LINK’s price can hit $20 again IF this prediction holds true

- LINK’s price could increase as selling pressure might grind to a halt.

- The liquidation levels displayed a bullish bias for the token.

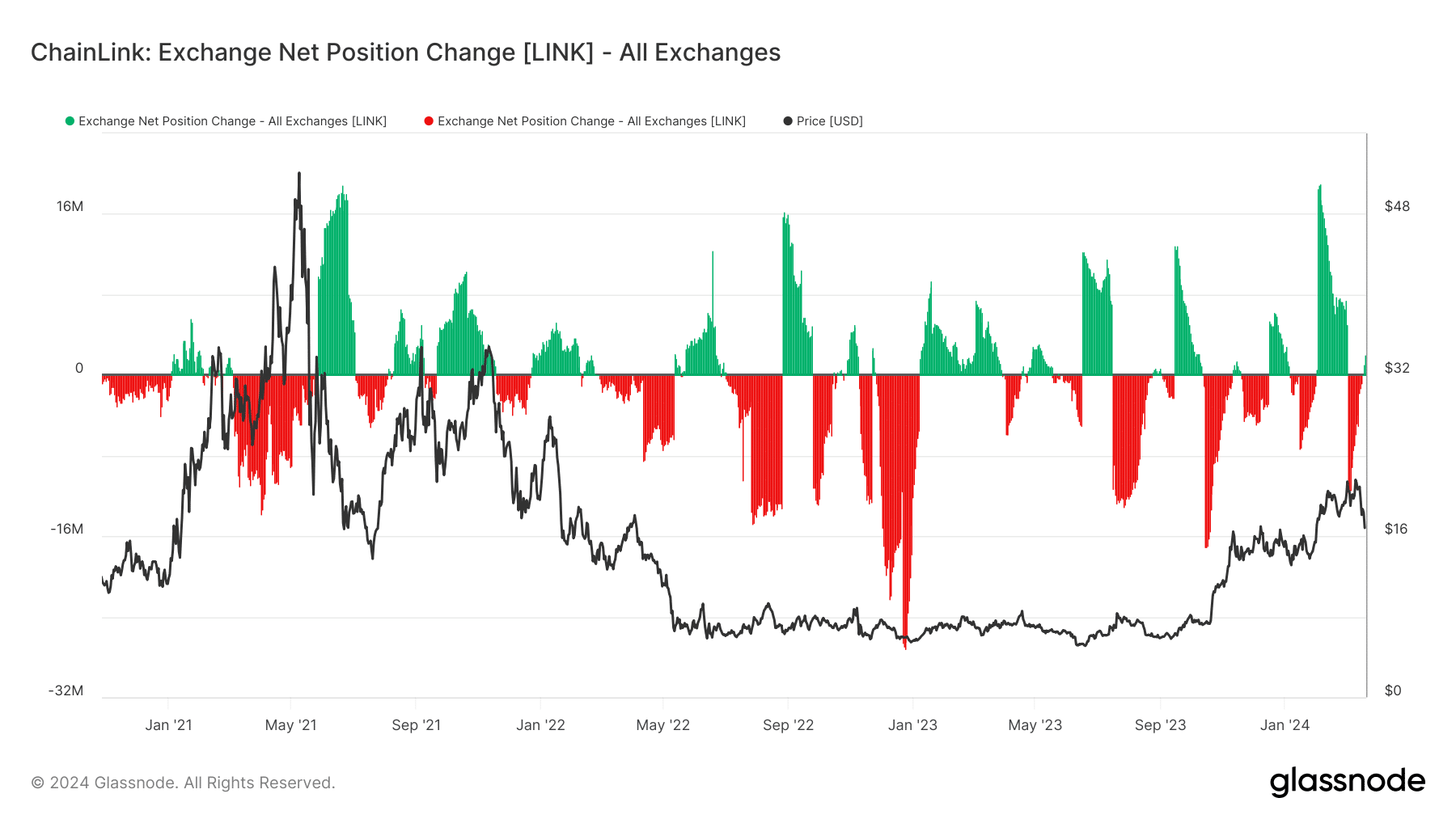

On the 20th of March, Chainlink’s [LINK] Exchange Net Position Change was -5.85 million, indicating that many tokens were withdrawn from exchanges. This was the case as LINK changed hands at $17.54.

Exchange Net Position Change measures the supply held in exchange wallets. If the supply increases, the chances of selling pressure have increased. However, if the metric decreases, an asset might evade further downside.

The pump is coming

But Chainlink was not the only altcoin undergoing a correction. According to CoinMarketCap, no cryptocurrency was spared as the market went down. Thus, LINK’s performance meant that it lost 14.39% of its value in the last week.

However, if the number of tokens withdrawn from exchanges continues to decrease, then the price might stabilize. Should this be the case, the cryptocurrency might exempt itself from the downturn which many have not recovered from.

In 2023, Chainlink was one of the few to 20 altcoins that detached from the market trend at different times. For most of this period, the price of the token pumped while others moved sideways or declined.

With the recent trend, there is a chance that LINK could repeat the move. To evaluate the potential, AMBCrypto looked at the liquidation levels.

