As Bitcoin nears $70K, how this group will help your BTC holdings

- Bitcoin whale addresses have increased to over 2,000.

- BTC moves closer to the $70,000 price zone.

The approval of the Bitcoin [BTC] spot ETF in the United States generated varied reactions across different metrics.

One such metric indicated that whales increased their accumulation as prices soared to all-time highs. How profitable have their holdings been over the past few months?

Bitcoin whales show ETF excitement

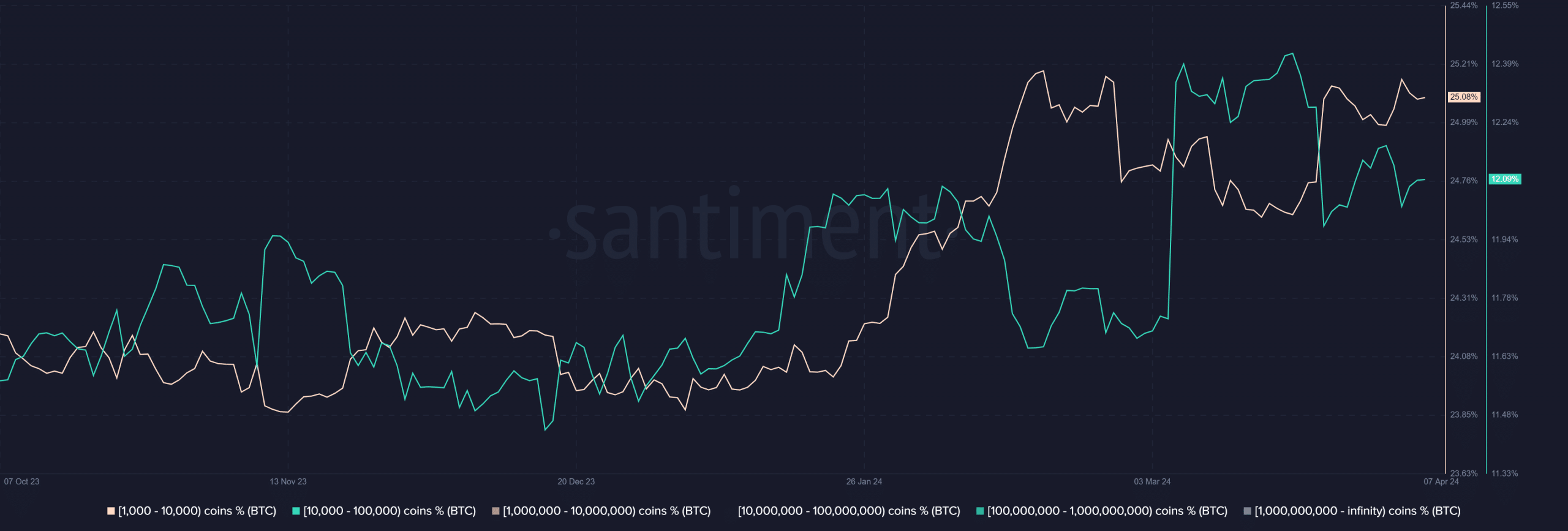

An analysis of whale addresses holding 1,000 or more Bitcoin revealed a significant increase following the approval of the spot ETF in January.

The chart showed a rise in the number of addresses from around 1,800 to over 2,000.

Despite a slight drop in recent weeks, the number remained above the 2,000 threshold. The balance held by these addresses surged by over 220,000 BTCs, equivalent to around $14 billion.

This suggested that the approval of the spot ETF spurred increased activity among whales, with more of these addresses accumulating additional BTC.

