Is Bitcoin Runes back to square one? Declining activity raises questions

- Fees generated by Runes to Bitcoin have fallen to 21.1% after an earlier dominance of 77.3%.

- Declining activity on the protocol and Ordinals have led miners’ revenue to plunge.

Bitcoin Runes, a token standard launched on the Bitcoin [BTC] blockchain less than 30 days ago, has recorded a massive decline in activity.

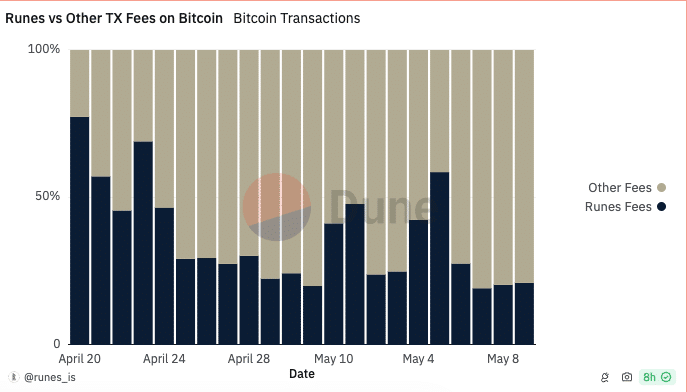

According to Dune Analytics, the total fees on the network were nowhere near the heights of the earlier introduction.

Casey Rodarmor, the same developer of Bitcoin Ordinals, developed the Runes protocol. The protocol aimed to improve the creation and management of fungible tokens on the blockchain.

From Rodarmor’s angle, this development might expand Bitcoin’s influence, and attract users to the network. Interestingly, the introduction of Runes coincided with the Bitcoin halving.

Activity fizzles, stops miners’ fanfare

As such, it did not take long for adoption to skyrocket. This ensured that Runes protocol generated over $135 million in fees in its first week.

However, data from Dune confirmed that activity had decreased on the protocol. For instance, Runes’ fees accounted for 77.3% of the total Bitcoin fees on the 20th of April.

At that time, other fees on the blockchain only shared 22.7%. But as of this writing, it was no longer the same. This time, other fees had a market share of 78.9% while Runes accounted for 21.1%.

If unattended to, this decline poses a risk to miners. Previously, the creation and generation of new rune units helped miners make a good amount of money in the initial stages.

During that period, AMBCrypto explained how the development of the protocol could act as cover, since rewards were cut in half.

However, that forecast might no longer hold water unless activity on the protocol begins to improve.