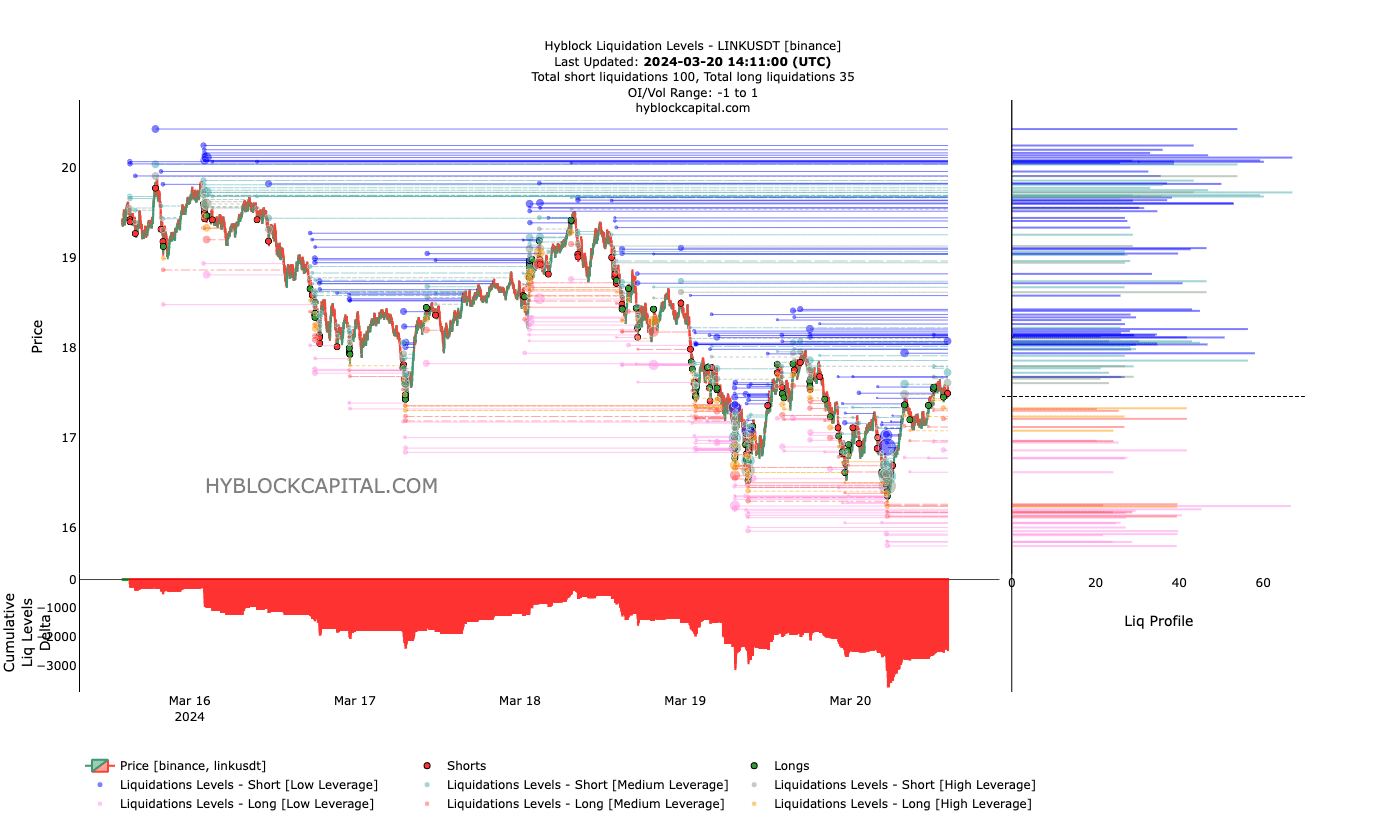

Liquidation levels are estimated price levels where liquidation events might occur. Liquidation takes place when a trader’s position is forcefully wiped out due to insufficient margin balance or high volatility in the market.

All bears may be liquidated

At press time, our analysis showed that a high number of liquidations might happen if LINK hit $18.20. As expected, shorts were the potential casualty.

Beyond the indicator, AMBCrypto also assessed the Cumulative Liquidation Levels Delta (CLLD). The CLLD is a beta of the liquidation levels. But the difference is that it can tell the kind of bias traders are showing and how it can affect prices.

As of the writing, the CLLD spiked in the negative direction. A move like this suggests that shorts are trying to catch the dip but might be unsuccessful in the attempt.

Hence, this offers LINK a bullish bias, and these late shorts might be liquidated as the price might recover in no time. In the meantime, some analysts have mentioned that the cryptocurrency’s recent decline was an opportunity.

Realistic or not, here’s LINK’s market cap in SOL terms

One of the analysts with this thought was Michaël van de Poppe. This was not the first time van de Poppe talked about Chainlink as he has been shilling the token since it was under $8.

This time, the analyst posted that anyone purchasing LINK at the current price levels would be doing so for his/her gain. Whether his opinion would be valid or not, the price action within the coming weeks will tell.