Uniswap: Can whale demand push UNI’s price higher?

- Buying pressure on UNI remained high last week.

- A few market indicators turned bearish on the token.

Uniswap’s [UNI] price witnessed a massive dip in its price as its weekly chart was red. But things started to change in the last 24 hours, as we saw a trend reversal. However, this doesn’t guarantee a further bull rally, as there are a few red flags.

Uniswap is recovering

The last week was somewhat disastrous for UNI, as while most cryptos enjoyed bull rallies, Uniswap’s value dropped.

According to CoinMarketCap, UNI was down by over 7% in the last seven days. In the meantime, a whale took the opportunity to accumulate more UNI while its price lay low.

Lookonchain recently posted a tweet revealing that a whale withdrew 86,467 UNI, which was worth $1.23 million from Binance. Soon after the purchase was made, UNI’s rice gained bullish momentum as it registered a recovery.

In the last 24 hours alone, UNI’s price spiked by more than 3.5%. At the time of writing, UNI was trading at $14.32 with a market capitalization of over $8.5 billion.

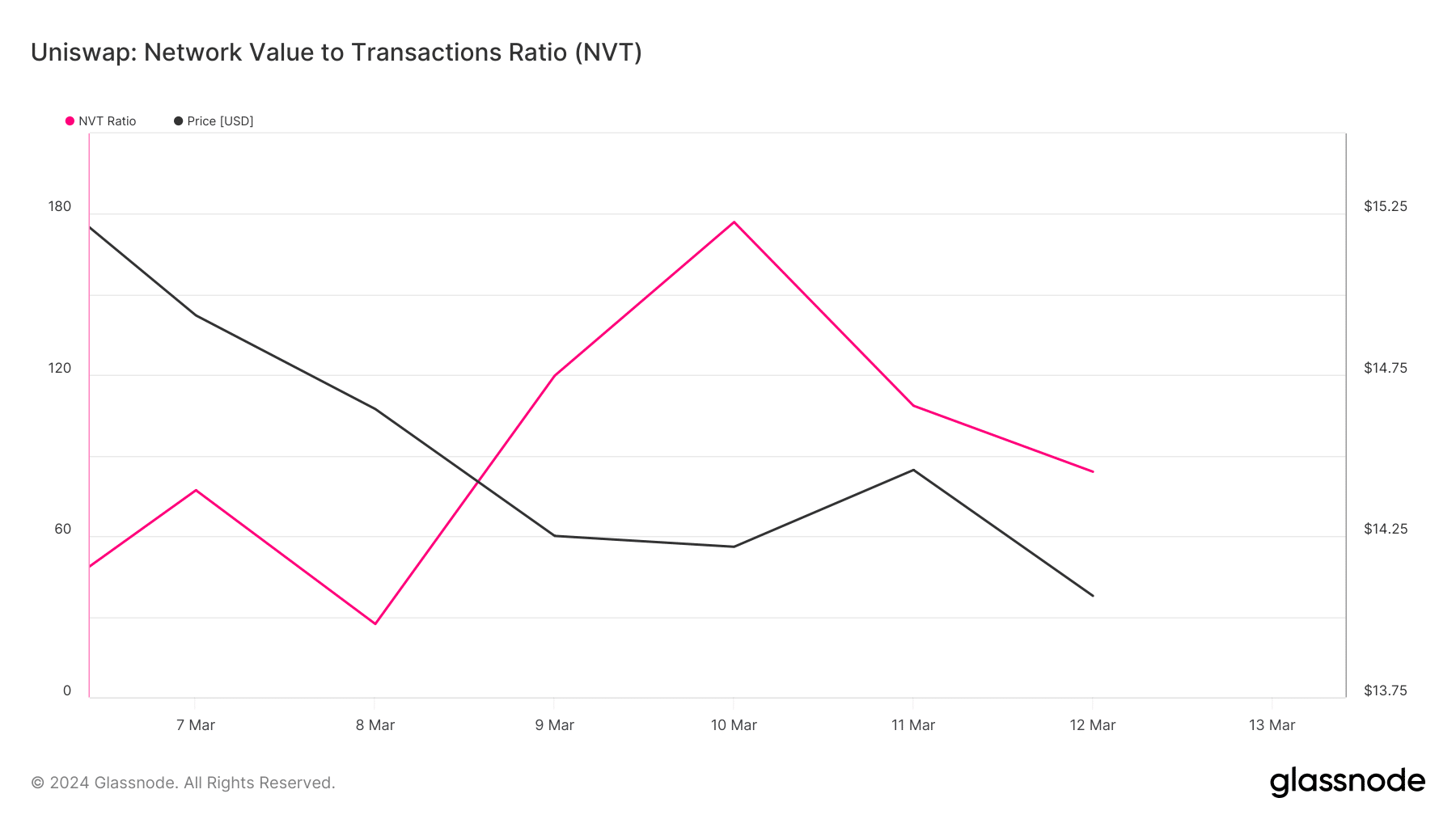

An analysis of Glassnode’s data revealed that the chances of a continued uptrend are high. Uniswap’s Network Value to Transactions (NVT) ratio dipped recently.

Whenever the metric drops, it suggests that an asset is undervalued, suggesting a price uptick.

These are the red flags

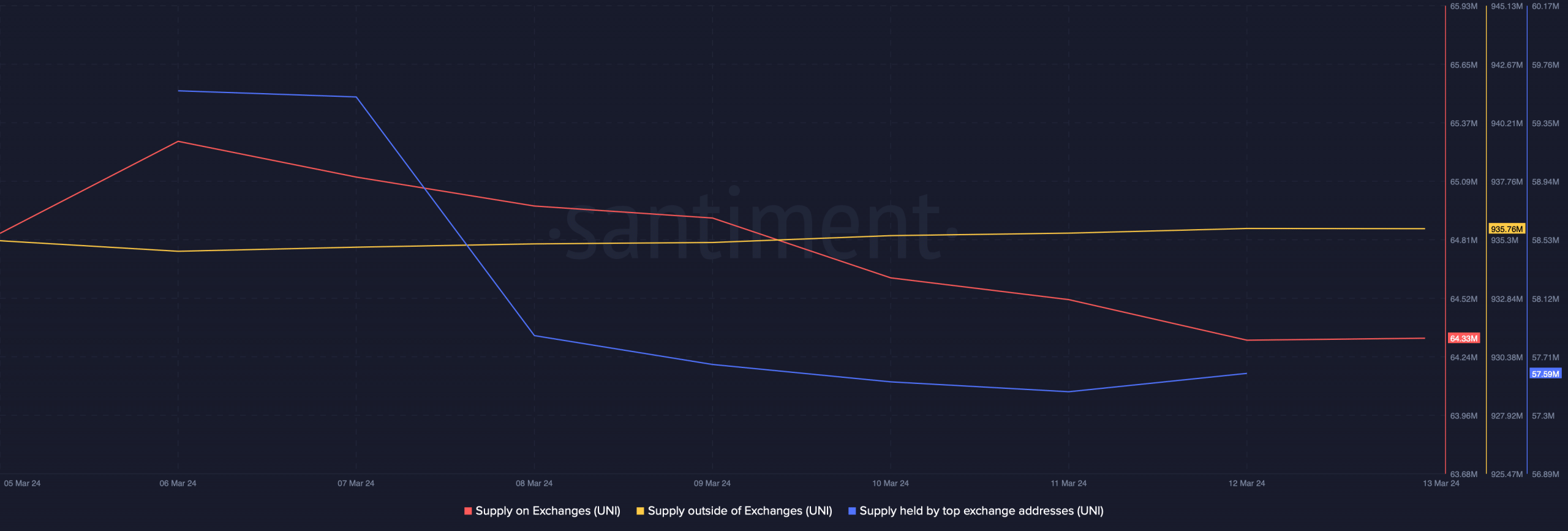

It was interesting to see that investors were buying Uniswap. The analysis of Santiment’s data revealed that UNI’s supply on exchanges dropped while its supply outside of exchanges increased, meaning that buying pressure was high.

However, the big players in the games, whales, actually sold their holdings as UNI’s supply held by top addresses fell.

A possible reason behind this was revealed when we took a look at Hyblock Capital’s data. We found that a substantial amount of UNI will get liquidated when its value touches the $14.6 mark.

A hike in liquidation means high selling pressure, which might put an end to the token’s bull rally in the coming days.

