Shiba Inu [SHIB], Dogecoin: What’s this week’s price prediction?

- Dogecoin has reacted quicker at the support zone than Shiba Inu.

- Most SHIB bulls and bears were likely sidelined, with neither party able to overwhelm the other.

Dogecoin [DOGE] and Shiba Inu [SHIB] saw a sizeable retracement over the past three weeks. Shiba Inu bulls showed a lack of conviction, while Dogecoin bulls were raring to lead the meme coin rally.

The sentiment behind Bitcoin [BTC] is also likely to play a major part in the capital inflow to meme coins in the coming weeks. The Fibonacci retracement levels highlighted key areas for both tokens.

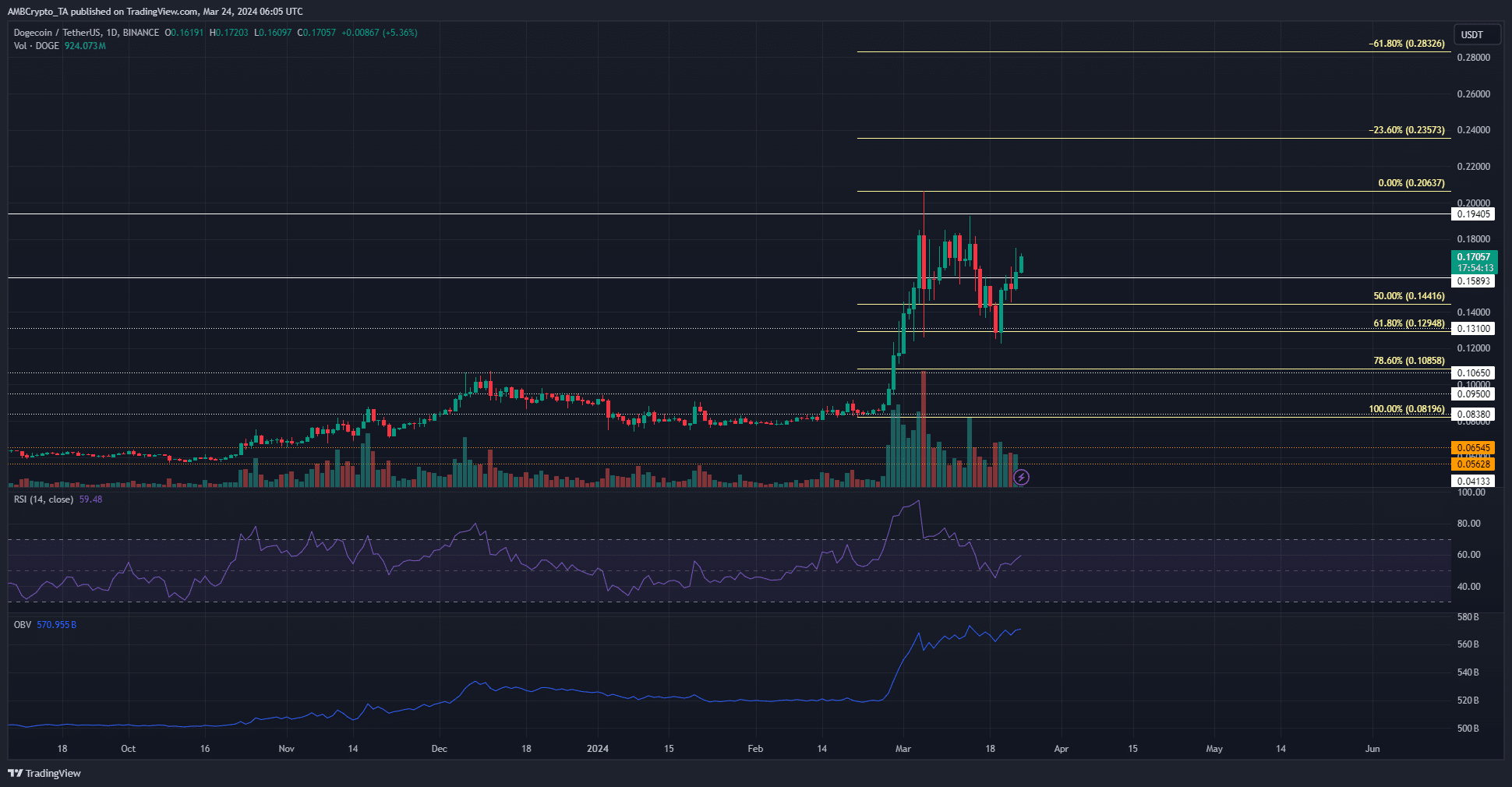

Dogecoin has recovered well after the setback

The one-day chart of DOGE reflected a bullish structure. The RSI noted that the upward momentum was strengthening.