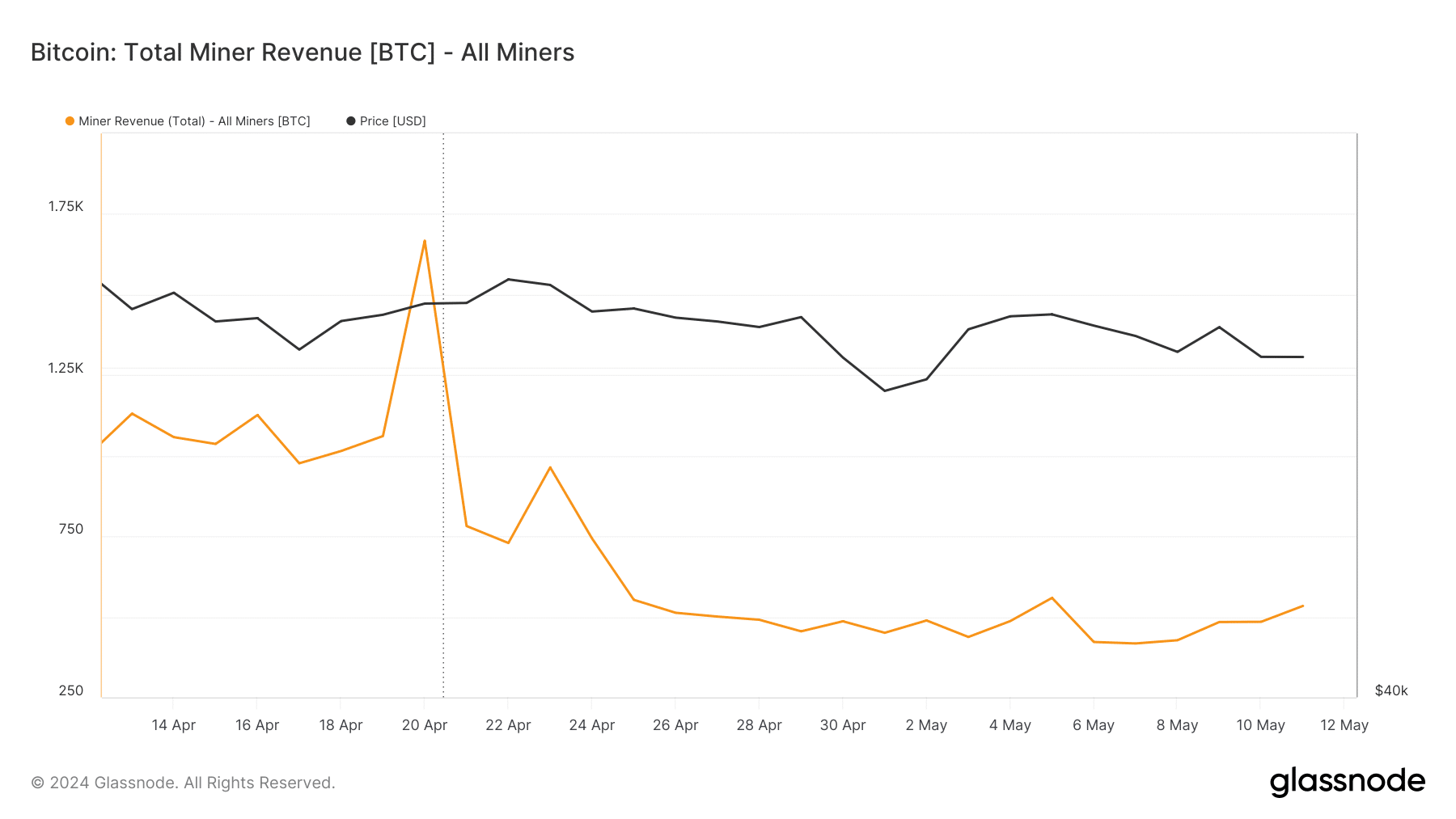

A look at Glassnode data confirmed this bias. According to on-chain data from Glassnode, miners’ revenue was 533.69 BTC on the 11th of May.

This was a significant decline when compared to the value on the 20th of April. At that time, the total revenue was 1677.09 BTC. The decline could be linked to the decreasing activity on Runes protocol.

Ordinals are not left out

On a broader outlook, it was also a sign of waning activity on the Bitcoin network. Meanwhile, Runes was not the only one plagued by disinterest.

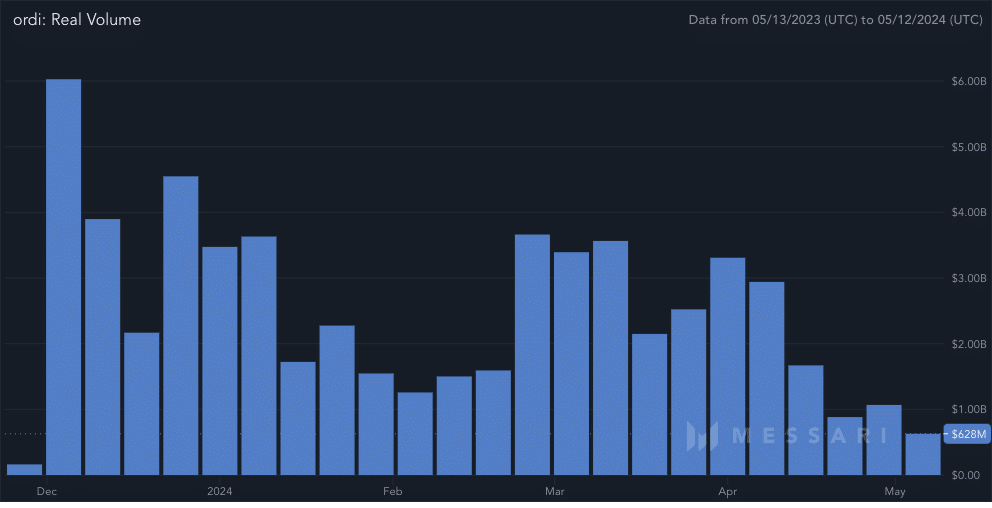

According to Messari, Bitcoin Ordinals, as well as BRC-20 tokens had their share of the heat. For context, BRC-2o tokens are fungible tokens created on Bitcoin using the Taproot update.

At press time, the price of ORDI, the largest BRC-20 token by market cap, was $36.37. This was a staggering 61.88% decrease from its all-time high.

Realistic or not, here’s ORDI’s market cap in BTC’s terms

Like its price, the volume has also been decreasing. As of this writing, ORDI’s volume was $628 million.

In December 2023, the same metric was over $6 billion, meaning that interest in the token was now 10 times lower.