Bitcoin halving 2024: How 27,000 BTC are prepping for the big day

- BTC accumulation climbs ahead of the halving event.

- The past few days have seen an uptick in market volatility.

Bitcoin’s [BTC] accumulation has reached a new milestone, with the next halving event just a few hours away.

In a new report, pseudonymous CryptoQuant analyst IT Tech found that on the 16th of April, inflows into BTC accumulation addresses exceeded 27,000 BTC.

The analyst described an accumulation address as an address with no record of outgoing transactions, a balance exceeding 10 BTC, no link to any centralized exchanges or miners, received more than two incoming transactions.

Its most recent transaction had occurred within the last seven years.

According to the report, the last all-time high inflows to these addresses were recorded on the 22nd of March, when they received 25,100 BTC.

Traders remain steadfast

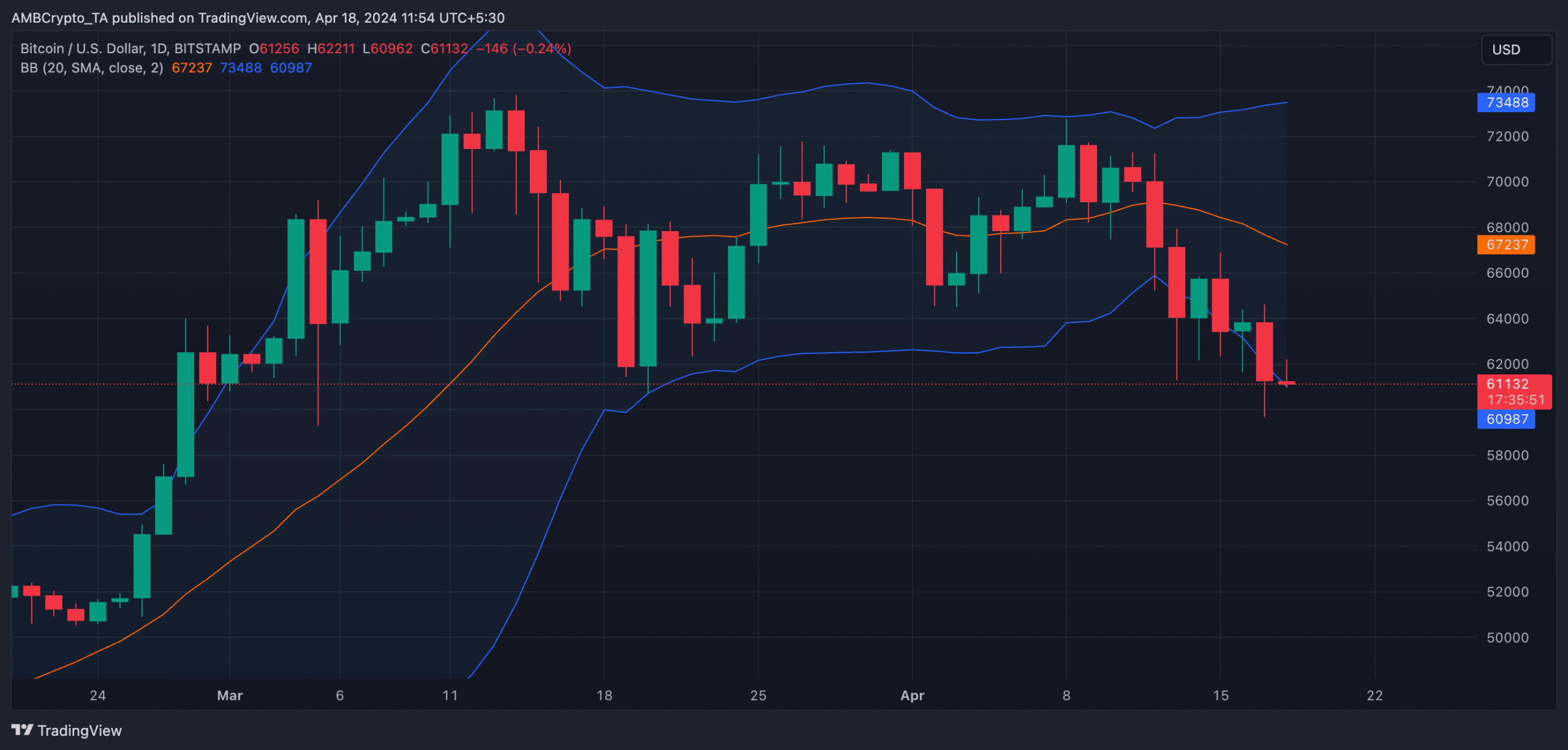

It is no longer news that the crypto market has declined in the past few weeks. Exchanging hands at $61,234 at press time, BTC’s price has dropped by 13% in the past seven days, according to CoinMarketCap’s data.

