Worldcoin becomes part of Ethereum L2: Will WLD rally again?

- Worldcoin to get its L2.

- WLD has remained in the $4.7 price zone despite the latest announcement.

Worldcoin [WLD] has a knack for the dramatic, and this trend continued with its recent announcement.

Following the controversy surrounding iris scanning, the platform has announced plans to launch its Layer 2 (L2) solution. Did this latest announcement move the price of WLD in any way?

Worldcoin’s Layer 2

In its announcement on the 17th of April, Worldcoin revealed the launch of what it termed the “World Chain.” This new platform is described as a Layer 2 solution built on the network.

Notably, the World Chain will be secured by Ethereum [ETH]. The announcement also mentioned the presence of bots on the platform, with some deemed necessary.

To address potential network congestion caused by unnecessary bots, Worldcoin plans to leverage World ID to distinguish between bots and human users.

Additionally, the post highlighted the prominent role of WLD, Worldcoin’s native token, which will be utilized for gas fees alongside ETH.

Did Worldcoin react?

The latest announcement from Worldcoin introduced a new utility for WLD, yet it failed to prevent the observed decline.

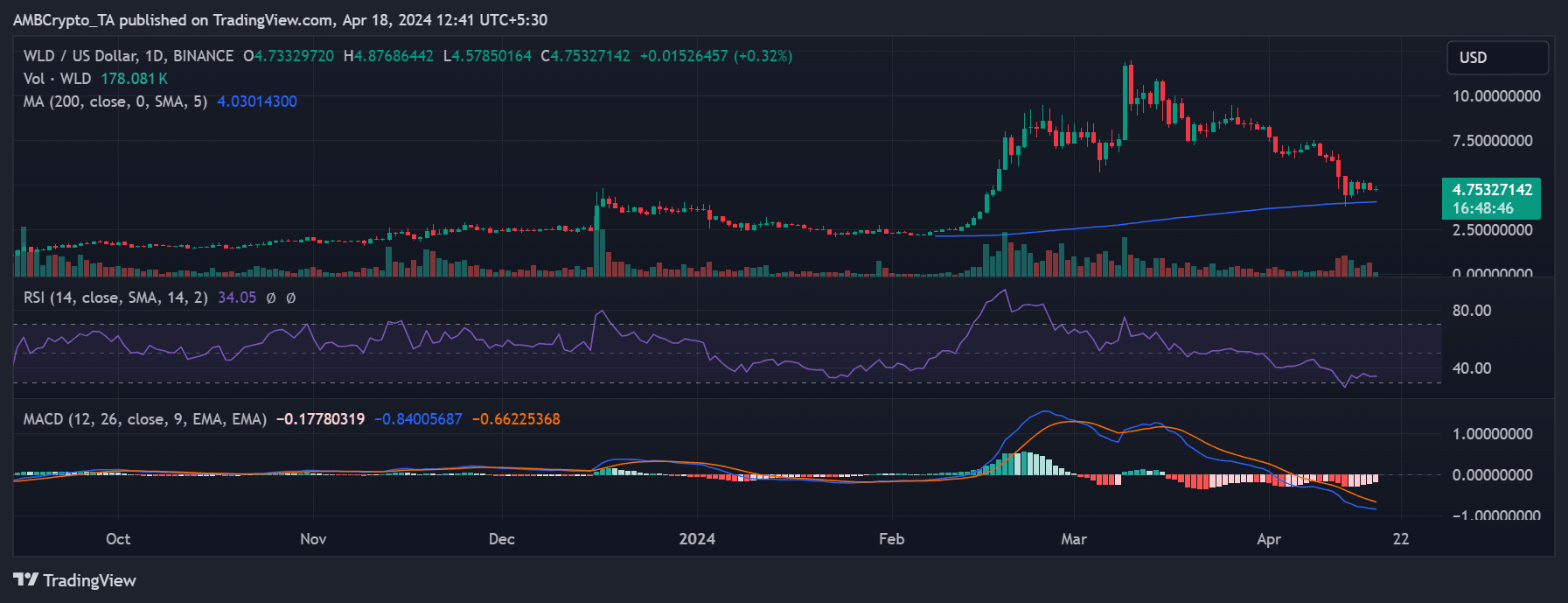

Analysis of the daily timeframe chart reveals that WLD concluded the day with a negative performance despite the announcement.

