Ethereum’s $15B signal: What Futures say about a return to $4K

- Ethereum’s futures open interest show that the coin will reclaim its all-time high in the mid-term.

- Its key indicators also confirmed the rise in bullish sentiment in the coin’s spot market.

Leading coin Ethereum [ETH] may be poised for another significant rally in the mid-term, pseudonymous CryptoQuant analyst ShayanBTC noted in a new report.

The report assessed the coin’s futures market and found that despite the general market consolidation in March, ETH’s funding rates have remained positive, and its open interest has continued to climb.

Funding rates are used in perpetual futures contracts to ensure that the contract price stays close to the spot price.

When an asset’s contract price is higher than its spot price, traders who hold long positions pay a fee to traders shorting the asset. Funding rates return positive values when this happens.

Conversely, when the contract price is lower than the spot price, short traders pay a fee to traders holding long positions, leading to negative funding rates.

According to the analyst, as ETH attempts to reclaim the $4,000 price mark, there has been a “corresponding spike in the funding rates metric.”

The report added,

“This indicates an aggressive execution of long positions by participants.”

Coinglass data showed that the coin’s funding rate was a positive 0.024% at press time. When an asset’s funding rate is positive and grows, more traders hold long positions. This means more market participants are expecting the asset’s price to rise in the short/mid-term than those anticipating a decline.

Regarding the coin’s futures open interest, its double-digit price rally in the past week has caused this also to grow. Per Coinglass data, ETH’s futures open interest was $15 billion as of this writing. In the last seven days, this had grown by 7%.

According to the report:

“Considering these metrics, the market appears poised for another significant move in the mid-term, with the potential for long positions to be reinstated in the perpetual market. This suggests a favourable outlook for Ethereum’s price trajectory, potentially pushing it towards its all-time high.”

Are the bulls regaining their strength?

March was significantly marked by bearish sentiments, which caused ETH’s price to consolidate within a tight range.

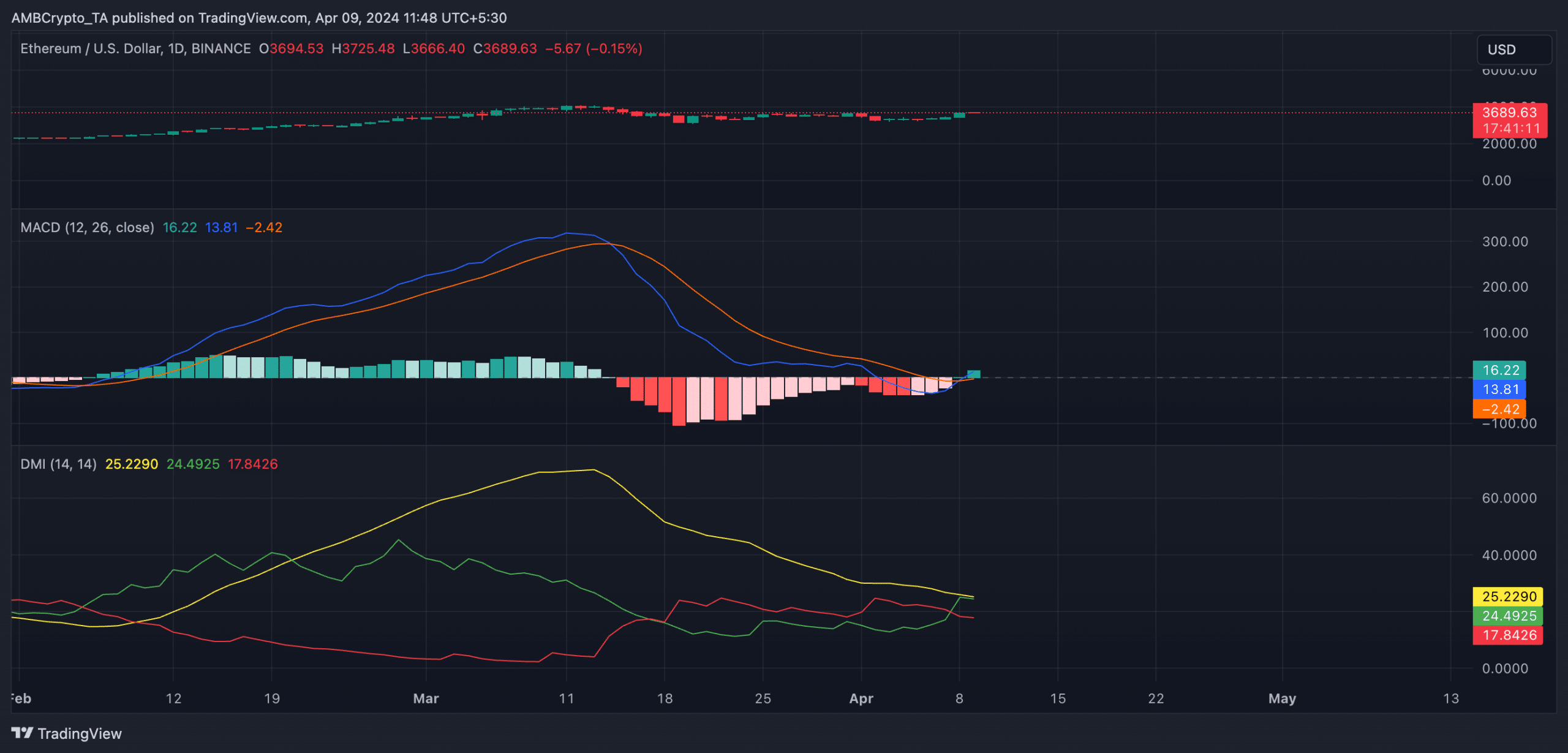

However, readings from some indicators observed on a 1-day chart showed that the rally in the coin’s price in the last week confirmed that the bulls are now attempting to re-enter the market.

For example, for the first time since 15th March, ETH’s MACD line rested above its signal line.

When an asset’s MACD line crosses above its signal line, it suggests that its shorter-term moving average is starting to move upward quicker than its longer-term moving average. This indicates an increase in bullish momentum in the short term.

Read Ethereum’s [ETH] Price Prediction 2024-25

Also, ETH’s Directional Movement Index (DMI) showed that its positive directional index (green) crossed above its negative index (red) on 7th April.

This confirmed the change in sentiment from bearish to bullish.