Is the altcoin season upon us? Takeaways from the Bitcoin halving

- The altcoin market was performing well in the past five months, but the halving fears stalled it.

- The next such run could take a while to materialize, but will leave telltale signs.

The altcoin market has lost a lot of value in the past month as fears swirled around a Bitcoin [BTC] halving.

Prominent crypto analyst Ali Martinez observed on X (formerly Twitter) that altcoin seasons start shortly after Bitcoin halving.

An alt season is when the market capitalization of altcoins multiplies. Given how capital rotation is believed to work in the crypto space, this usually does not last more than a few months.

Yet, it gives investors a great opportunity to capture profits.

Is another altcoin season looming?

Source: Ali_charts on X

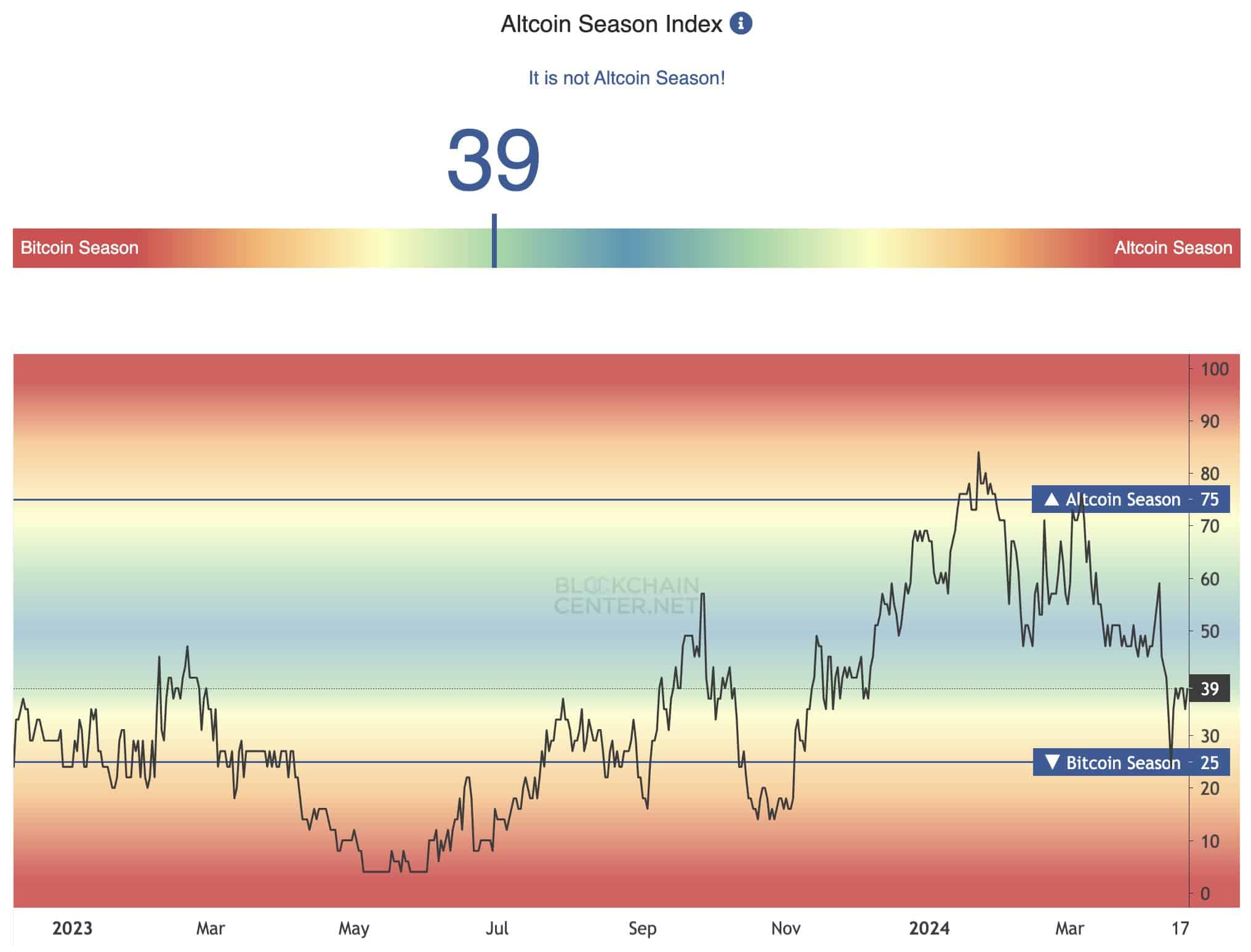

The altcoin season index reached above 75 in early 2024. The halving event saw the index oscillate to the 25 value to reflect Bitcoin season- but in reality, altcoins lost a lot more value than Bitcoin in the past month.

