Bitcoin – Dump the FUD as BTC’s price is still on course for $85,000!

- Increasing calls to sell BTC could fuel a rebound towards $68,600

- An important metric revealed that the coin has not yet hit the peak of this cycle

In an interesting turn of events, Bitcoin’s [BTC] fall below $63,400 has fueled much Fear, Uncertainty, and Doubt [FUD] in the market. This assertion can be supported by looking at traders’ sentiment over the last 12-24 hours.

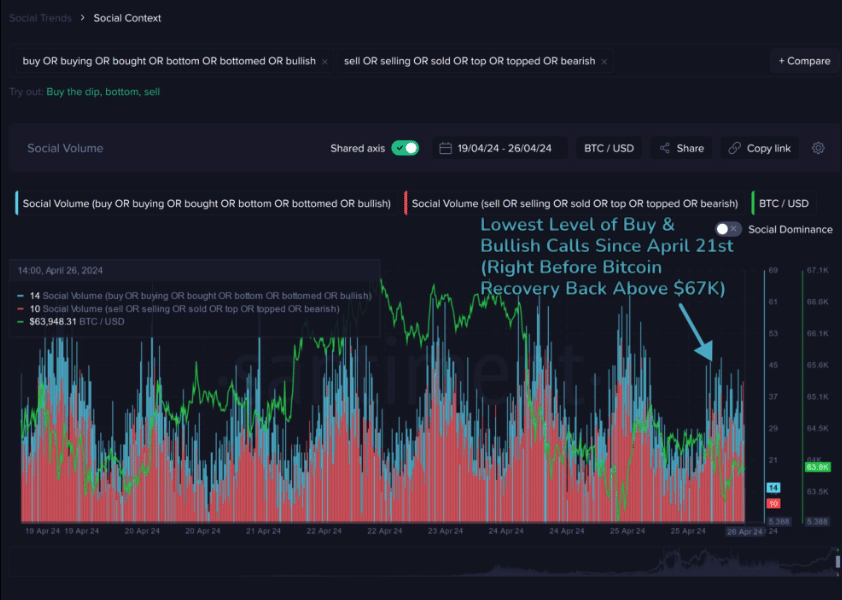

Using Santiment’s on-chain social tool, AMBCrypto noticed that the calls to sell were much more than the ‘buy the dip’ screams. A few weeks ago, that was not the case. This, because any slight dip in the cryptocurrency’s price triggered a wave of bullish calls around that time.

Is fear the power source for a hike?

However, this situation is not entirely bad for Bitcoin as a peak in FUD might set off a bounce on the charts. In fact, something similar happened recently, specifically on 21 April.

On that day, BTC depreciated and fell to $64,531, with many traders opining that a further decline was imminent. Contrary to those expectations, however, Bitcoin swung upwards and hit $67,169.

With that in place, it is possible to see a repeat of that situation if bears continue to share their sentiment publicly. However, it is also important to look at the possibility from a metric-driven PoV.

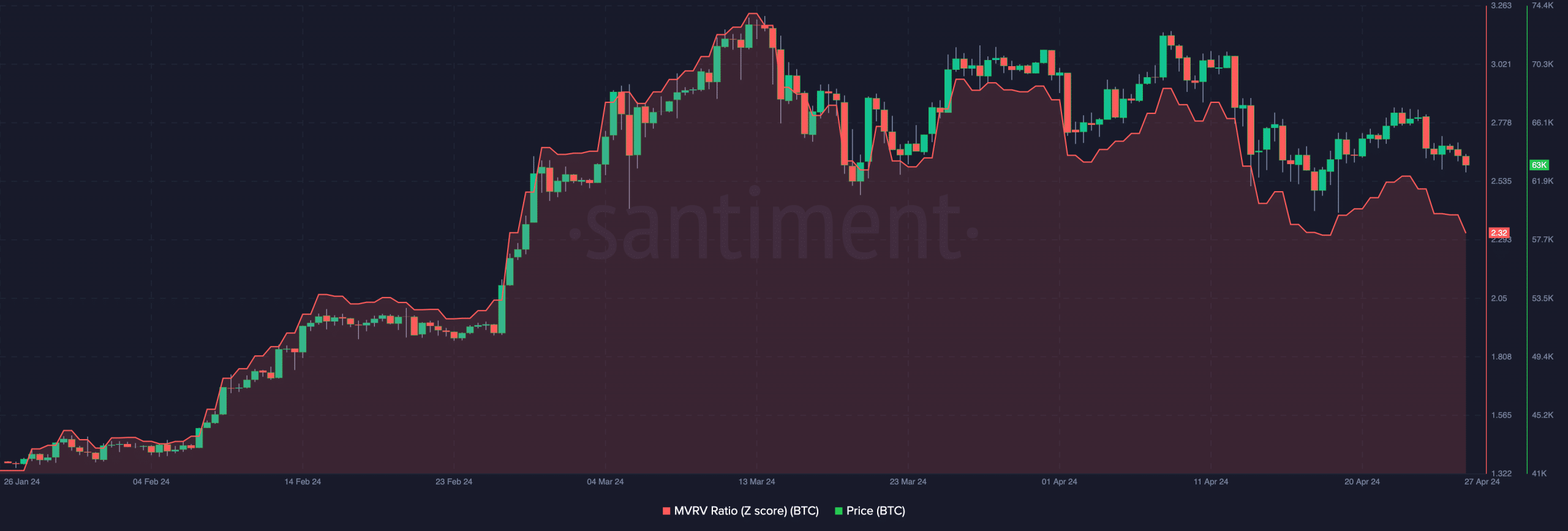

To start off, AMBCrypto looked at the Market Value to Realized Value (MVRV) Z Score. For the uninitiated, the MVRV Z Score can spot the bottoms and tops of a cryptocurrency. It can also tell if an asset is overvalued or undervalued.

