Solana DeFi TVL soars 80% in a month: How will SOL react?

- Solana’s DeFi TVL has climbed by over 80% in the last month.

- Demand for SOL persisted despite the general market downturn.

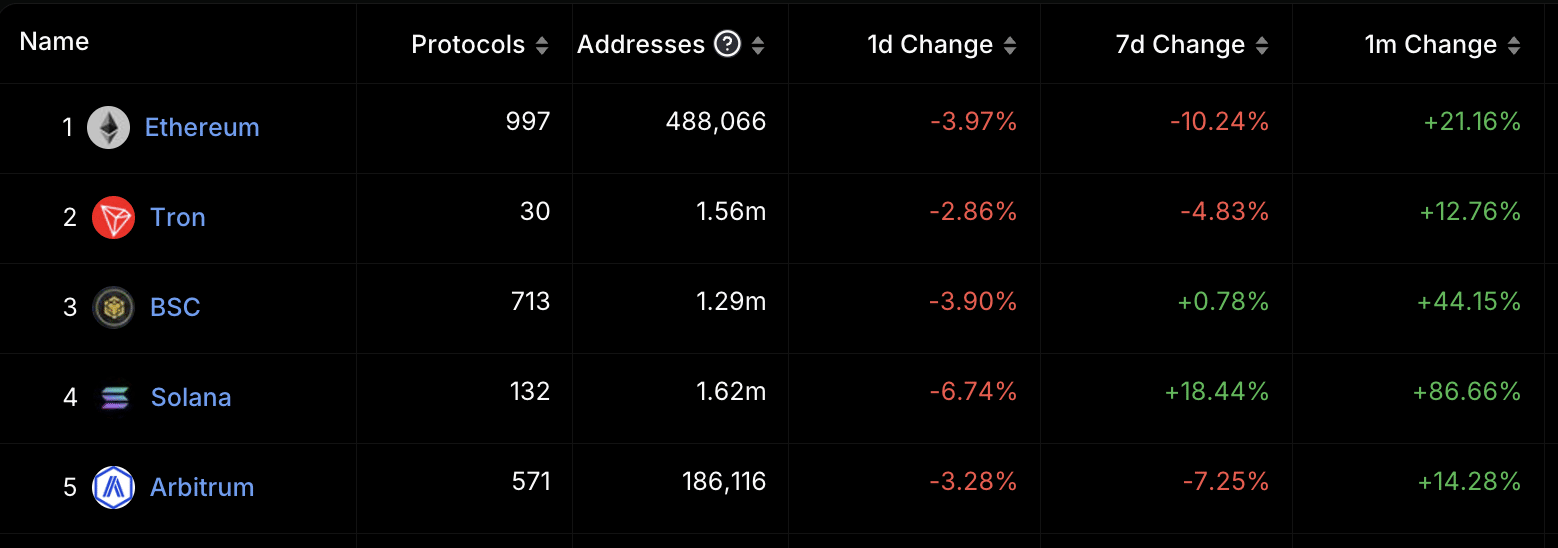

Solana’s [SOL] decentralized finance (DeFi) total value locked (TVL) has surged by over 80% in the last month, according to data from DefiLlama.

This impressive growth has propelled Solana’s DeFi TVL to its highest level in the past two years.

At press time, the network’s DeFi TVL was $3.8 billion. Among the top five DeFi networks by TVL, it ranked as the blockchain with the highest growth over the past month.

