BNB’s new ATH – How close or how far is it really?

- Volume in the derivatives market increased, suggesting a significant appreciation.

- A thorough price analysis indicated that BNB might hit $694.

After AMBCrypto published predictions explaining how Binance Coin [BNB] might surpass $600, the coin now seems to be targeting another level.

At press time, BNB changed hands at $610. The price increase has also helped it retain the number 4 spot after Solana [SOL] took its place for a while.

However, the forecast that the Binance exchange coin could hit another high was not just mere talk. Instead, we gathered a lot of datasets that aligned with the deduction.

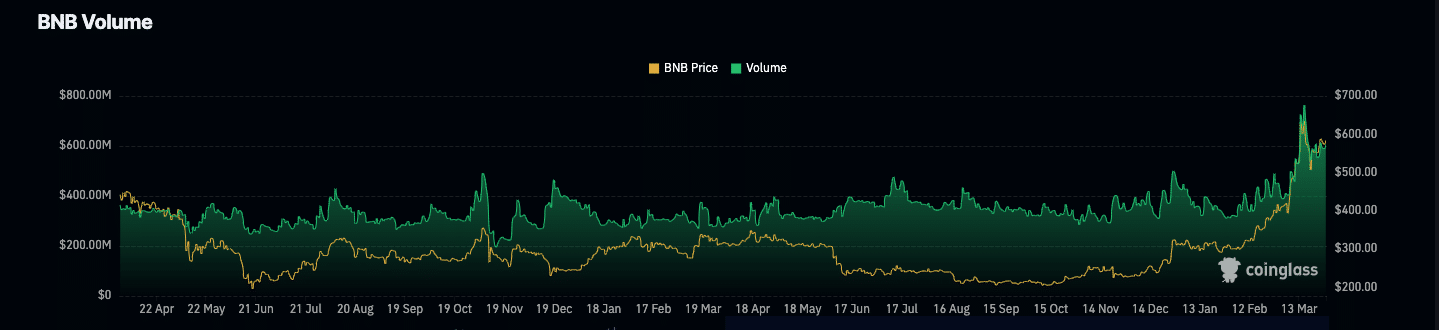

To start with, we looked at the happenings in the derivatives market. According to data analyzed from Coinglass, BNB’s derivatives volume hit an incredible $1.44 billion.

Hold on! Hurdles ahead

This represents a 15.05 % increase in the last 24 hours, suggesting strong trading activity, and high-risk appetite. Previously, AMBCrypto had mentioned that many contracts targeted a bullish end to the month.

With this trend, it might seem that the bets might be in favor of bulls. For that to happen, the volume has to sustain the hike alongside the price action.

But beyond this month, BNB’s price action indicated that it could be ready to surpass its all-time high. BNB’s ATH was $686.31, meaning that the coin was 11.22% away from hitting the value.

