Cardano’s potential 75% price hike must wait until THIS prediction pans out

- ADA’s price might climb past $0.80 if historical data is anything to go by

- Indications from the OI and liquidations suggested an initial decline below $0.46

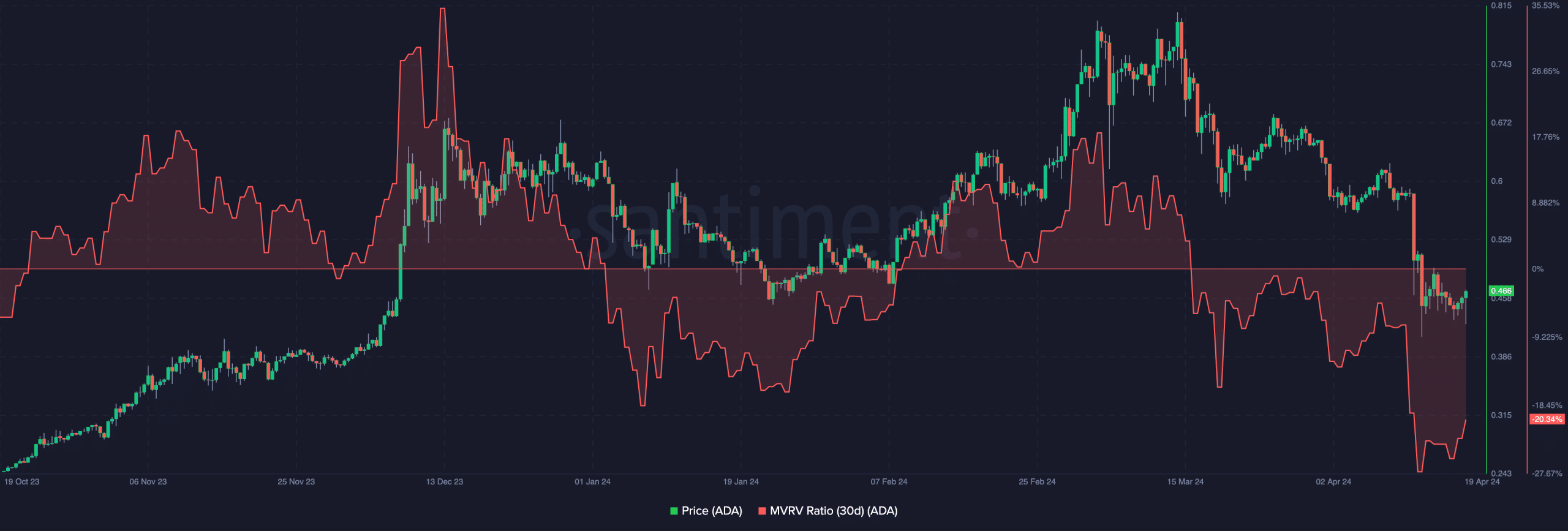

If the past shapes the future, then Cardano’s [ADA] price might jump by 75% within a short period. AMBCrypto made this conclusion after examining the Market Value to Realized Value (MVRV) ratio.

On 18 April, Cardano’s 30-day MVRV ratio hit 22.04%. The last time the metric got close to this point, ADA rallied from $0.45 to $0.72. This was back in January.

Floodgates may soon be open

However, January was not the only time Cardano made such a move. In October 2023 too, ADA jumped from $0.24 to $0.43 after a similar trend appeared on the MVRV ratio.

In the last 30 days, the cryptocurrency’s value has fallen by 23.60%. However, in light of Bitcoin [BTC]‘s halving, the price followed other altcoins’ direction and jumped.

At press time, ADA was valued at $0.46, thanks to a 3.41% 24-hour hike. However, it is uncertain how Cardano would react after the completion of the halving.

Weeks after the 3rd halving in 2020, ADA rose to $0.08 after trading at $0.04 on the day of the event. If a similar scenario plays out, the token’s price could be between $0.80 and $0.92 before the end of June.

However, before its mid-term performance, ADA might stall or swing between $0.45 and $0.48. This, because of the indications shown by the volume.