At the time of writing, Bitcoin’s MVRV Z Score was 2.32. Looking at the chart below, we can see that since March, the price has recovered every single time the metric fell below 2.60.

However, there is a chance that BTC might drop to lower than $62,400 if bears retain control of the price. If that is the case, the revival could be better, and a hike to $68,600 could be next.

BTC looks sound for the latter part

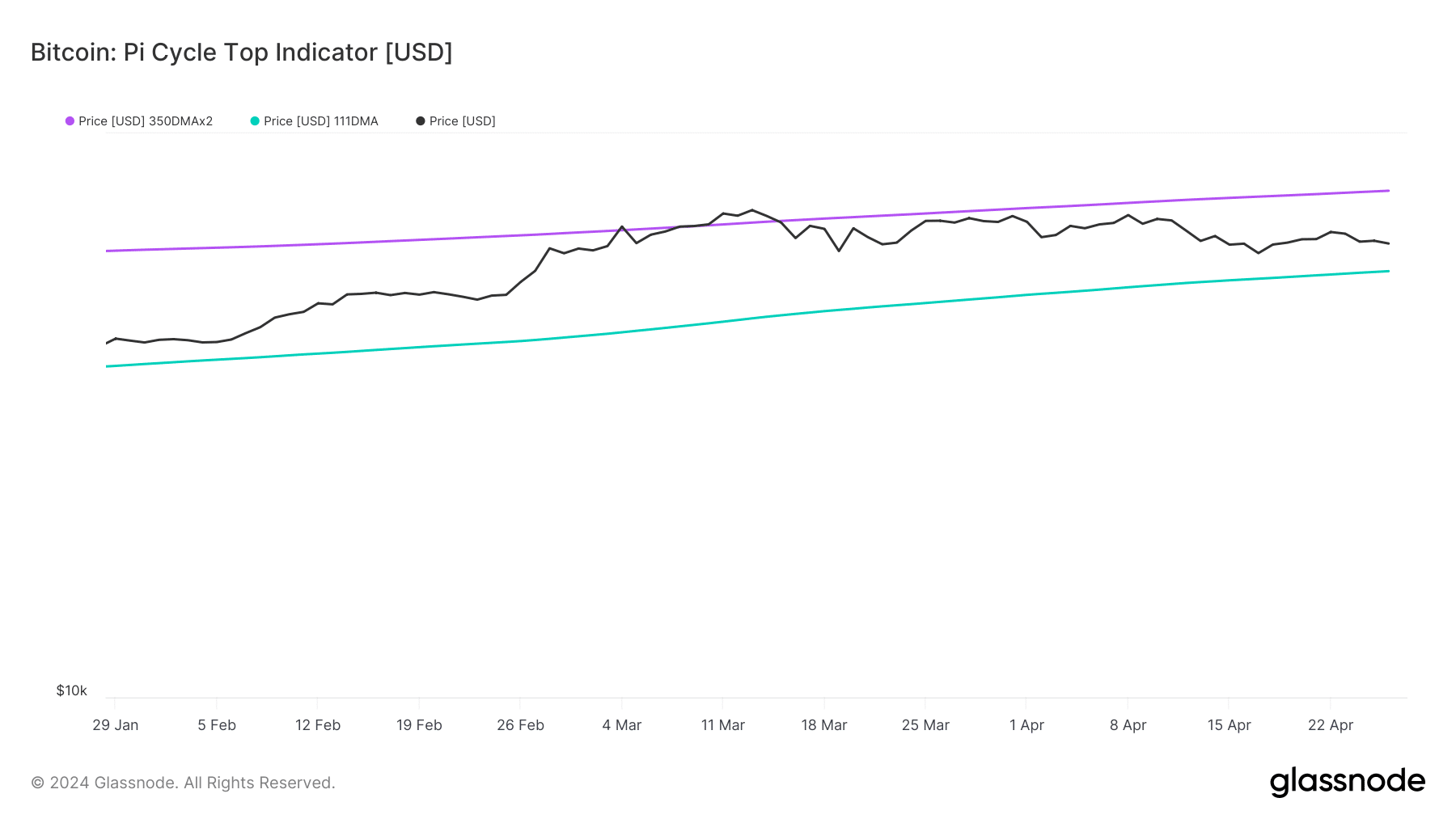

Another metric AMBCrypto evaluated was the Pi Cycle Top indicator. Historically, this metric has been instrumental in identifying when BTC is overheated or otherwise. On the indicator, you would find two lines — A green one and a purple one. The green line represents the 111-day Simple Moving Average (SMA) while the purple indicates the 350-day MA.

In most cases, Bitcoin closes in on the top when the 111SMA reaches the same spot or crosses above the 350SMA. However, at press time, that was not the situation as the green line remained below the purple line.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

The state of this metric seemed great for Bitcoin bulls not only for the short term. but for most of this cycle.

Should the Pi Cycle Top hold its position in the coming months, BTC may rally. And, a target of $80,000 to $85,000 could be possible too.