How much are 1,10,100 UNIs worth today

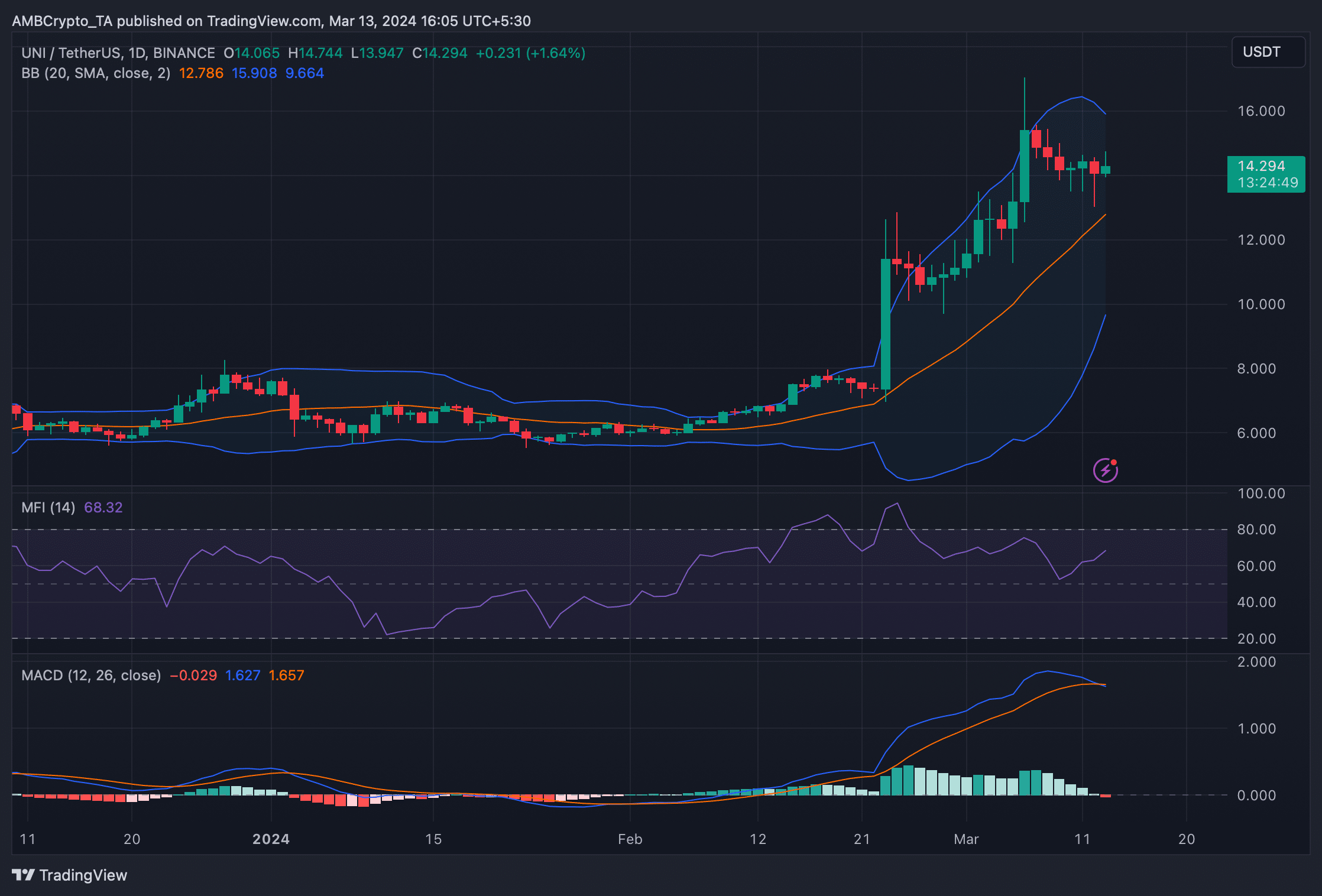

To check what to expect from UNI, we analyzed Uniswap’s daily chart. We found that UNI’s price was entering a less volatile zone, as revealed by the Bollinger bands.

Its MACD also displayed a bearish crossover, further suggesting that the bull rally might end soon. Nonetheless, the Money Flow Index (MFI) registered an uptick, which was a bullish development.