50% of MATIC holders are facing losses – What now?

- Less than 45% of holders were in profit.

- MATIC’s price might climb to $1.30 as the Napoli upgrade approaches.

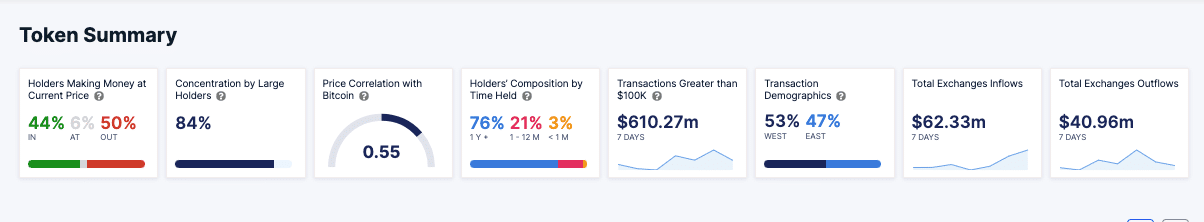

Polygon [MATIC] erasing a large part of its recent gains has caused holders nothing but pain, data from IntoTheBlock showed. According to the crypto analytics platform, 50% of MATIC holders were at a loss.

On the other hand, 44% were in profit while the remaining 6% had broken even. This data comes as a surprise considering how the token performed at one point.

Few weeks back AMBCrypto reported how Polygon’s token climbed and showed potential of hitting $2. However, the last few days have not been great for the cryptocurrency.

As of this writing, CoinMarketCap revealed that the price of MATIC had decreased by 4.44% in the last seven days. Specifically, MATIC’s value was $0.99, indicating that bulls found it difficult to revisit the $1 psychological resistance.

However, this decline does not mean that MATIC was out of the race for tokens that would perform well this season. But recovery might be important for short-term holders.

Polygon wants MATIC to cook

So, does Polygon have any significant upgrade that could fuel a “buy the rumor” hike? Well, AMBCrypto found that there might be one.

On the 27th of March, the project revealed that a new upgrade was in the works called the “Napoli upgrade.” According to the blog post, the upgrade would help Polygon achieve network consensus.

It added that this would be done via the integration of improvements to the parallel execution, and new operational codes for the Ethereum Virtual Machine (EVM).

As a result of the Napoli upgrade, Mumbai, which is a Testnet of the Proof-of-Stake (PoS) network, would be phased out in April. In turn, the Amoy Testnet would take its place.

Like previous upgrades, this upcoming development could be bullish for MATIC. Should buying pressure increase going forward, then MATIC’s price might rise toward $1.30.

Some difficulties arise

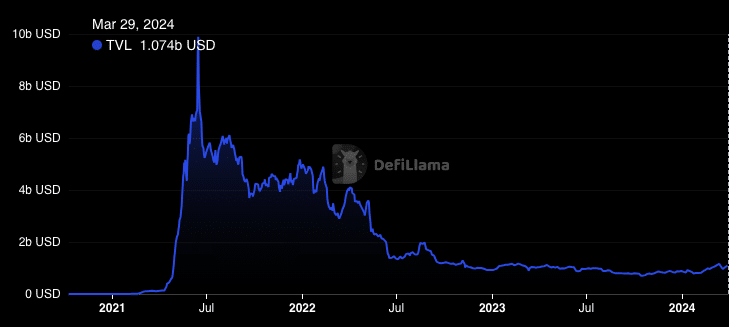

Despite the bullish potential MATIC has, Polygon still has some challenges. One of them was with its Total Value Locked (TVL).

In 2021, Polygon’s TVL had an incredible run that saw it get close to $10 billion. But press time data from DeFiLlama showed that the metric was a mere $1.07 billion.

TVL measures the value of assets locked or staked in a protocol. If it increases, it means that market participants have added liquidity to the protocol while helping to improve its health.

Realistic or not, here’s MATIC’s market cap in ETH terms

The opposite happens when the metric decreases. In the last 30 days, deposits to protocol under Polygon have increased by 3.66%. However, the increase was small compared to other chains.

But it is not all the time that this metric influences price. As such the value of MATIC might jump irrespective of the condition of the network’s health.