Why Bitcoin price’s latest breach means $75K predictions could be next

- Market sentiment around BTC turned bullish.

- The selling pressure on the coin was relatively low.

Bitcoin [BTC] continued to trade above the $70k mark, and things might soon get better for investors. The latest analysis suggested that BTC went up a resistance level, which allowed it to reach an all-time high.

Does this guarantee yet another bull rally for BTC?

Bitcoin is holding its ground

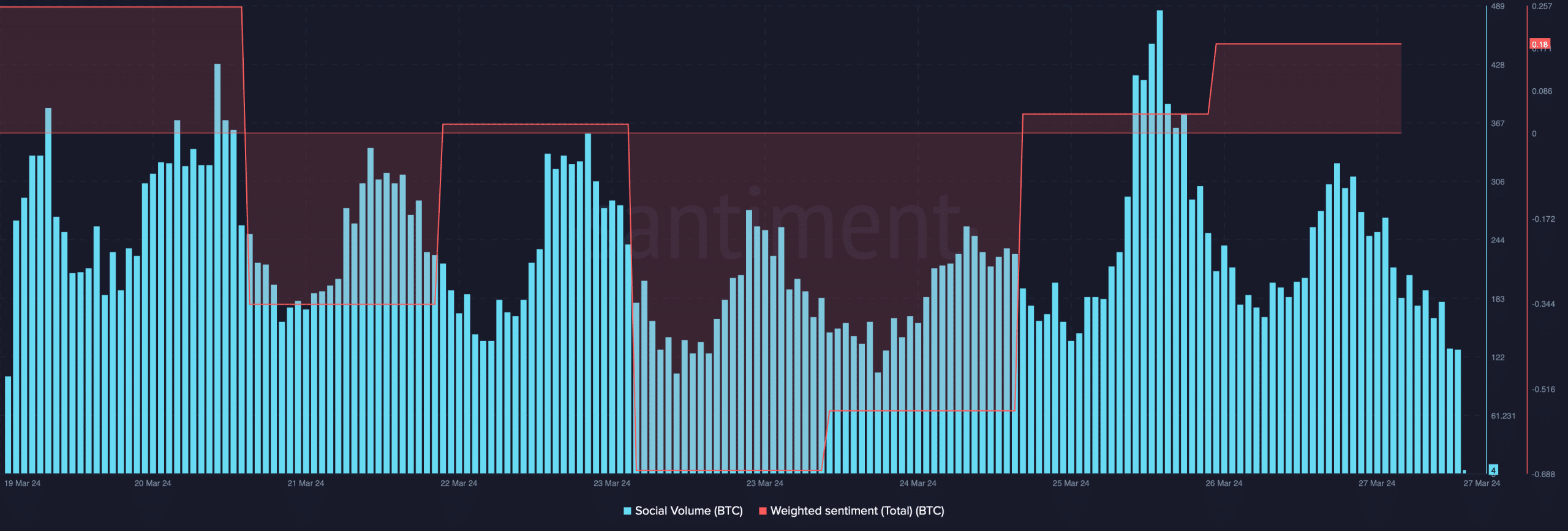

According to CoinMarketCap, the king of cryptos was up by more than 12% in the last seven days. Thanks to the recent uptrend, BTC’s social volume spiked in the last few days.

Additionally, its Weighted Sentiment went into the positive zone, indicating that bullish sentiment around the token increased.

In the meantime, Ali, a popular crypto analyst, posted an analysis highlighting an interesting fact. As per the tweet, BTC’s price went above a key resistance level of $70.8k.

This hinted at a further uptrend in the days to follow. To check if the uptrend could happen, AMBCrypto checked BTC’s metrics.

Are investors selling Bitcoin?

Since BTC’s value crossed a resistance level, AMBCrypto checked other metrics to find out whether people are buying BTC.

As per our analysis of CryptoQuant’s data, BTC’s exchange reserve was dropping, meaning that selling pressure on the coin was low.

The miners’ position index revealed that they were selling holdings in a moderate range compared to their one-year average.

Additionally, buying sentiment among US investors was dominant, which was evident from its green Coinbase premium.

