BNB places this group in trouble as bulls eye $630

- Increasing Open Interest and negative Funding Rate placed BNB in place to hit $630.

- BNB might continue to outperform SOL despite the negative sentiment around it.

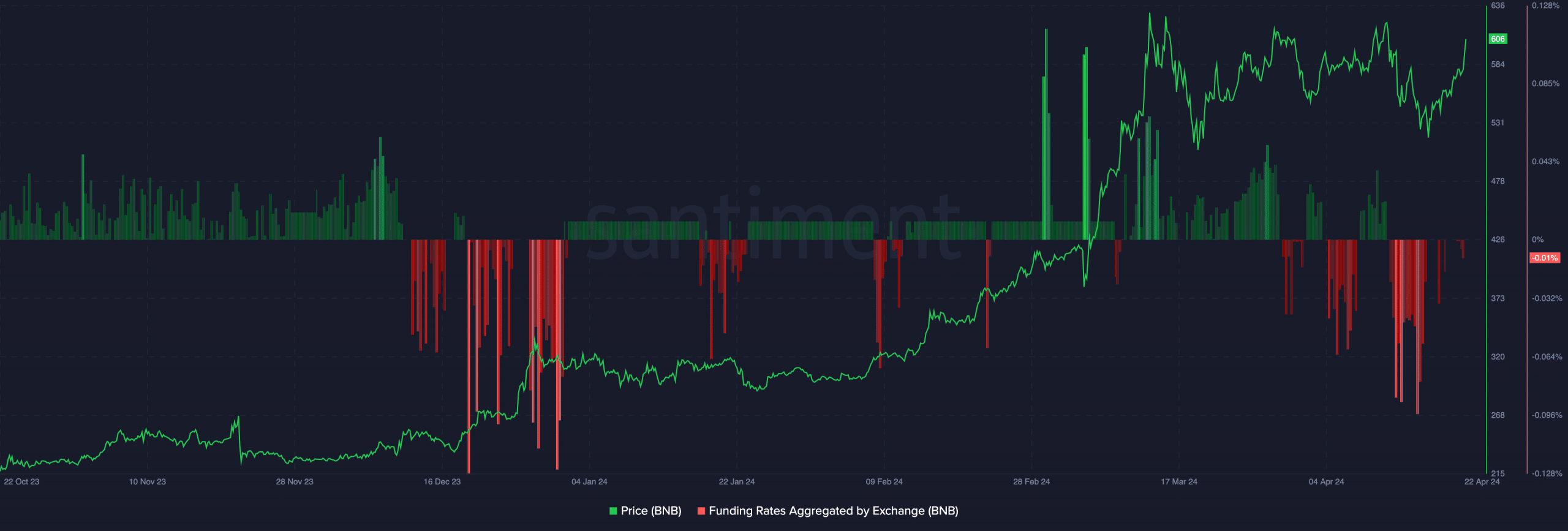

According to AMBCrypto’s analysis, Binance Coin’s [BNB] Funding Rate turned negative on the 22nd of April, implying that short positions dominated the derivative market.

For context, a short is a trader betting on a price decrease to make gains. Funding Rate, on the other hand, is the cost of holding an open perp position.

If positive, longs pay shorts to keep their positions open. But since it was negative, it implied otherwise for BNB. Despite their dominance in the market, shorts were being rewarded for their positions.

BNB is king, sets eyes on another rally

This was because of BNB’s price action. In the last 24 hours, BNB’s price has increased by 4.33%, with the price crossing the much-talked-about $600.

Typically, negative funding alongside a rising price means shorts are not getting rewarded. For the price, this position could be bullish.

Should this remain the case over the next few days, the price of the coin might rise as high as $630. For some time, BNB has been the top performer out of all the cryptocurrencies in the top 10.

On a Year-To-Date (YTD) basis, the value of the coin has increased by 92.12%, beating the likes of Solana [SOL] at its own game. But will the price continue to rise in the short term?

