Bitcoin miners’ halving hangover – Here’s what Stronghold is up to

- Some Bitcoin miners are considering strategic alternatives like asset sales post-halving

- Miners “extremely underpaid,” revenues now at lowest levels since late 2022

The much-anticipated Bitcoin [BTC] halving came and went last month. However, while it’s yet to have its intended impact on the price front, its miners have certainly been affected by the same.

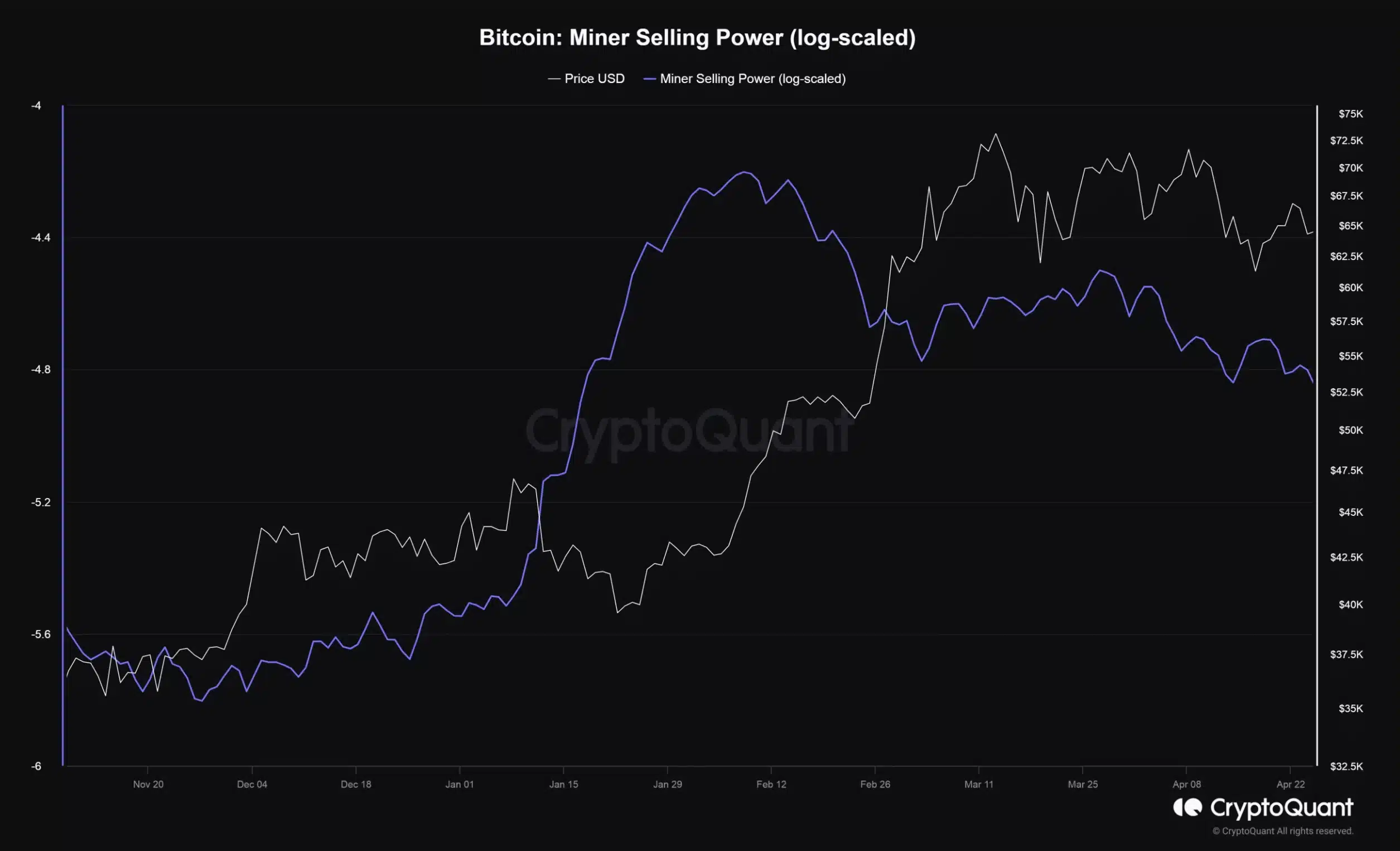

In fact, AMBCrypto’s analysis of CryptoQuant data revealed a notable decline in selling pressure from miners post-halving.

Stronghold’s strategic decisions

With BTC falling on the price charts, many miners are concerned. Stronghold Digital Mining, a leading Bitcoin mining company, is one of them. And, it’s in the news today after it announced its financial and operational results for the first quarter of 2024.

Here, it’s worth remembering that mining rewards are slashed after each halving event, a factor that could have played a role in influencing Stronghold’s strategic decisions.

As per a press release report released on 2 May,

“The company is considering a wide range of alternatives to maximize shareholder value, including, but not limited to, the sale of all or part of the Company, or another strategic transaction involving some, or all of, the assets of the Company.”

This announcement has drawn a lot of attention, especially considering the potential implications of miner capitulation following the Bitcoin halving event.

Miner capitulation occurs when many miners in the cryptocurrency industry cease or scale back their mining activities due to various factors like a prolonged drop in the cryptocurrency’s price or rising operational expenses.