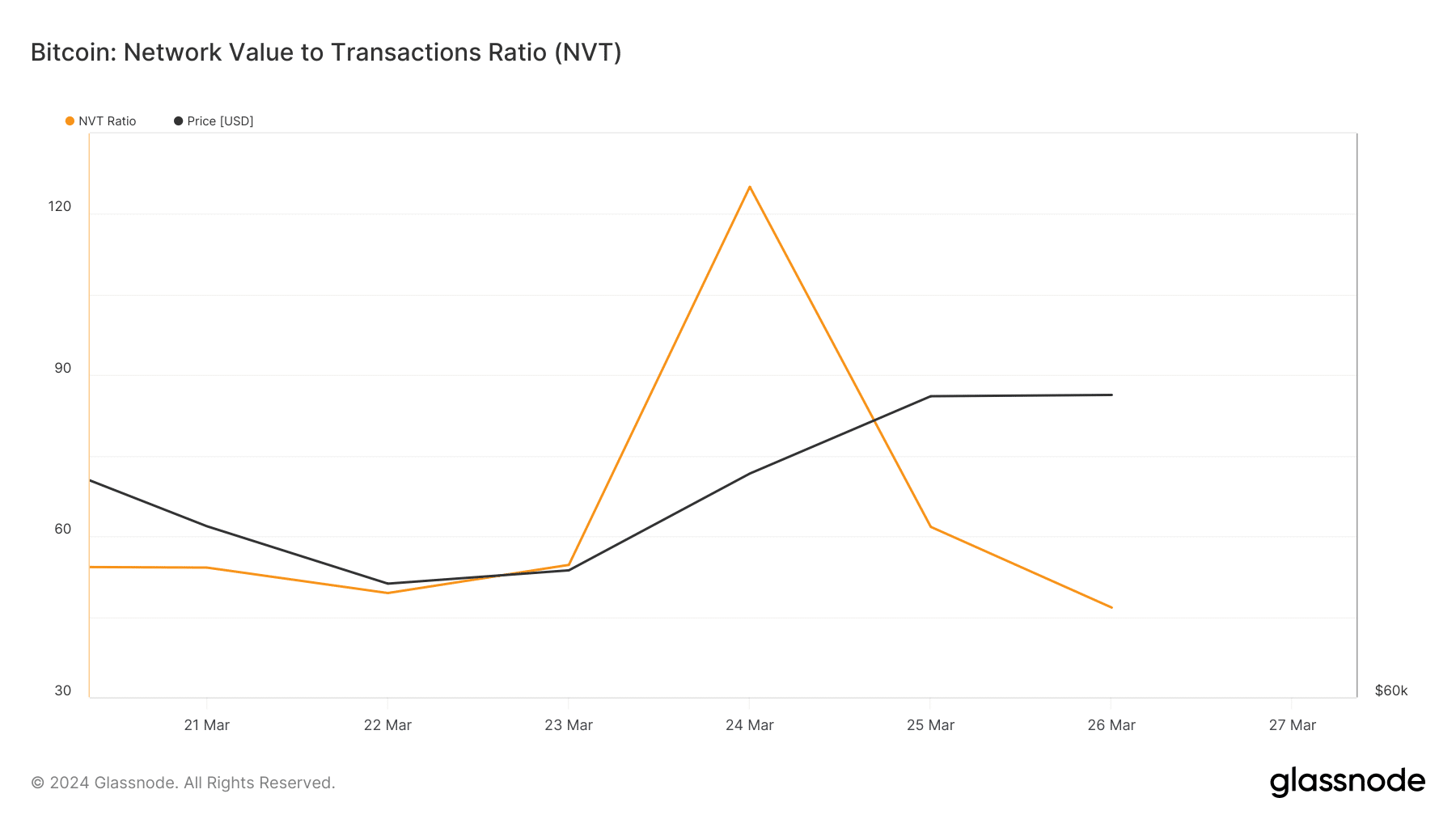

The chances of BTC continuing the uptrend were even higher when we analyzed Glassnode’s data. We found that BTC’s Network Value to Transactions (NVT) ratio dropped.

For starters, the NVT ratio is computed by dividing the market cap by the transferred on-chain volume measured in USD.

Whenever the metric drops, it signifies that an asset is undervalued. This indicated that BTC investors might witness yet another bull rally from the token soon.

Read Bitcoin’s [BTC] Price Prediction 2024-25

To better understand what to expect from BTC, we then checked out derivatives metrics. They also looked pretty bullish, as its Funding Rate was high.

This meant that derivatives investors were actively buying the coin at press time. However, its Taker Buy Sell Ratio was red, suggesting that selling sentiment was still dominant in the derivatives market.