Shiba Inu’s whales v. retail clash: Here’s what it means for SHIB’s price and you

- Whales took profits while small holders are taking advantage of the dip.

- SHIB’s price might extend to $0.000052 when the correction is over.

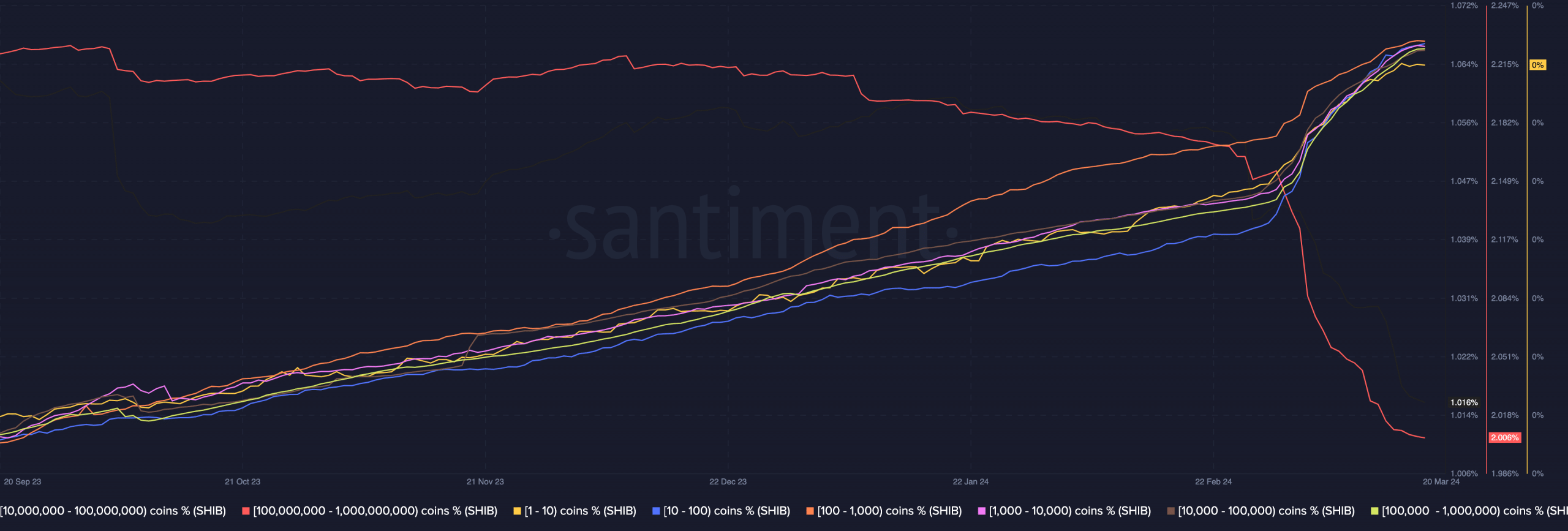

AMBCrypto’s on-chain analysis revealed that Shiba Inu [SHIB] whales were selling some of their holdings while the retail cohort did the opposite. We were able to arrive at this conclusion after examining the balance of addresses.

Whale is a term used to describe holders of a cryptocurrency who own it in large quantities. Because of their holding strength, their actions impact prices.

“We’re not on the same side”

At press time, data from Santiment showed that the 100 million to 1 billion SHIB cohort has continually shed the number of tokens owned. However, those in the 1-1 million group have been accumulating.

This conflicting position suggests that whales and the retail cohort shared a different sentiment about the price action. At press time, Shiba Inu’s price was $0.000025. This value was a 22.67% decrease in the last seven days.

Though the broader market experienced a correction, SHIB’s decline could also be connected to the way whales booked profits, especially as the value doubled in the last 30 days. But what is next for SHIB’s price?