The OBV has formed higher lows throughout March, which indicated a lack of firm selling pressure.

The 61.8% Fibonacci retracement level was retested as support on the 19th of March. This brought a positive reaction from the buyers, and DOGE has gained 39.2% since the recent swing low.

The $0.18-$0.194 area is expected to oppose the buyers’ northward march. A move past $0.206 would indicate that DOGE is rallying toward $0.283 or potentially higher.

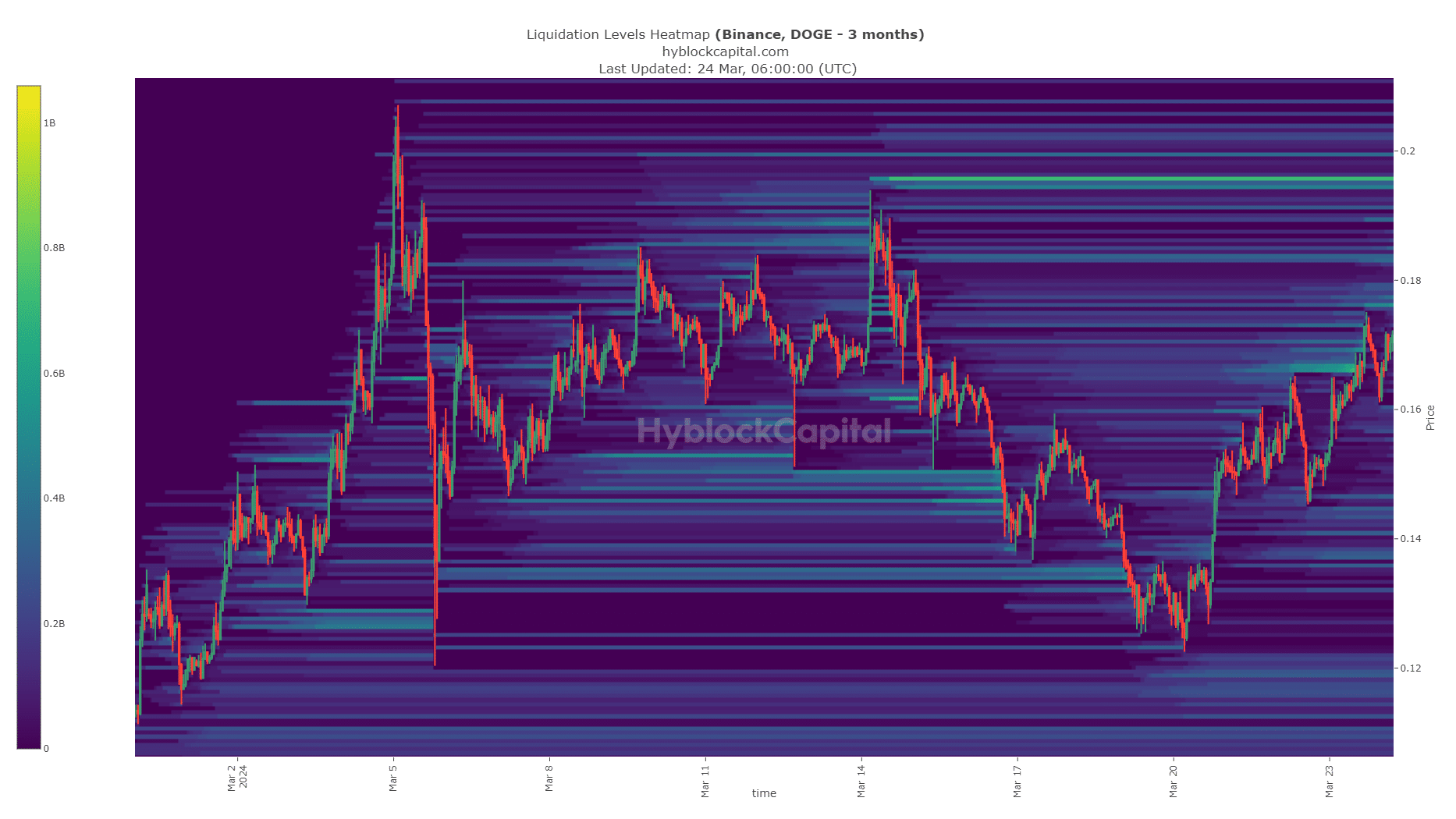

Source: Hyblock

The liquidation levels heatmap showed that the closest pocket of liquidity was at the $0.176-$0.178 area. Higher still, the $0.195 level was prominent on the heatmap, marking it as another level of interest.

To the south, the $0.14-$0.146 region and the $0.137 vicinity had a notable amount of estimated liquidations. Given the momentum of DOGE, further upside was likely.

Yet, it was unclear if prices would reverse below $0.2 or sustain the momentum.