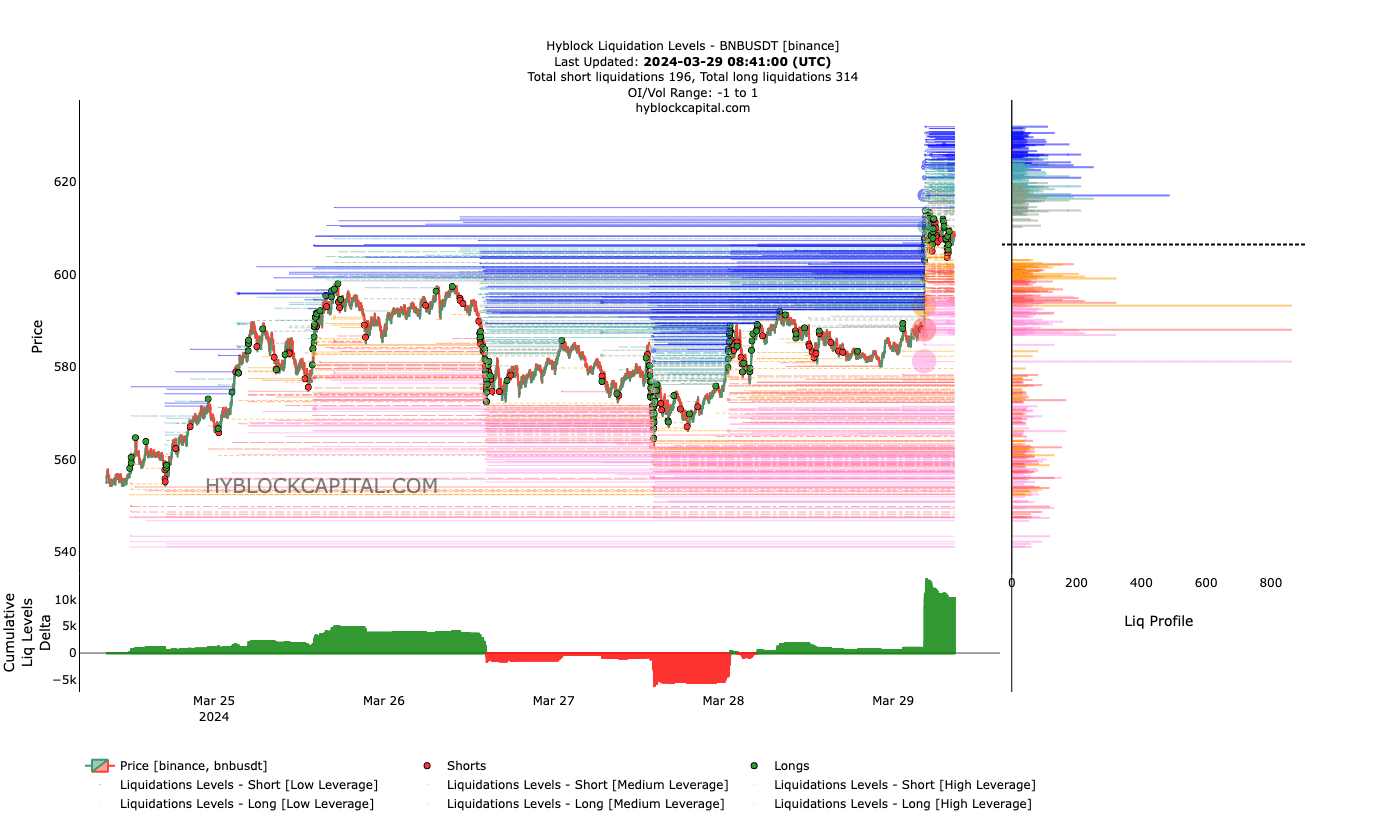

Another area we considered was the liquidation levels which show possible prices where liquidation might occur. At the time of writing, there was a cluster of liquidity from $615 to $631.

If the coin does not encounter any overhead resistance, the price could appreciate toward these levels. However, it is also crucial to check the bias displayed by the Cumulative Liquidation Levels Delta (CLLD).

Positive values of the CLLD indicate that there are more long liquidation levels. When the CLLD is negative, it implies that short liquidation levels are higher.

It’s a direct route to the top

At press time, the CLLD was at a very positive point, indicating that BNB might experience a full retrace. This could halt BNB’s bullish momentum, and the price might decline.

However, this bearish bias might be invalidated if spot buying increases. Should this be the situation, the price of the coin might climb toward $640.

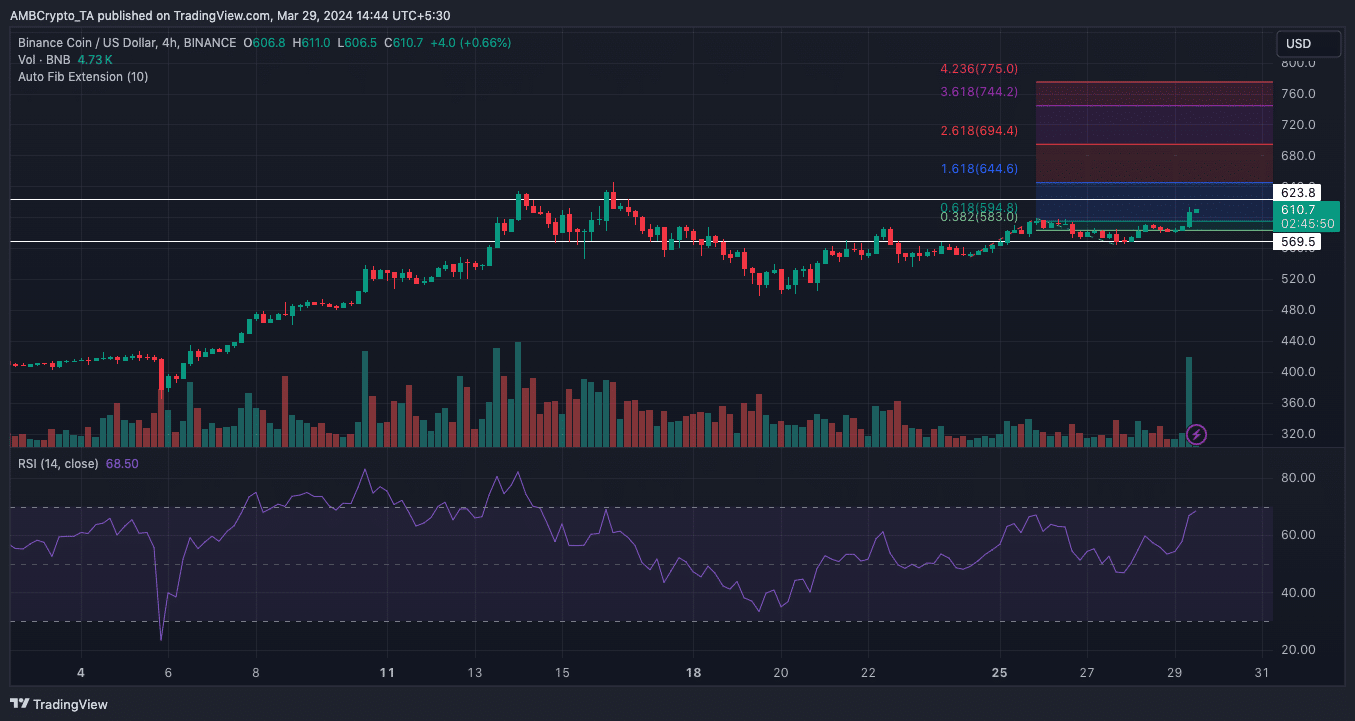

On the 4-hour timeframe, BNB displayed a readiness to surpass the overhead resistance at $623. However, that would depend on how tight bulls can defend the support at $569. With sustained buying pressure, BNB might break the resistance, possibly clearing the path to revisit $644.

Furthermore, the Relative Strength Index (RSI) indicated that momentum was bullish. Should buyers keep sellers in check, a reversal could be off the table.

Read Binance Coin’s [BNB] Price Prediction 2024-2025

AMBCrypto also observed the Fibonacci extension indicator. According to the signals, the coin’s price might extend as high as $694.

In a highly bullish phase, the 4.236 Fib placed the price prediction at $775.