Bitcoin halving countdown: Why the next 3 days are crucial for miners

- Miners have been investing in more efficient machines to tackle post-halving financial stress.

- Miners’ sell-offs increased in recent months.

With less than three days to go for the pivotal Bitcoin [BTC] halving event, the focus has shifted to miners and their economic sustainability in the aftermath.

What next for miners after halving?

Historically, miners’ revenue streams take a big hit immediately after the halving, owing to slashing of block rewards by half. This was exemplified by on-chain analytics firm IntoTheBlock.

However, the pain was observed to be temporary, as the king coin progressively increased in value following the quadrennial event.

The halving in July 2016 was followed by a 3x rise in BTC’s value over the next 12 months. Similarly, the last halving in May 2o20 saw the king coin explode by 500% in the following year, AMBCrypto noted using CoinMarketCap data.

Since miner revenue is positively correlated with the price of Bitcoin, it has historically risen to new highs within a year of halving.

Miners’ preparations before halving

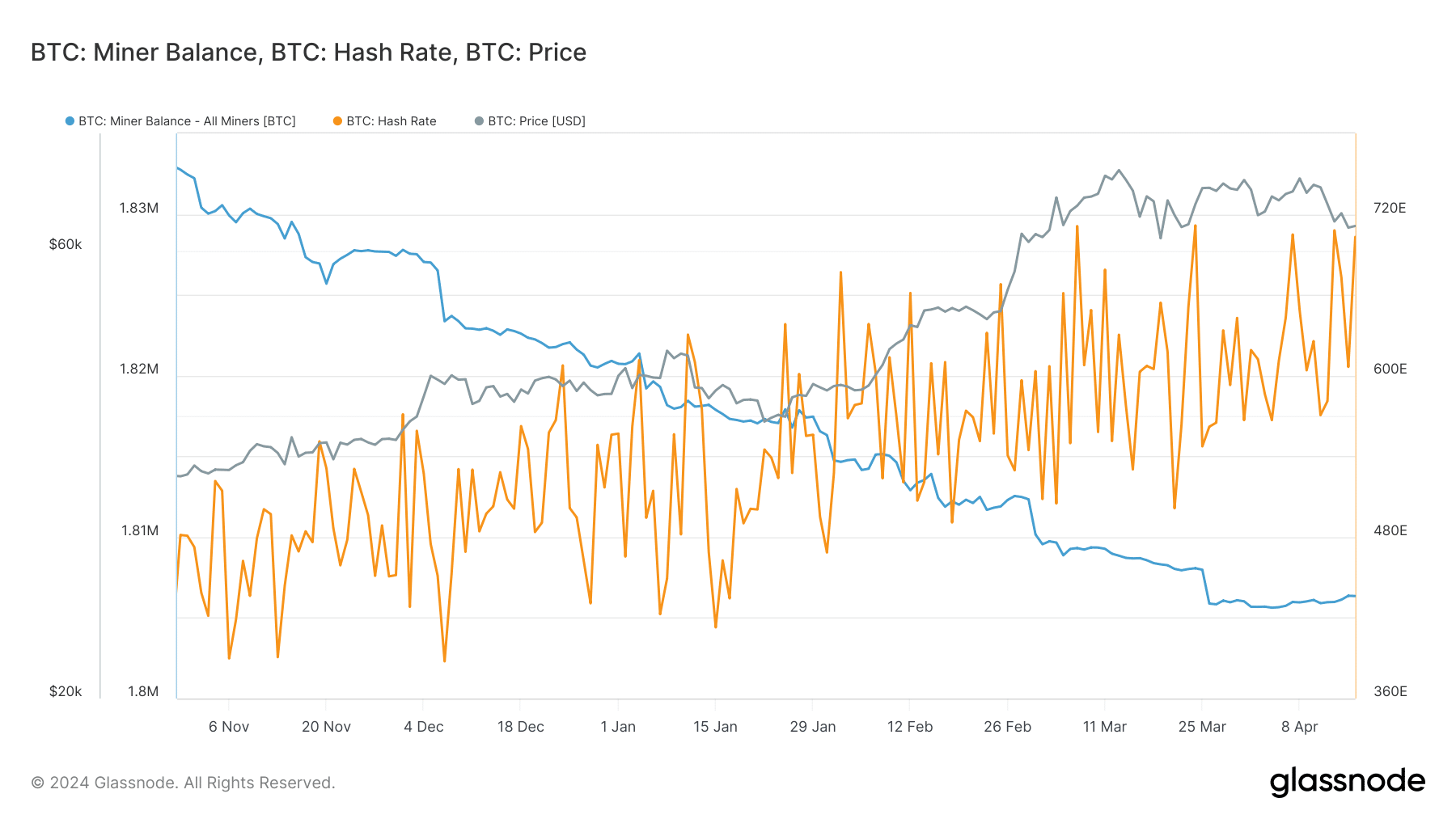

Over the last few months, Bitcoin’s hash rate, a measure of the computational power dedicated by miners, has trended upwards, AMBCrypto noticed using Santiment’s data.

This could be due to miners investing in more efficient machines that generate higher hash rate per unit of electricity consumed.

Such steps become imperative, as the halving would double the cost to miners to break even.

Additionally, miners have been liquidating their Bitcoin holdings steadily in recent months, likely to generate cash to invest in more sophisticated machines. The drop in number of coins held in miner wallets alluded to this deduction.

Is your portfolio green? Check out the BTC Profit Calculator

Bitcoin was trading in the $63k zone as of this writing, per CoinMarketCap, having seen significant downward volatility in the lead up to the halving.

Overall, such supply shocks could prove to be beneficial for Bitcoin’s long-term value, provided demand for the asset remains robust.