Stronghold’s potential for growth

Emphasizing Stronghold’s robust position in the market and its potential for further growth and diversification, Greg Beard, Chairman and Chief Executive Officer of Stronghold, added,

“We have observed what we believe to be valuation dislocation when comparing Stronghold’s market value to valuations of public Bitcoin mining peers, merchant power companies, and data center and power generation assets trading in the market.”

Following the same, the company saw a significant uptick in revenue, marking a sequential increase of 27% and a year-over-year surge of 59%, culminating in a total revenue of $27.5 million in the first quarter of 2024.

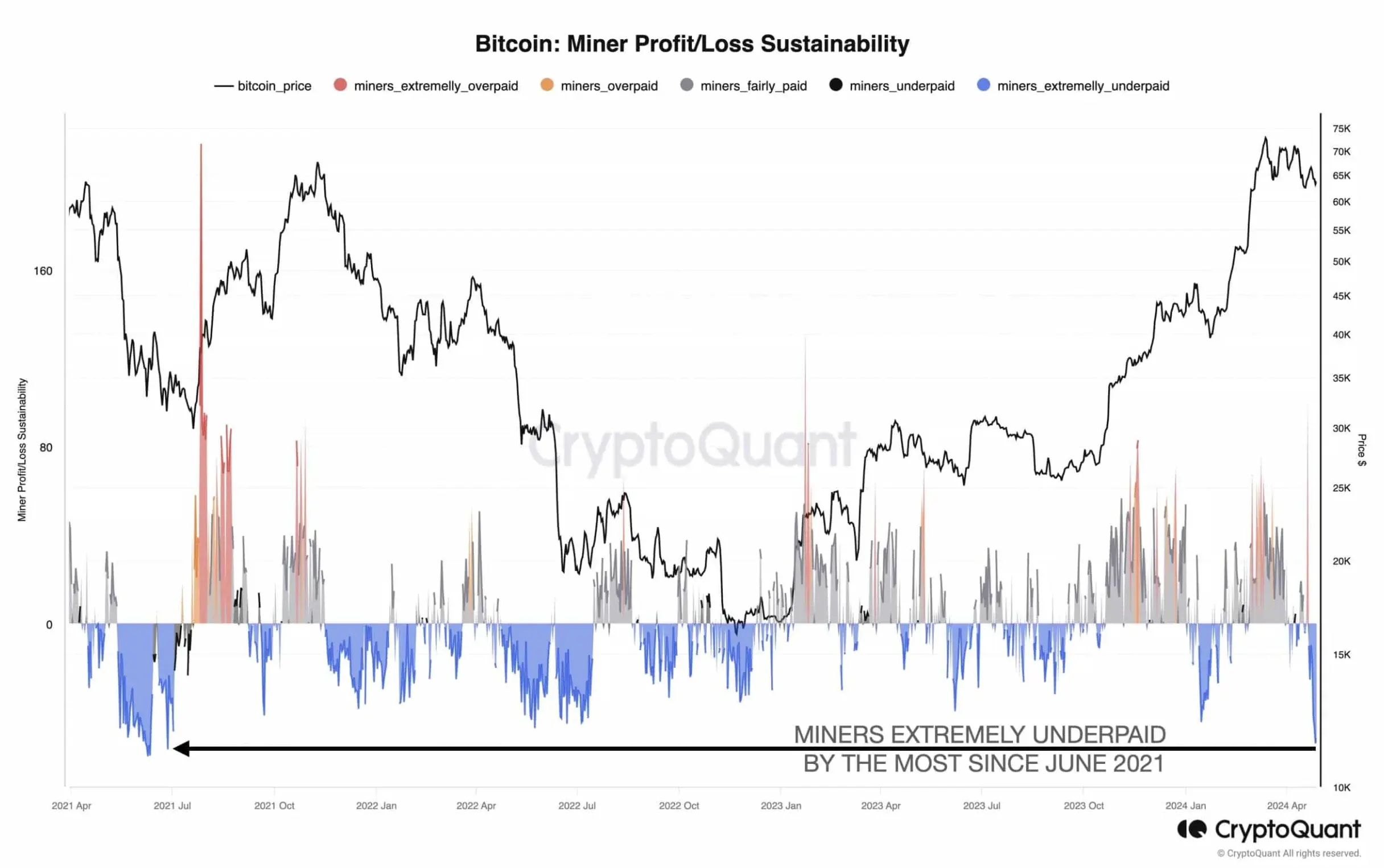

Interestingly, drawing parallels with historical data, Julio Moreno, Head of Research at on-chain analytics firm CryptoQuant, said,

“Bitcoin miners are extremely underpaid right now as daily revenues have plummeted to the lowest since Nov 2022. The miner profit/loss sustainability reached the lowest since June 2021.”

The aforementioned metric compares block rewards to mining difficulty, showing that miners have been underpaid. Additionally, daily revenues were down on the charts too.

This happened because the halving cut miners’ block rewards in half, forcing miners to double their investments to break even, resulting in small miners struggling to survive.

Way forward

This raises a crucial question – How will miners change their business plans and mining activities to keep supporting Bitcoin with fewer rewards?

While it’s tough right now, the halving may lead to miners becoming more efficient and stronger. As major players like Stronghold explore strategic alternatives, all eyes are on how the mining landscape will evolve to meet this new reality.