The downturn is not forever

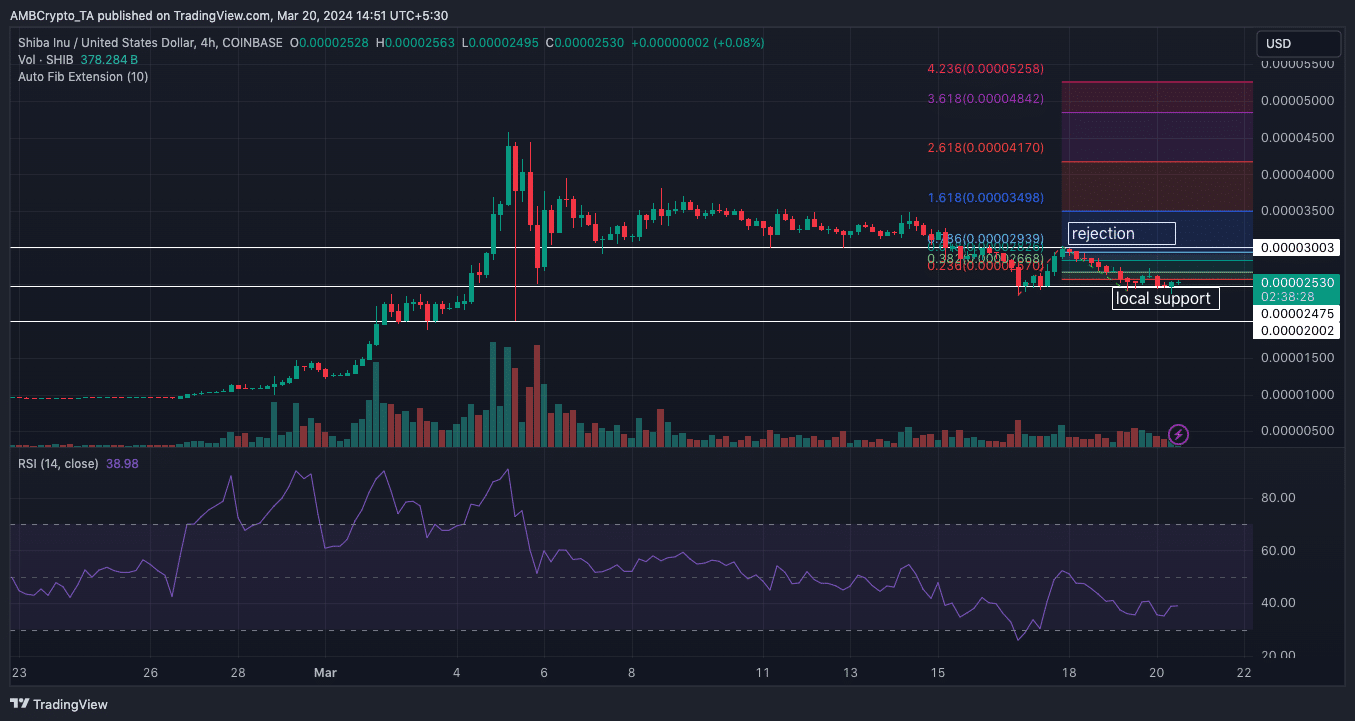

According to the 4-hour SHIB/USD chart, bears resisted the attempt at flipping $0.000030 on the 18th of March. However, bulls seem to be doing well in defending the $0.000024 local support.

Should bears fail to arrest this bullish resolve, then SHIB might rebound off the trough. Conversely, a close below $0.00024 could lead the price down to $0.000020.

In the meantime, the Relative Strength Index (RSI) neared the oversold region. This suggests that Shiba Inu remained in a bearish control and the corrective phase might not be over.

Despite the possibility of a further downtrend, the Fibonacci extension showed the SHIB’s potential recovery could be better. In a highly bullish scenario, the price of SHIB might rally as high as $0.000052. From the current lows, this would indicate a 51.9% rally.

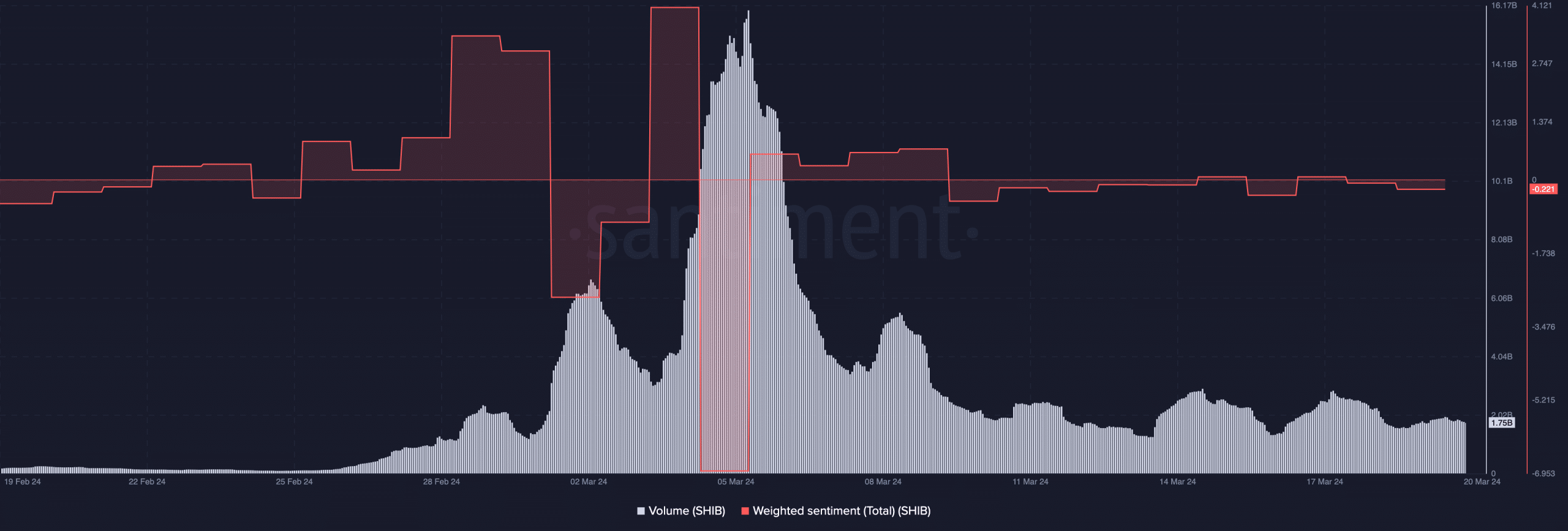

AMBCrypto also looked at Shiba Inu’s on-chain volume. As of this writing, the volume was 1.75 billion— a significant decline from what it was on the 6th of March when the price skyrocketed.

However, the declining volume might not be a bad omen for SHIB. Historically, rising. volume on rising price fuel further jumps. But at the same time, a falling volume while the price decreases could trigger an increase. This is because the downtrend might become weak in the process.

Is your portfolio green? Check the SHIB Profit Calculator

In terms of sentiment, on-chain data showed that participants were not yet convinced that SHIB would exit its bearish phase. At press time, the Weighted Sentiment was -0.0221. But this could also signal that it was time to accumulate the token.

Most times, a highly positive sentiment indicates a local top. However, when the sentiment is negative, buying opportunities appear, and that could be the case with SHIB.