This was a result of the fear of selling pressure behind Bitcoin. At press time, the index was at 39 and did not reflect an altcoin season upon us.

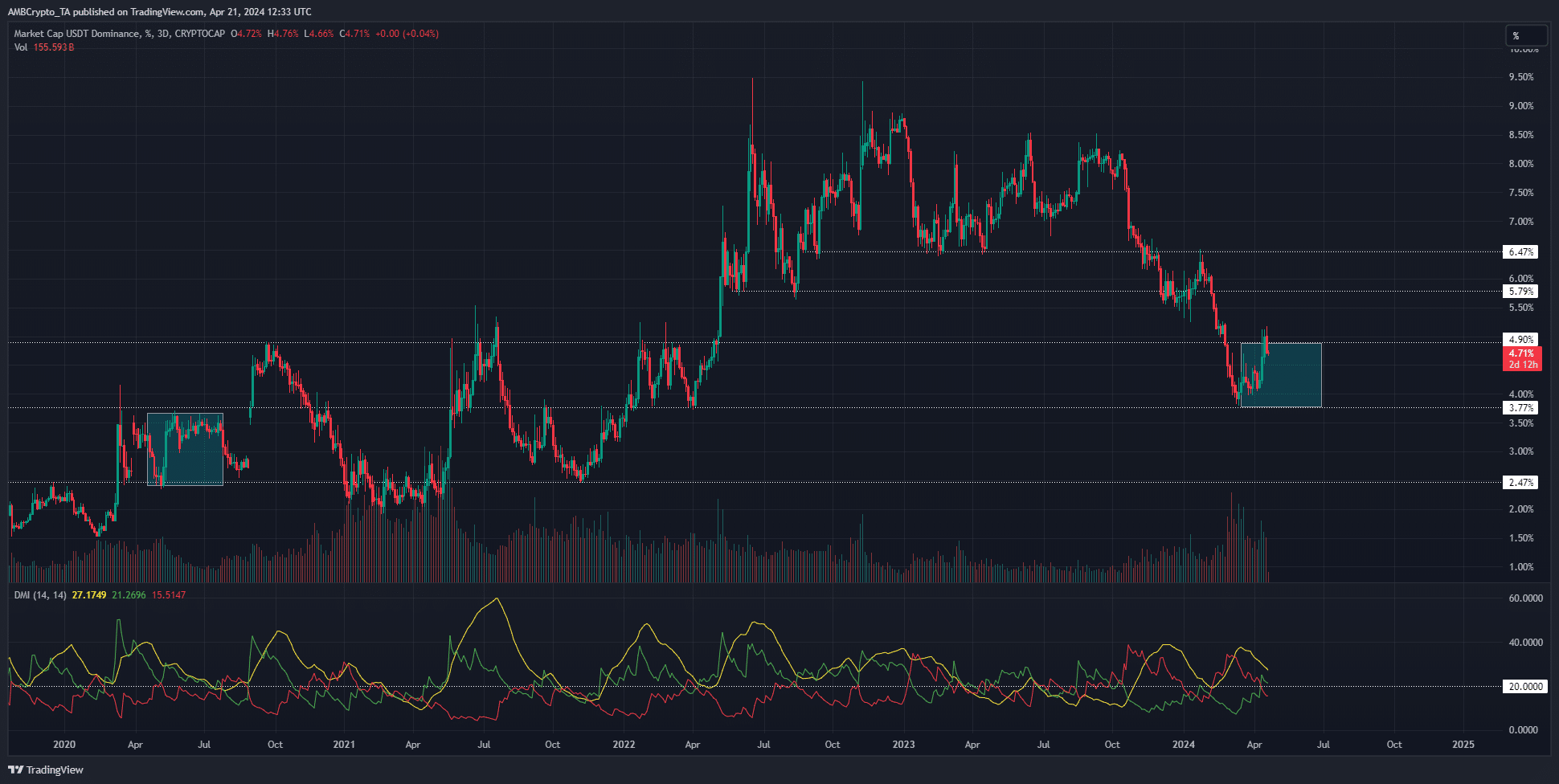

Technical analysis of the Tether [USDT] dominance chart showed that its downtrend was nearing an end.

The USDTD trending downward is a good sign because it denotes investors assuming risk and exchanging stablecoin for crypto assets.

A USDT dominance’s upward trend would show the opposite.

Therefore, in an altseason, we want a strong downtrend. The Directional Movement Index on the 3-day chart showed that a downtrend was in play from late October to early April.

This was a sizeable amount of time and suggested that the market would need time to reset before the next downtrend. Additionally, the cyan boxes highlight the 2020 and 2024 BTC halvings.

