PEPE leads weekly gainers, but this concern arises

- PEPE’s exchange supply has risen in the past few days.

- This suggests an increase in token sell-offs.

Meme coin Pepe [PEPE] faces a potential price drawback as its supply on exchanges spikes, suggesting a rally in profit-taking activity, data from Santiment has shown.

The increase in the token’s exchange reserves comes amid the significant surge in its value in the past few weeks. At press time, PEPE exchanged hands at $0.000009.

In the last week, its value increased by 120%, causing it to rank as the asset with the most gains during that period, per CoinMarketCap’s data.

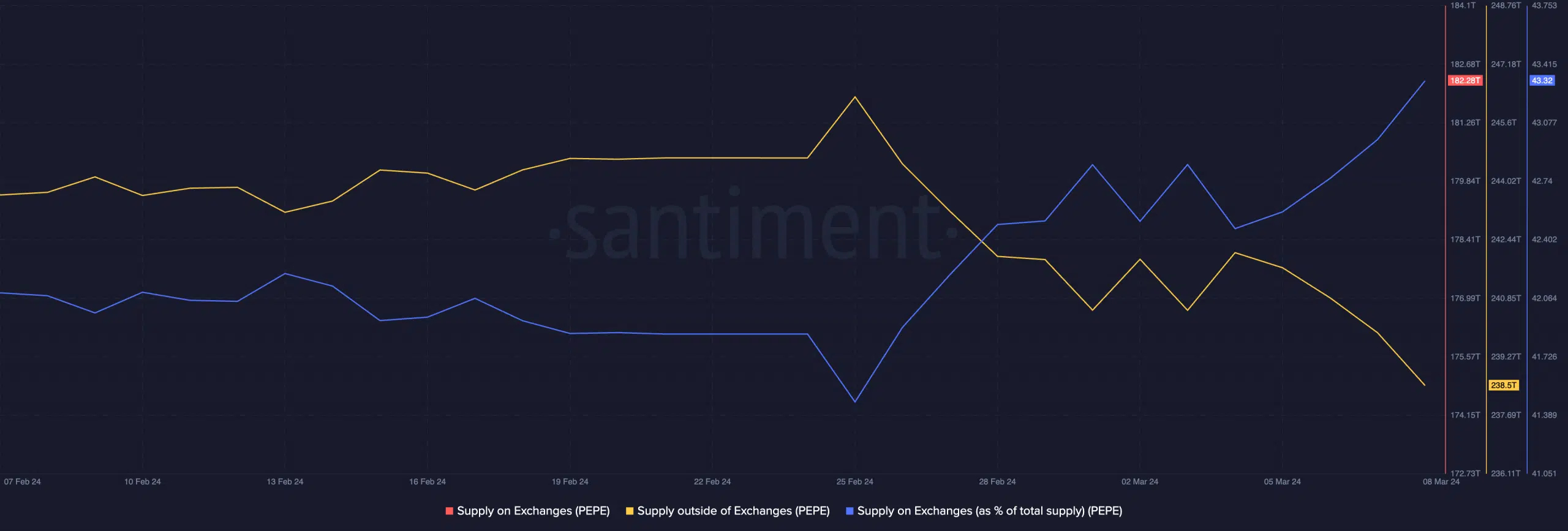

As of this writing, 182 trillion PEPE tokens sit on crypto exchanges. This represented 43% of the altcoin’s total circulating supply of 423 trillion PEPE.

On-chain data obtained from Santiment showed that the meme coin’s Supply on Exchanges has increased by almost 5% in the past four days.

Conversely, its Supply outside of Exchanges witnessed a 2% decline during the same period.

PEPE prints green for its holders

The current spike in PEPE sell-offs is attributable to how profitable transactions involving the altcoin have become as the meme coin frenzy intensifies.