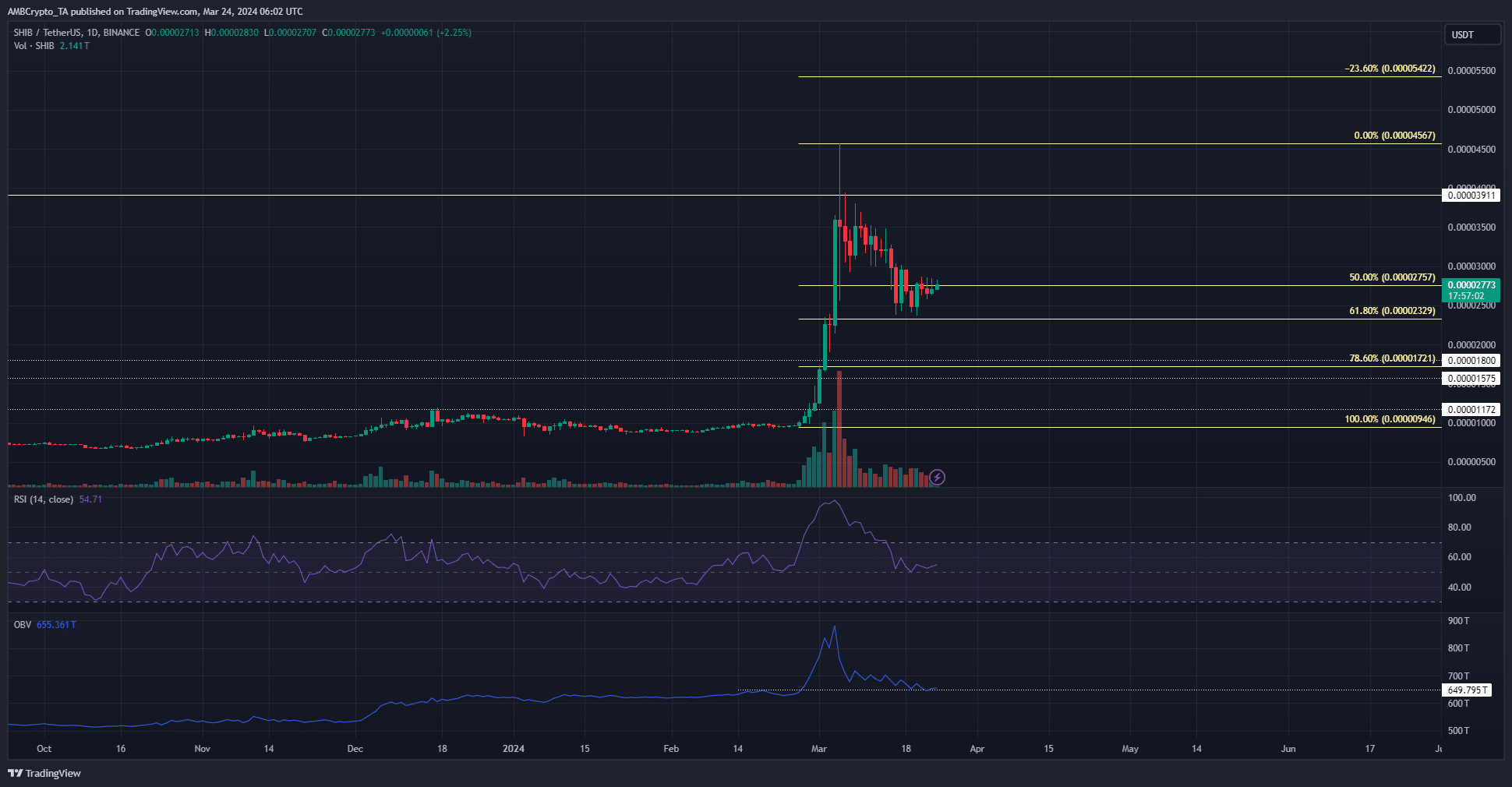

Shiba Inu witnesses a stutter in trading volume

The strong rally in late February and early March was accompanied by phenomenal trading volume. Unsurprisingly, the retracement of the past two weeks saw muted volume as bulls lost their strength.

Yet, the OBV sank to the February highs. A big part of this was the selling volume on the 5th and 6th of March.

While the 61.8% retracement level has served as support, the bulls have not been successful in pushing prices higher yet.

Shiba Inu differed from Dogecoin in this facet, but like DOGE, it retains its bullish market structure.

