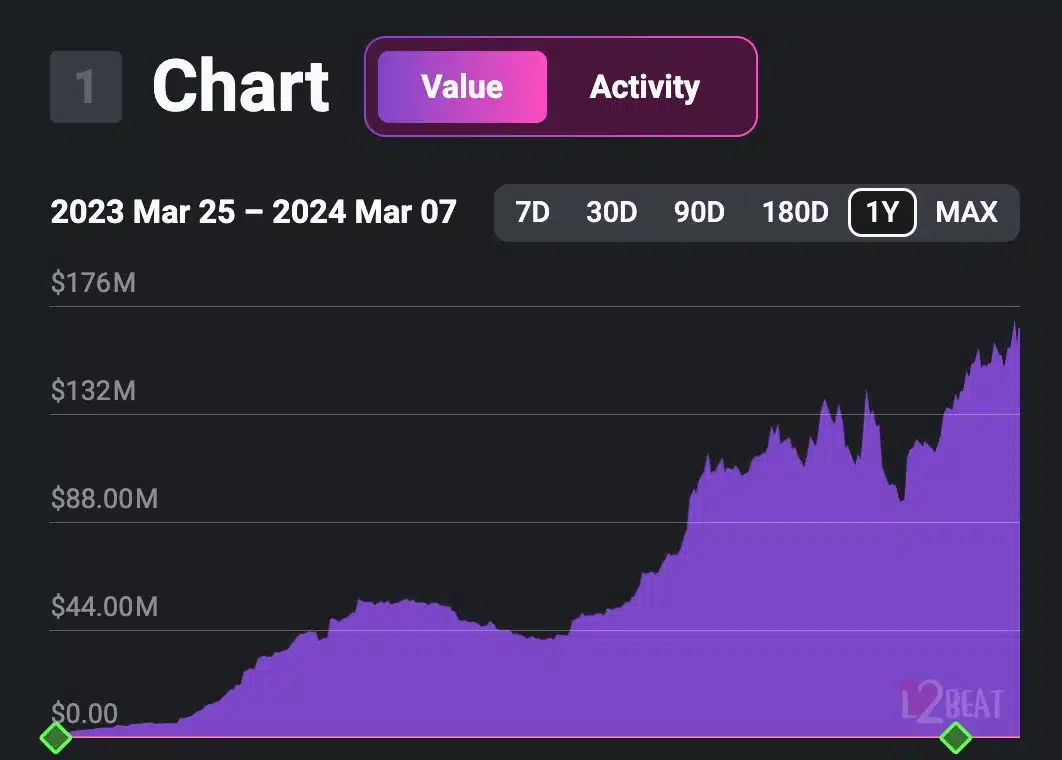

Polygon was also doing well in terms of network activity. Notably, the zkEVM had reached a total TVL milestone of $170 million at press time.

Read Polygon’s [MATIC] Price Prediction 2024-25

With higher TVL, liquidity is bolstered. This, in turn, provides crucial support for decentralized finance (DeFi) applications on the Polygon ecosystem, ensuring smoother and more efficient transactions.

Such milestones also enhance the network’s appeal to developers, as it encourages them to build and deploy their decentralized applications on a platform with a secure environment.