Ethereum’s next price target – ETH can climb to $3,300 ONLY if…

- Ethereum’s price appreciated by more than 2.5% in the last 24 hours

- Most metrics and market indicators looked bullish on ETH’s charts

As market sentiment changed over the last few hours, Ethereum [ETH] benefited from the same as its daily chart turned green. However, the latest uptick might just be the beginning of a massive rally, especially since the king of altcoins’ price is now moving inside a bullish pattern.

Ethereum’s bullish move

The last 7 days weren’t in the investors’ best interests as ETH’s price dropped by over 5%. However, as the market trend changed, ETH also managed to push its price up by more than 2.5% in 24 hours. According to CoinMarketCap, at the time of writing, ETH was trading at $2,988.30 with a market capitalization of over $358 billion.

Interestingly, things might get even better for ETH in the coming days. World of Charts, a popular crypto-analyst, recently shared a tweet highlighting that the ETH/BTC pair was moving inside a falling edge pattern. A successful breakout from the pattern could result in ETH hitting new highs in the coming months.

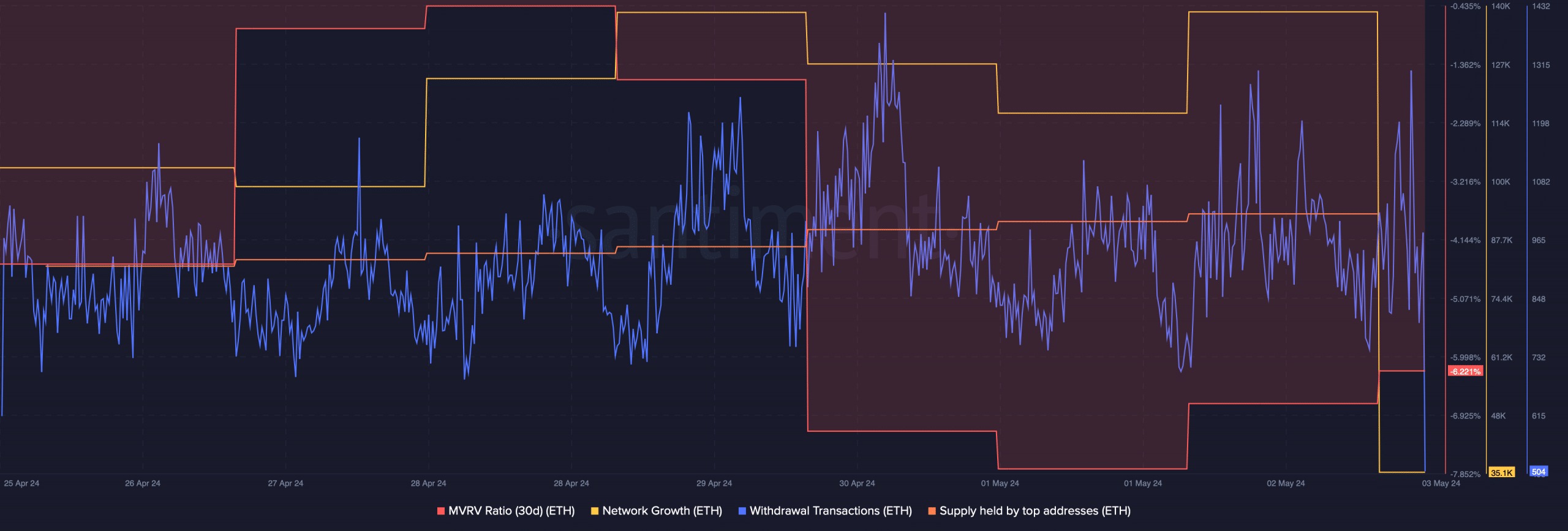

Therefore, AMBCrypto checked ETH’s metrics to see whether it would manage a breakout. Our analysis of Santiment’s data revealed that ETH’s network growth hiked over the last few days. Simply put, more addresses were created to transfer the token as its active withdrawal rate climbed last week.

Additionally, Ethereum’s supply held by top addresses also rose slightly, suggesting that buying pressure on the token was high.

On the contrary, its MVRV ratio remained low. At press time, ETH’s MVRV ratio had a value of -6.22%.