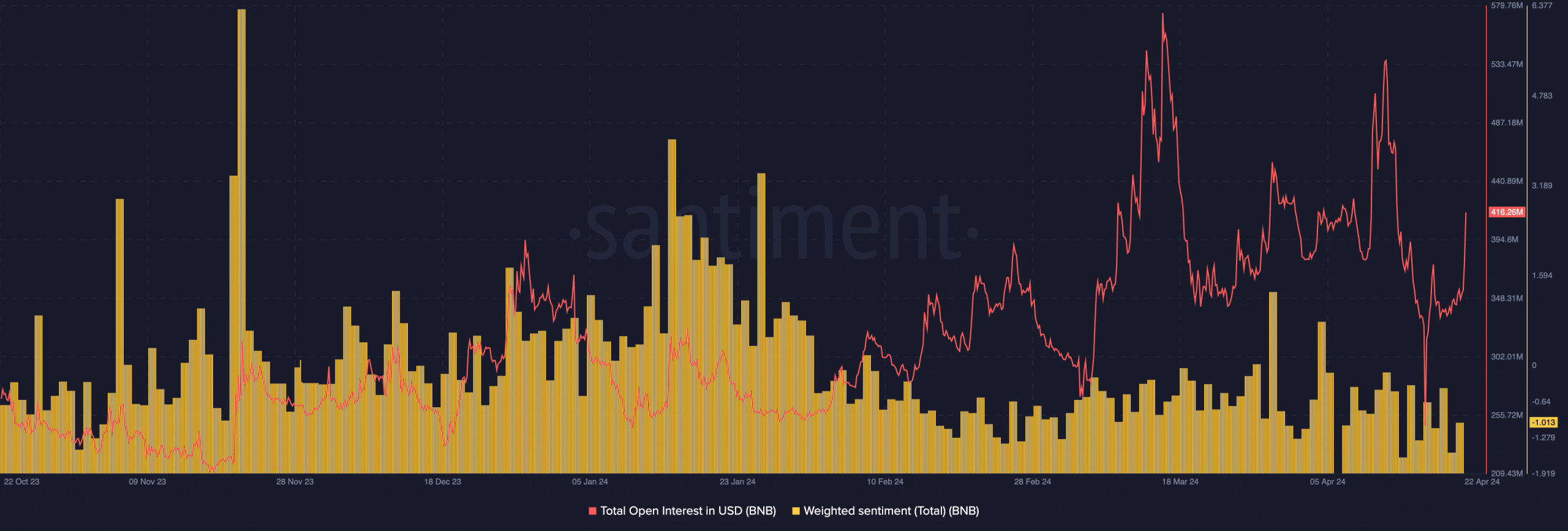

To assess the potential, AMBCrypto looked at BNB’s Open Interest (OI). On-chain data from Santiment showed that the OI increased by 17.89% in the last 24 hours.

This placed the metric at $416.26 million, indicating that many traders were opening more contracts related to the cryptocurrency. Beyond that, OI influences price action.

Despite the coin at your peril

If the OI continues to increase likewise the price, then the uptrend might continue, and longs might keep having an edge over shorts.

On the other hand, if the OI drops while the price rises the upswing might become weak, and a decline could be imminent. But for the time being, that might not be the case.

Furthermore, the Weighted Sentiment around the coin was negative in light of the bullish bias. The negative reading of the metric suggests that comments about BNB were mostly bleak.

Generally, this sentiment is supposed to drag down demand for the coin. But one thing AMBCrypto noticed was that anytime the metric was in the red zone, BNB defied the odds and went on a “hated rally.”

Realistic or not, here’s BNB’s market cap in SOL’s terms

However, traders might need to watch out for BNB momentum in the short term. Should the coin get overbought, the price might retrace and a fall below $600 could be possible.

But as it stands, bears might not be able to halt the coin’s northward move.