Solana’s DeFi ecosystem so far this month

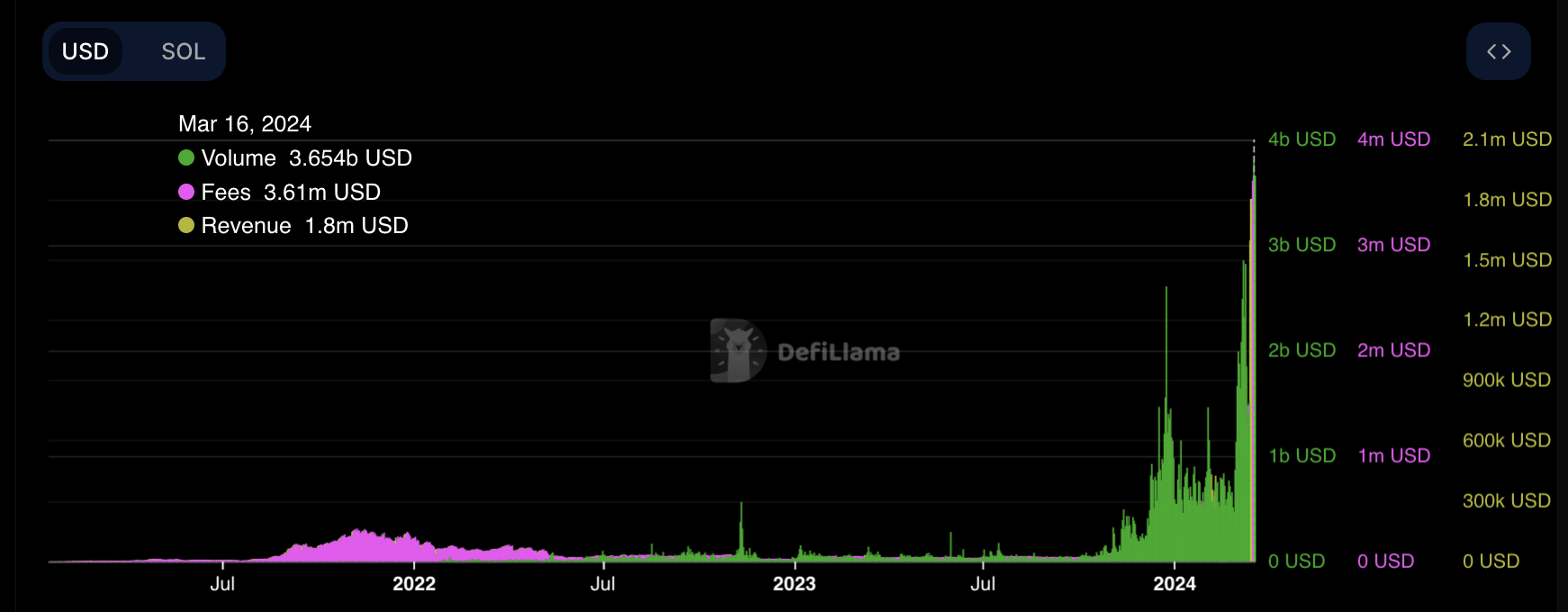

The surge in Solana’s TVL in the last month is attributable to the significant uptick in trading volume on the DeFi protocols housed on the Layer 1 network (L1).

Since the beginning of the month, the total trading volume recorded daily on these protocols has climbed by 125%.

In fact, on the 15th of March, trading volume on Solana’s DeFi vertical rallied to a multi-year high of $3.7 billion.

Network fees totaled $3.61 million on the 16th of March, marking the network’s highest single-day recorded fees since launch.

The revenue derived from these fees was $1.6 million, representing the network’s highest daily revenue.

SOL defies market trajectory

At press time, SOL exchanged hands at $187. Per CoinMarketCap’s data, the altcoin’s value has increased by 72% in the last month.

While the rest of the market grapples with price reversals, SOL bucks the trend as bullish sentiment grows.