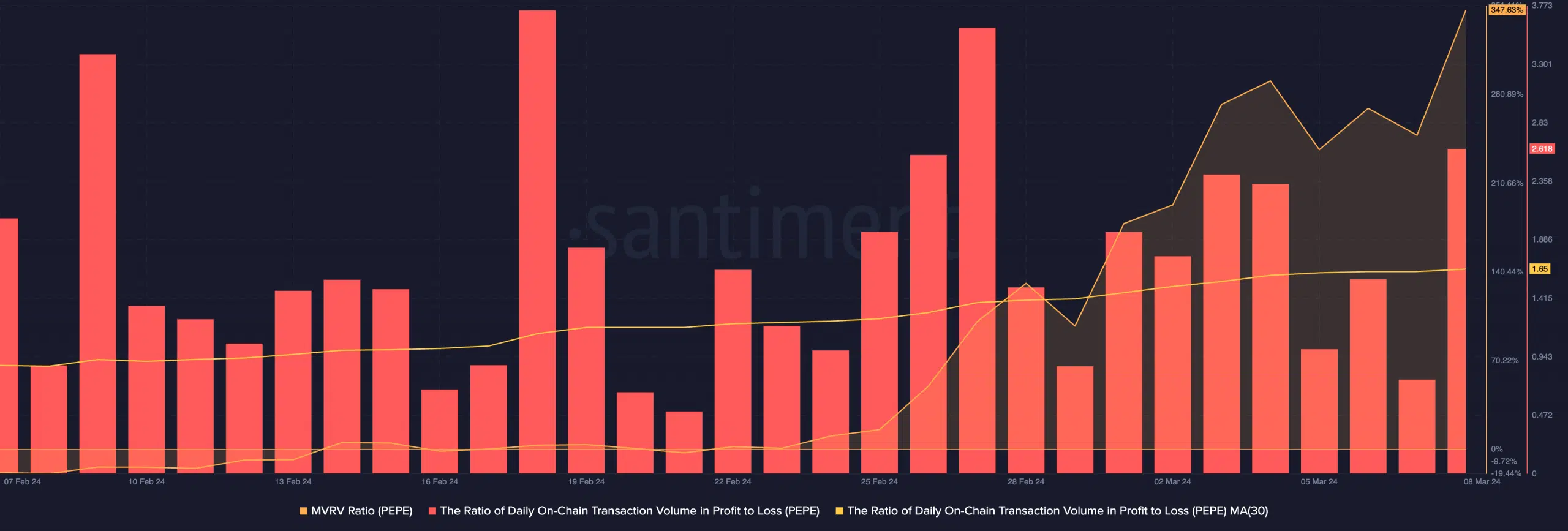

An assessment of PEPE transactions revealed that the daily ratio of its transaction volume to loss was 2.61 on the 9th of March.

This indicated that on that day, for every PEPE transaction that ended in a loss, 2.61 transactions returned a profit. Observed on a 30-day moving average, this ratio remained positive at 1.65.

Further, the token’s Market Value to Realized Value (MVRV) ratio, which measures whether an asset is overvalued or undervalued, was 347.63% at press time.

An MVRV ratio of 347% indicates that, on average, the current market value of PEPE is 3.47 times higher than the average price at which coins were last transacted.

This means that, on average, investors who hold the meme coin have realized significant gains, as the current market price is substantially higher than the price at which they acquired their holdings.

PEPE’s Awesome Oscillator, assessed on a single-day chart, posted only upward-facing green bars, suggesting that the current bullish trend will likely continue in the near term.

This indicator measures market momentum and identifies potential trend reversals. When it returns green, upward-facing bars, it suggests that the bullish momentum in the market is strengthening.

Also, readings from PEPE’s Directional Movement Index (DMI) showed that the bulls remain in control of the market.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

At press time, the altcoin’s positive directional index (green) rested significantly above the negative index (red).

Lastly, at a high of 62.47, its Average Directional Index (yellow) indicated that the bears might find it challenging to regain market control in the short term.