By the end of the trading session on the 17th of April, WLD experienced a decline of over 6%, trading around $4.7.

At the time of writing, it fluctuated between gains and losses, exhibiting a less than 1% increase while still trading around $4.7.

The long Moving Average (blue line) currently acts as support around $4. Still, a breach below it could initiate a more significant decline.

Furthermore, the Relative Strength Index (RSI) confirmed a bear trend, with the RSI below 40, indicating a strong bearish sentiment.

This trend suggested that WLD had its trajectory, and the recent announcement failed to generate any positive impact.

Active addresses show reduced activity

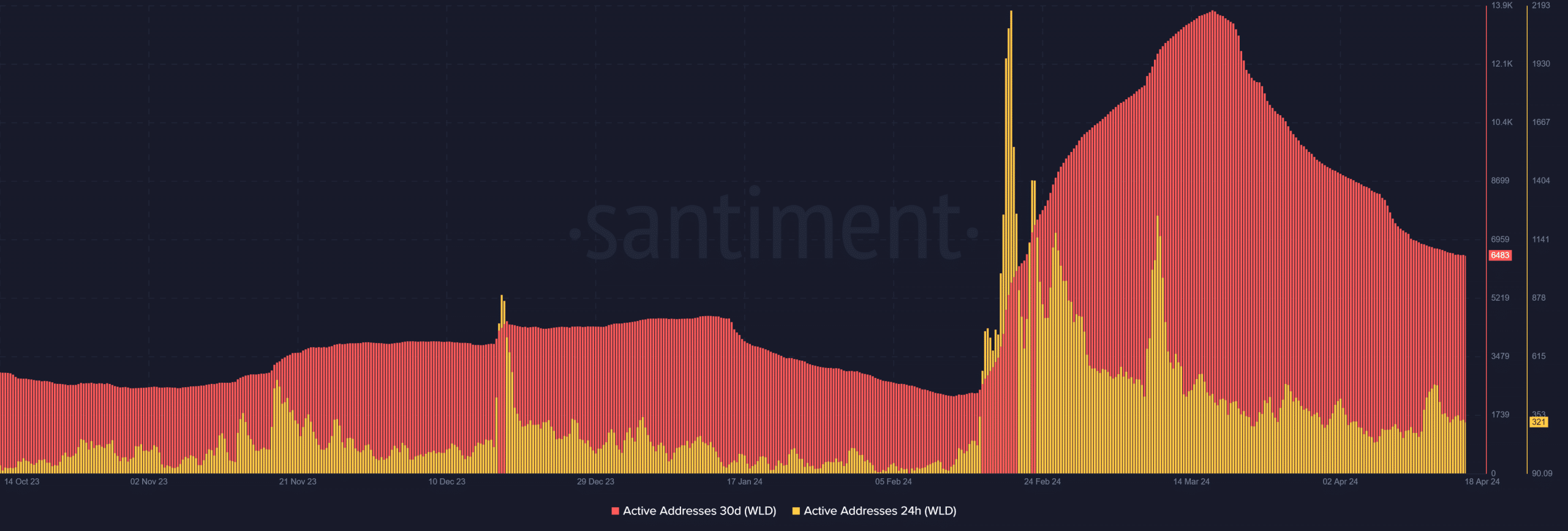

Besides the price movement, analysis of the 24-hour and 30-day active addresses metrics indicated a lack of excitement surrounding Worldcoin.

Read Worldcoin’s [WLD] Price Prediction 2024-23

According to Santiment, the 24-hour active addresses metric shows no significant change between the 17th of April to press time, with a slight decline observed.

At the time of this writing, there are 321 active addresses. Additionally, the 30-day active addresses metric reveals significant declines over the past few weeks, with only 6,483 active addresses at the time of writing.