Is Ethereum whale’s $128 million ETH purchase HODLing advice for you?

- Despite high unrealized losses, a whale was seen accumulating ETH

- ETH supply held by addresses that don’t belong to exchanges increased in recent weeks

Ethereum’s [ETH] price corrected sharply during the early trading hours in Asia on Friday due to escalating tensions between Israel and Iran. Though it recovered to be valued at over $3,000 at press time, the second-largest cryptocurrency has largely been in the red over the past week. In fact, it lost more than 12% of its valuation, according to CoinMarketCap.

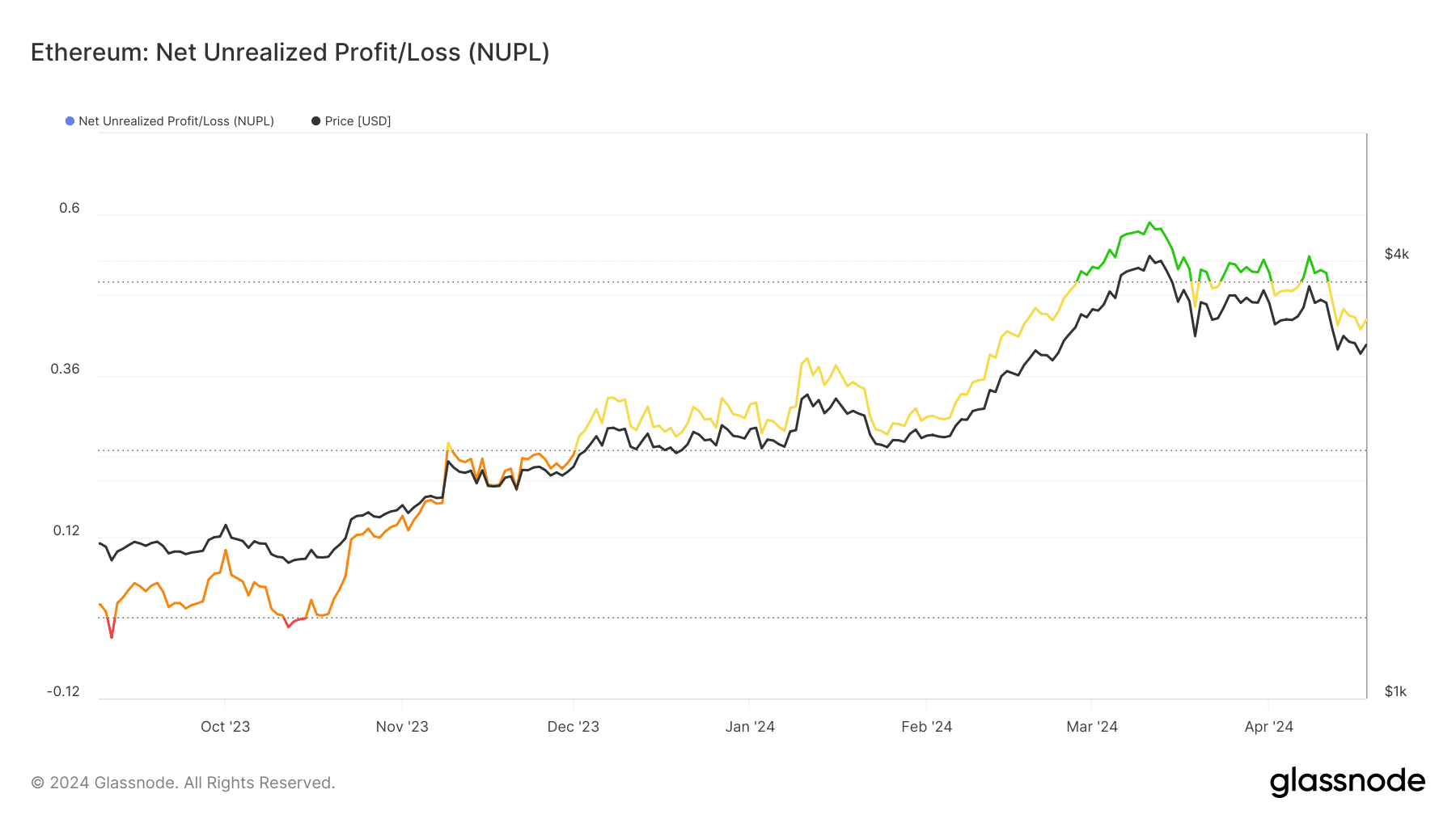

ETH’s profitability drops

The slump contributed to the net unrealized profits of the network declining. AMBCrypto examined the same using Glassnode’s data and found that the number of ETH holders in profit came down sharply.