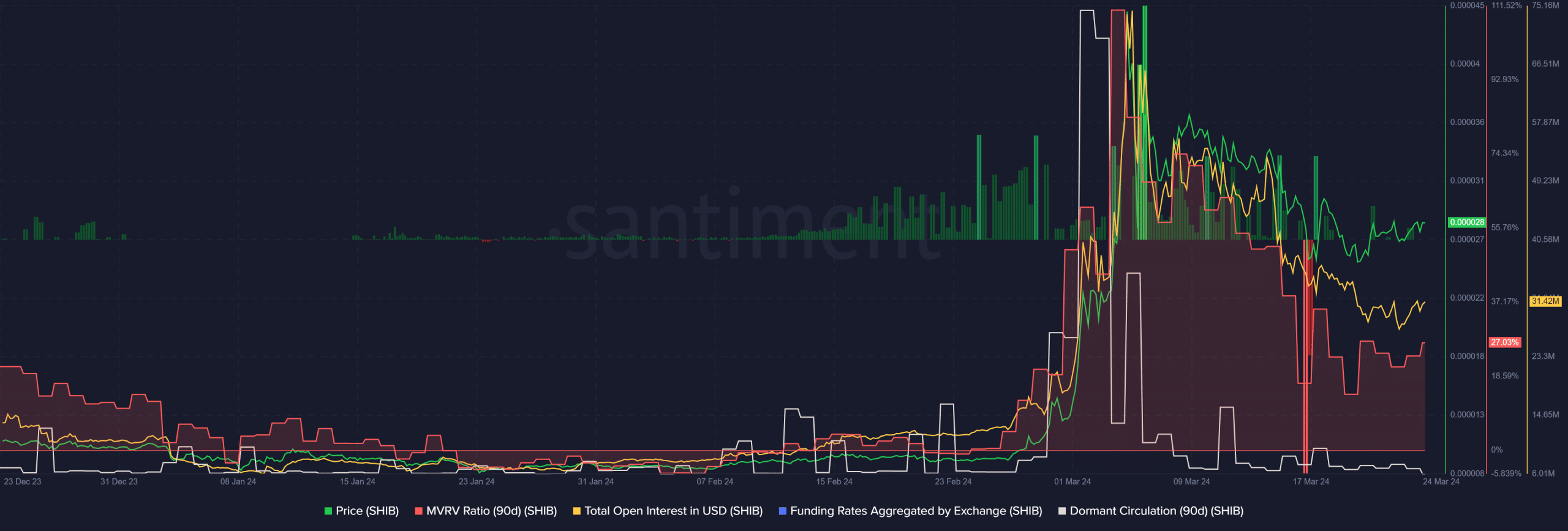

Source: Santiment

The dormant circulation has trended downward for Shiba Inu. This showed that selling pressure has not ramped up.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

The MVRV ratio was high at 27%, showing holder conviction, even though it reached 110% on the 4th of March.

The total Open Interest behind SHIB has fallen alongside prices to signal bearish sentiment. Overall, Shiba Inu buyers were not yet convinced that it was time for a recovery, unlike Dogecoin bulls.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.