If the 2020 similarities play out, we could see altcoins lose more value in the coming weeks.

Buying power in the market was rising

Source: CryptoQuant

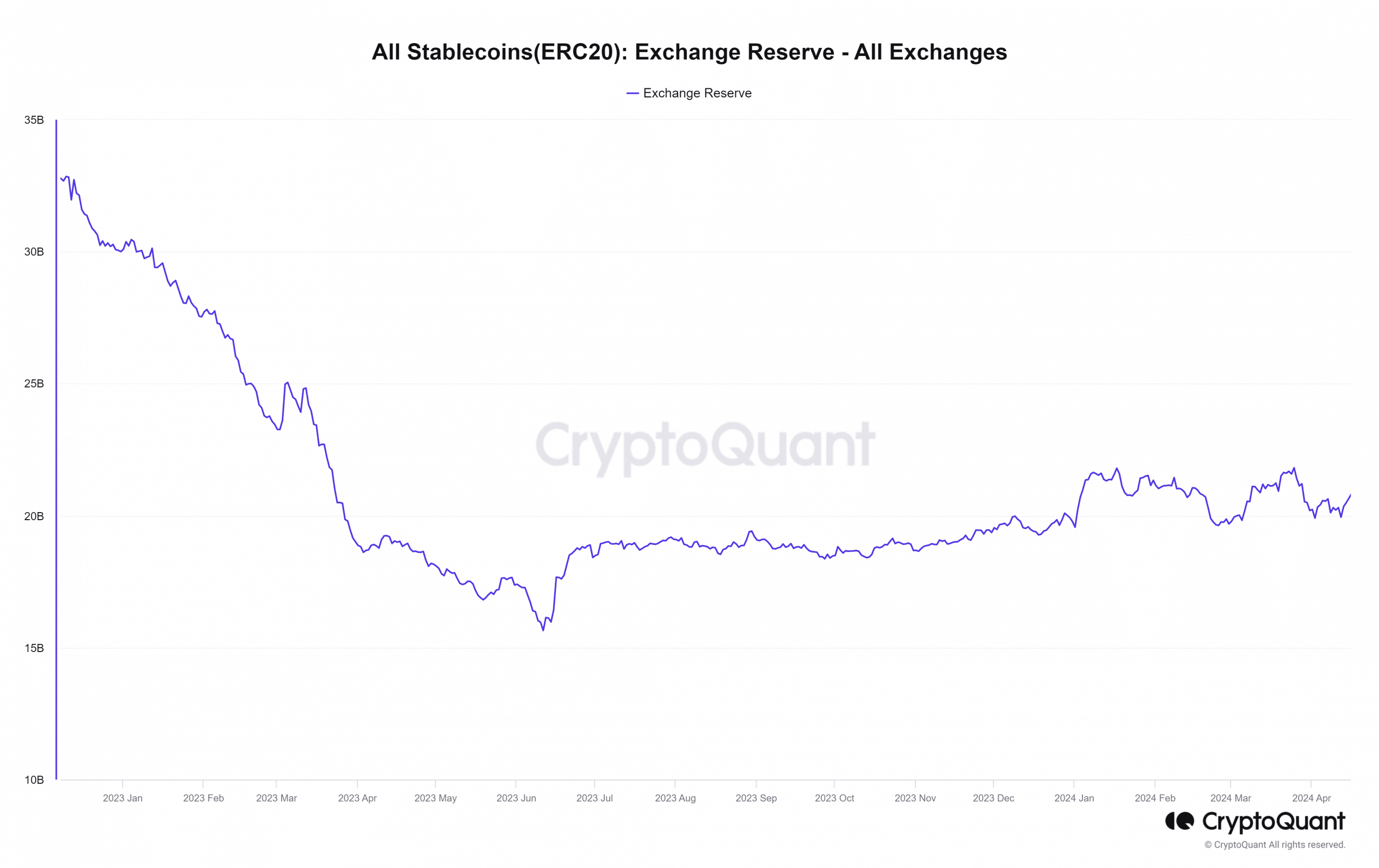

AMBCrypto’s analysis of CryptoQuant data showed that the buying power was climbing higher since mid-October. The exchange reserve of stablecoins is a reflection of the buying power in the crypto market.

Comparing it to the 2020-2021 run, the metric has not yet gone parabolic like it did in the previous cycle. The vast expansion of market capitalization in 2021 saw the exchange reserves climb dramatically.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Therefore, another rapid rise in stablecoin reserves would be an indicator that another altcoin season is upon us.

Combining it with the Tether dominance chart and the altcoin season index could give investors an edge in the markets.