When confronted with such risks to their portfolios, a lot of participants start to capitulate, resulting in panic selling. However, the actions of one particular whale investor piqued the interest of the market.

Unfazed whale goes on buying spree

According to on-chain tracking platform Spot On Chain, a “giant” whale is accumulating ETH despite being in unrealized loss. The risk-tolerant investor snapped 41,358 ETH over the past five days, valued at around $128 million at prevailing prices.

Overall, the whale is now in possession of a whopping 117,268 ETH coins, which if sold would result in losses of roughly $20 million.

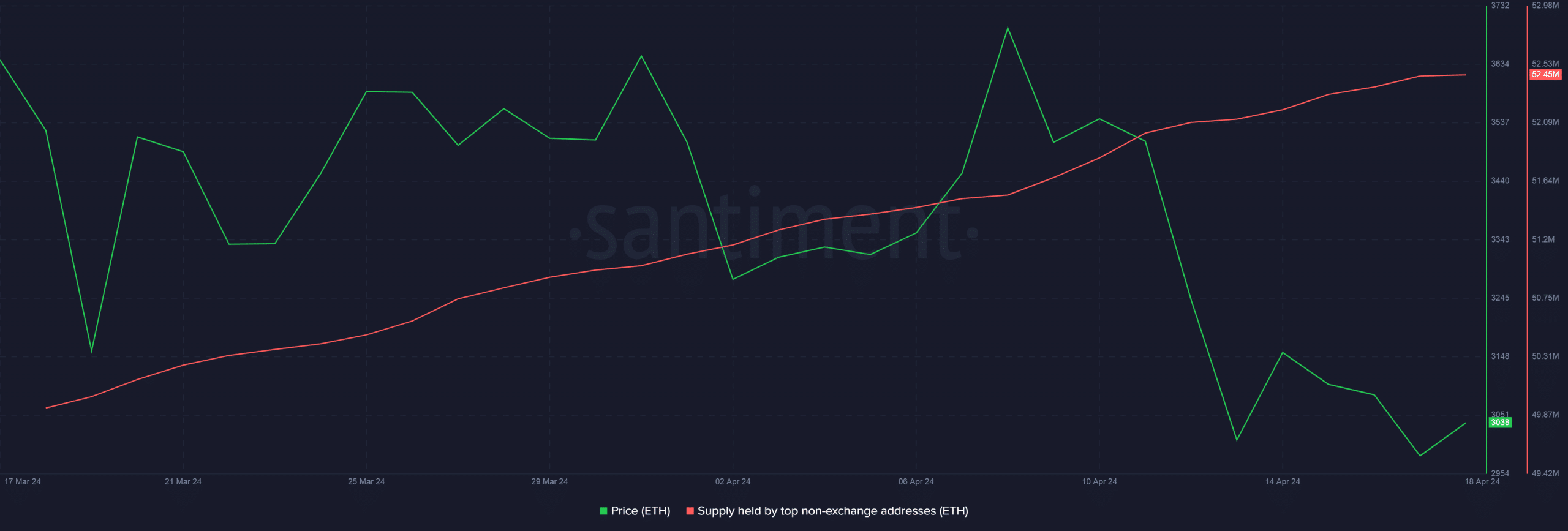

The accumulation pattern, however, was not limited to the aforementioned whale. AMBCrypto dug further using Santiment data and noticed a steady rise in ETH supply held by addresses that don’t belong to exchanges.

These HODLing tendencies are a sign of confidence in ETH’s price over the long-term. These addresses might be expecting ETH to rebound and rebound well.

Is your portfolio green? Check out the ETH Profit Calculator

What to expect next?

At the time of writing, Ethereum’s market was in a neutral state, as per the latest readings from Ethereum Fear and Greed Index. This signified a balanced market sentiment without a strong bias towards buying and selling.

Bitcoin’s [BTC] halving is expected to create ripples across the broader market, including ETH. Following the last halving in 2020, ETH’s trajectory mirrored BTC’s, and both leading assets hit new highs the following year.