Ethereum’s weekly target

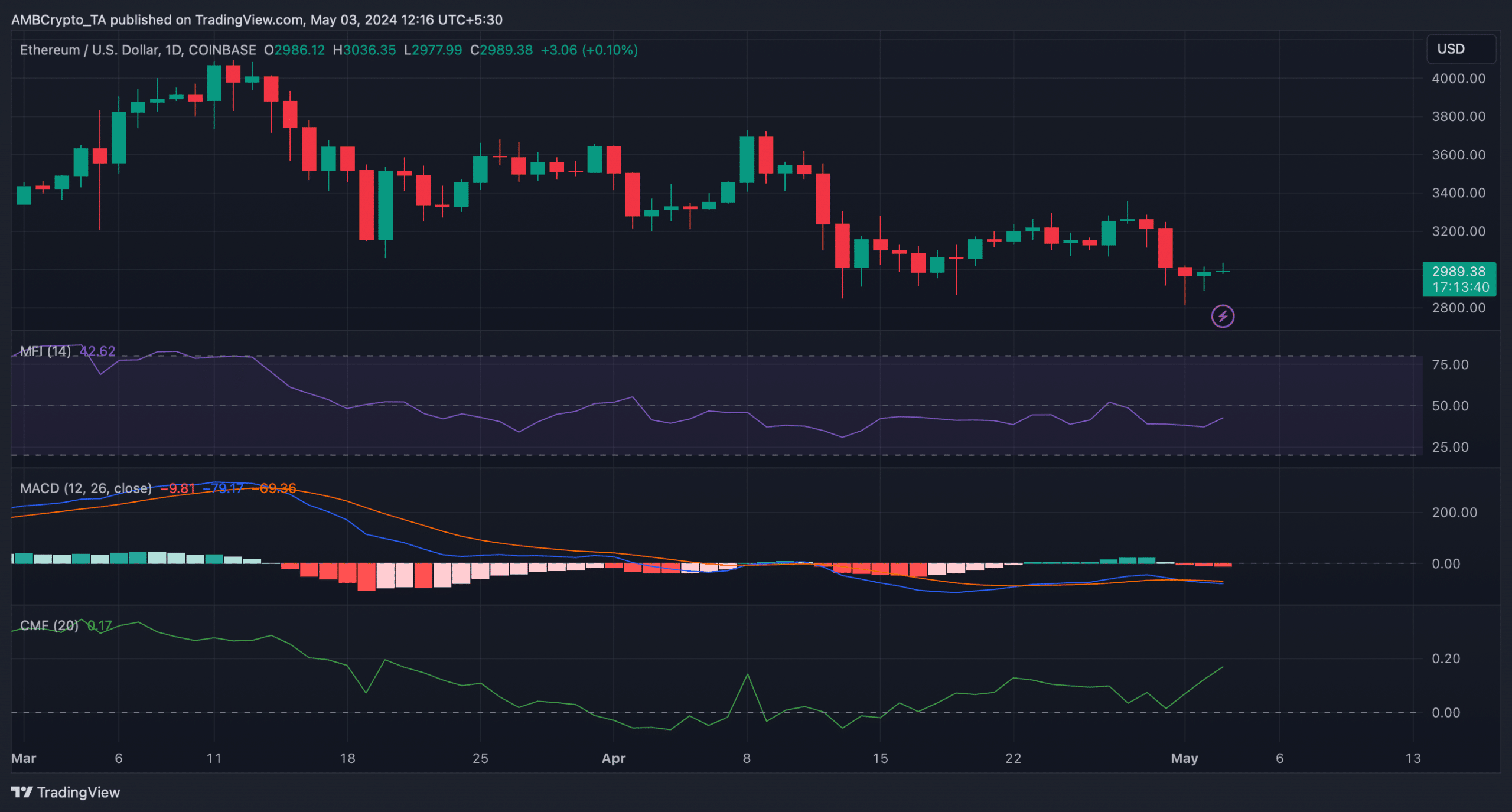

Since most metrics seemed bullish, AMBCrypto then checked ETH’s daily chart to see whether a further uptrend was inevitable.

We found that ETH’s Chaikin Money Flow (CMF) registered a sharp uptick from the neutral level. The Money Flow Index (MFI) also went north. Both of these indicators suggest that the chances of a sustained bull rally are high.

On the other hand, the MACD supported the sellers as it flashed a bearish crossover on the charts.

We then analyzed Hyblock Capital’s data to find out the possible targets ETH might hit this week if the bull rally lasts. In order for ETH to sustain the rally, it will be crucial for the token to go above $3,100, as liquidations would rise sharply.

Read Ethereum’s [ETH] Price Prediction 2024-25

A hike in liquidations could result in a price correction. A successful breakout above that level could allow ETH to climb to $3,300 by the end of this week if everything falls into place.