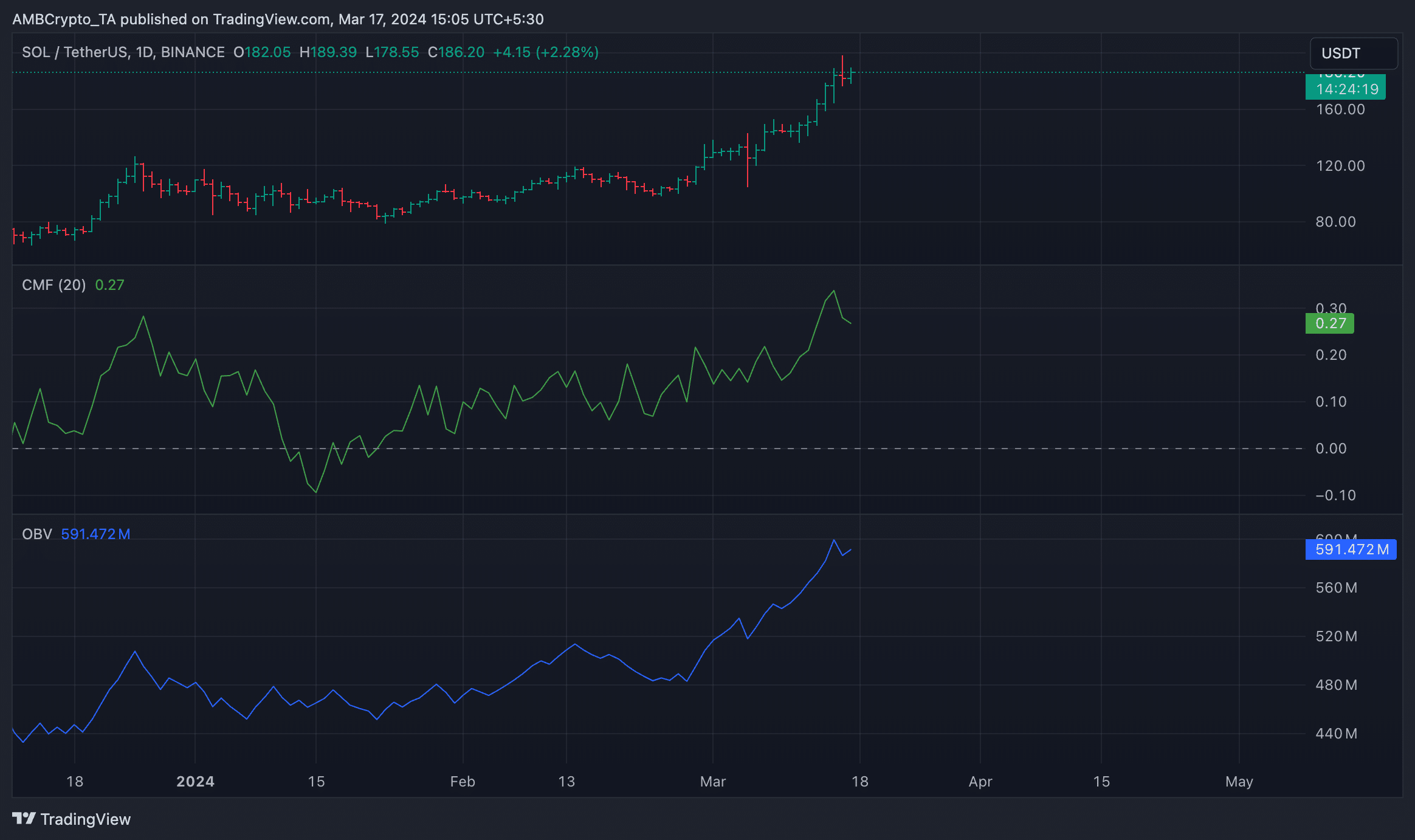

AMBCrypto’s assessment of the coin’s movements on a daily chart revealed a steady uptick in demand for SOL.

For example, its On-Balance-Volume (OBV), which tracks the coin’s buying and selling pressure, was in an uptrend at press time.

At 591.42 million at press time, SOL’s OBV has risen by 16% since the beginning of March. When an asset’s OBV witnesses this kind of growth, it suggests a growth in buying momentum.

How much are 1,10,100 SOLs worth today?

The uptrend in SOL’s Chaikin Money Flow (CMF) confirmed this growth. This indicator measures the flow of money in and out of an asset.

Above zero and returning a value of 0.27 at press time, SOL’s CMF showed growth in liquidity inflow into the market.