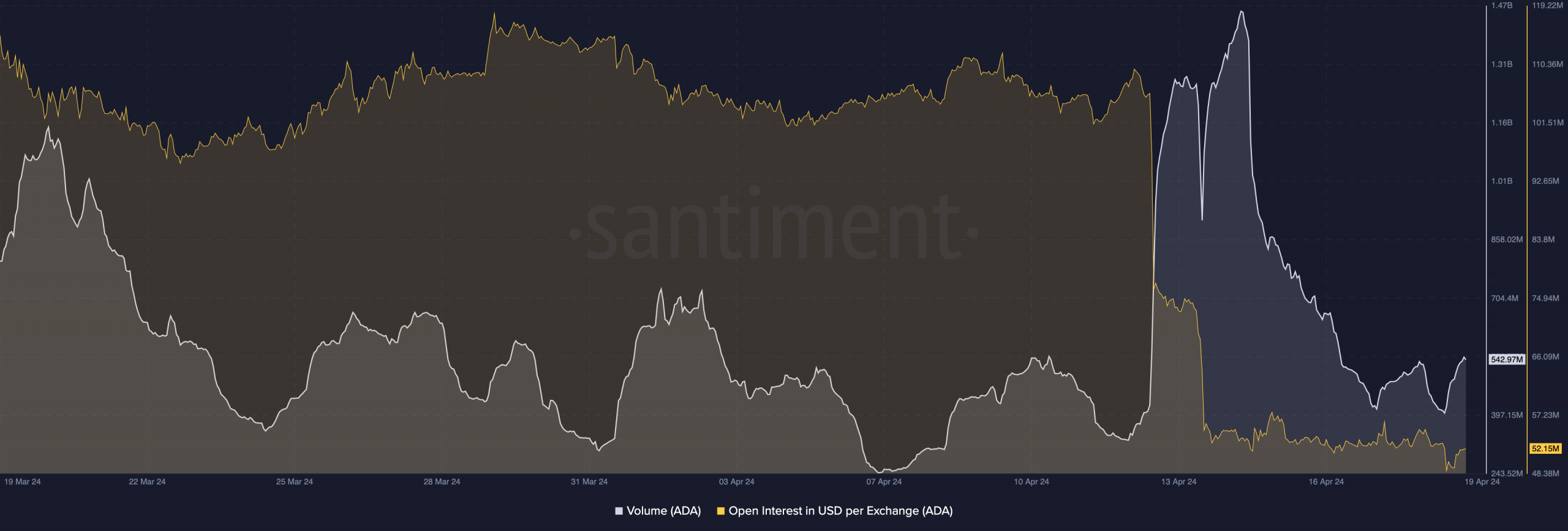

At the time of writing, ADA’s volume was $542.97 million. While this represented an increase, it did not seem solid enough to keep Cardano in a continuous uptrend.

However, if the volume rises past $1 billion, while ADA’s price appreciates too, the value might climb to $0.50. On the other hand, a declining volume could pull down ADA, and the value might drop back to $0.43.

Won’t be a straight path to the peak

Another metric AMBCrypto evaluated was Open Interest (OI). The OI decreases or increases based on net position. If it increases, it means that buyers are more aggressive. On the other hand, a decreasing OI suggests sellers are the aggressive ones.

However, Cardano’s OI was not large enough to trigger a pump. Therefore, ADA’s price might swing sideways for some days before the predicted rally comes to pass.

Meanwhile, contracts worth $1.31 million have been liquidated in the last 24 hours. Out of this total, $773 million were long positions while shorts accounted for $534 million.

Liquidation happens when a trader’s position is forcefully closed because of high leverage or insufficient margin balance. Here, it is important to note that liquidations can have an impact on price trends. From a trading perspective, large OI and short liquidations could trigger a crypto’s price into the overhead resistance. But, ADA had higher long liquidation.

Read Cardano’s [ADA] Price Prediction 2024-2025

When combined with a small OI, it means that the price might dump into the underlying support. Therefore, the potential 75% surge might happen much later after Cardano slips below $0.46.