However, despite the price fall, market participants continue to accumulate more coins ahead of the halving event scheduled for 19th April.

The surge in BTC accumulation in the face of recent headwinds is due to the anticipation of a post-halving price rally.

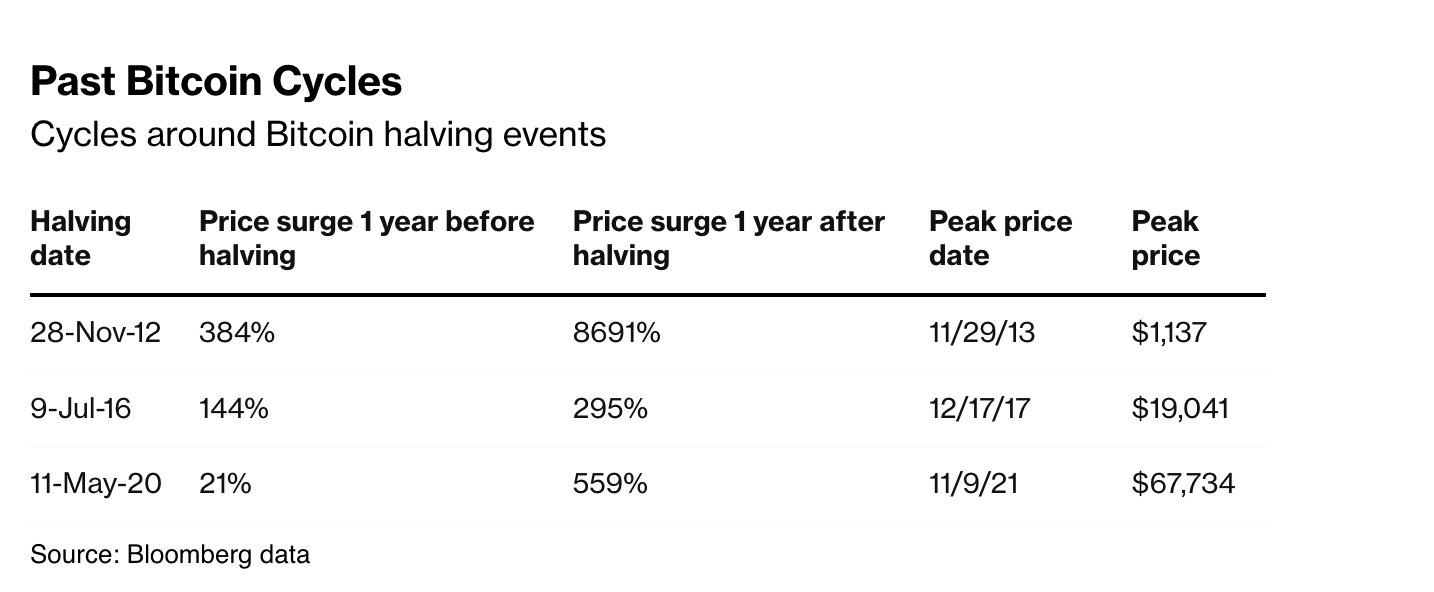

Historically, the coin’s price has surged following past halving events. According to Bloomberg’s data, a year after the 2012 halving, BTC’s price climbed by over 8,000%.

Similarly, a year after the 2016 event, the coin’s value rose by 295% and by 559% 365 days after the 2020 event.

The current decline in selling pressure could be gleaned from the steady decrease in the coin’s exchange reserve.

Per data from CryptoQuant, in the last week, the amount of BTC held on crypto exchanges has fallen by 1%.

As of this writing, 1.94 million BTCs worth around $119 billion at press time market prices are held on exchanges.

Remain on the lookout

With a few hours till the halving event, market volatility is climbing.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Readings from BTC’s daily chart showed that the gap between the upper and lower bands of its Bollinger Bands indicator has widened steadily in the past few days.

When the gap between these two bands widens this way, it indicates an increase in volatility. It suggests the asset’s price is moving more aggressively and can break out in either direction.