Bitcoin whale remains in the profitable zone

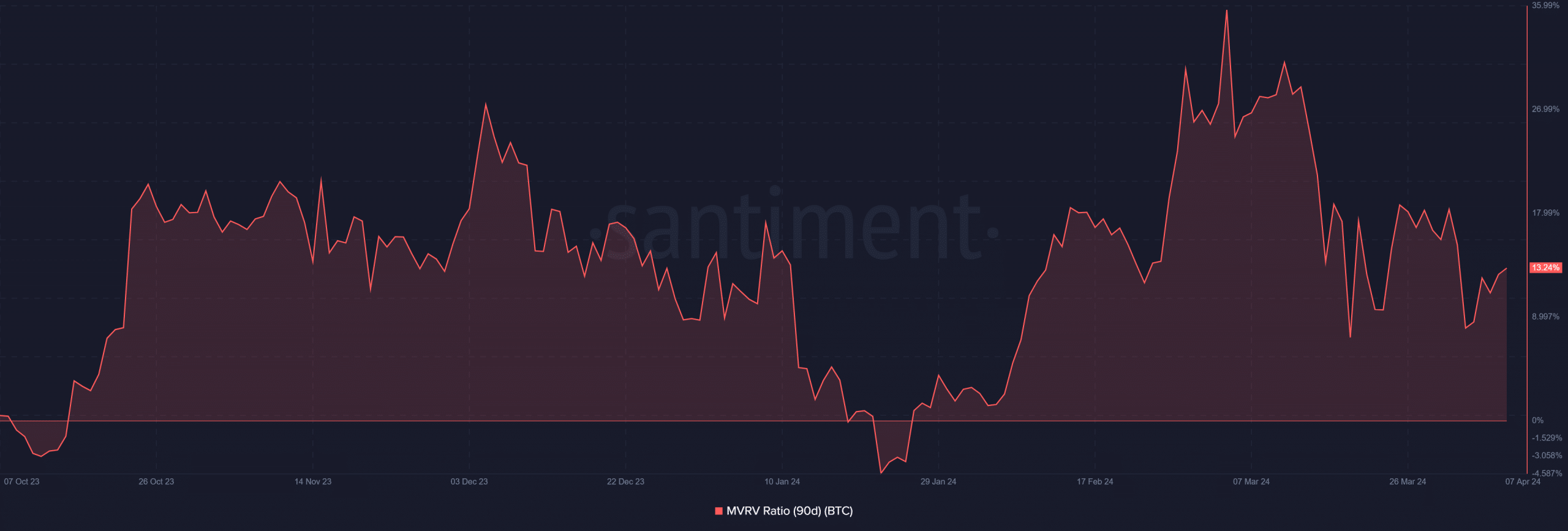

The assets accumulated by these whales in the months following the ETF approval have proven profitable. Analysis of the Bitcoin 90-day Market Value to Realized Value ratio (MVRV) showed it has been above 0.

Subsequently, the MVRV surged to over 35% in March before experiencing a significant decline.

At the time of this writing, the MVRV had decreased to around 13.24%, returning to the region it was in before the approval. This decline is attributed to the recent price decrease observed in BTC.

However, despite this decline, the current state of the MVRV suggests that whales who purchased during this period are still holding at a profit.

BTC moves closer to $70,000

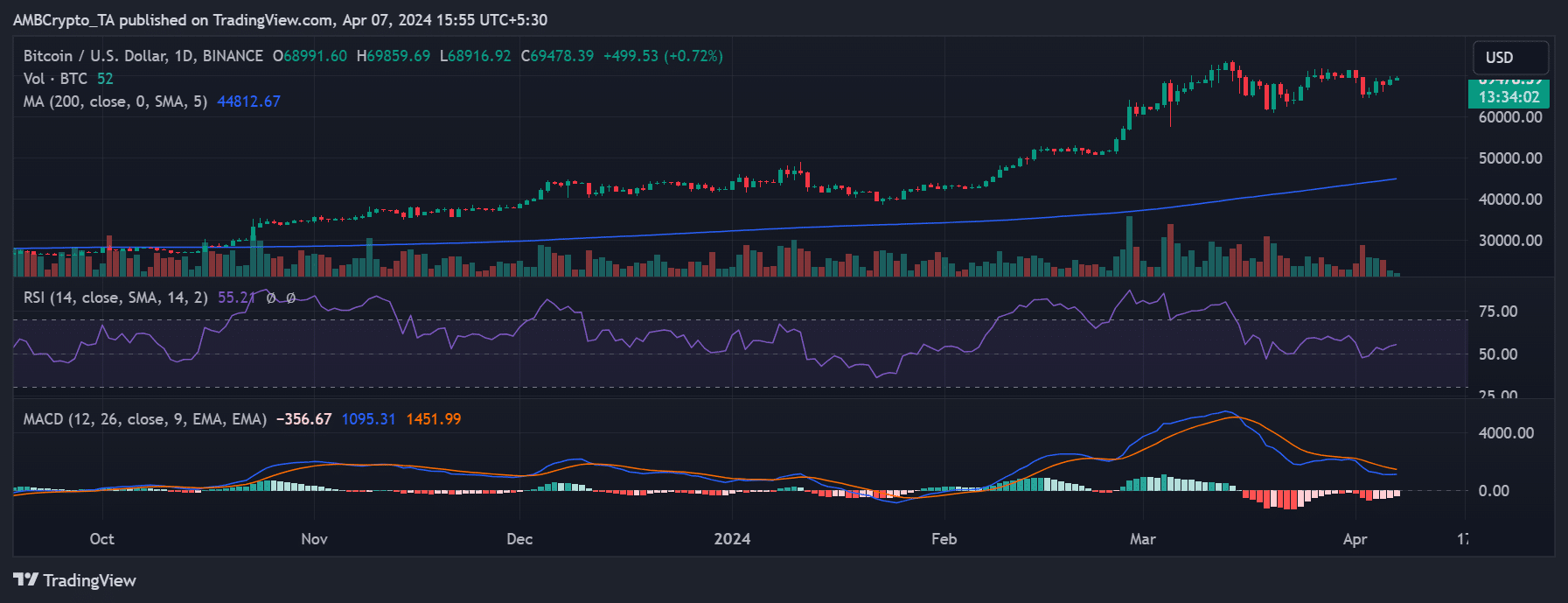

AMBCrypto’s analysis of Bitcoin’s price trend on a daily timeframe chart revealed a notable surge following the approvals, reaching new highs.

Is your portfolio green? Check out the BTC Profit Calculator

However, the price has been moderated in recent weeks, dipping below the established threshold of over $70,000. Despite the decline, it remained close to the $70,000 price zone.

At the time of this writing, BTC was trading over $69,000. Additionally, it was in a bullish trend, as indicated by its Relative Strength Index (RSI) being above 50.