Toncoin [TON] to outperform Bitcoin? Investors are waiting for THIS…

![Toncoin [TON] to outperform Bitcoin? Investors wait with bated breath](https://ambcrypto.com/wp-content/uploads/2024/05/Toncoin-Featured-Image-1200x686.webp)

- Toncoin’s dormant circulation was quiet, suggesting reduced selling pressure

- The performance compared to Bitcoin meant TON investors were jubilant

Toncoin [TON] outperformed Bitcoin [BTC] in the past few days. It has gained 21.36% in the past seven days and 4.98% in the past 24 hours, based on CoinMarketCap data.

By comparison, BTC has dropped 2.84% in the past week and gained 2.26% in the past 24 hours.

The social volume of TON was one of the outliers in the crypto market, rising by more than 20% compared to the previous week. Could this trend continue?

One metric that marked the previous local top has been silent, so far

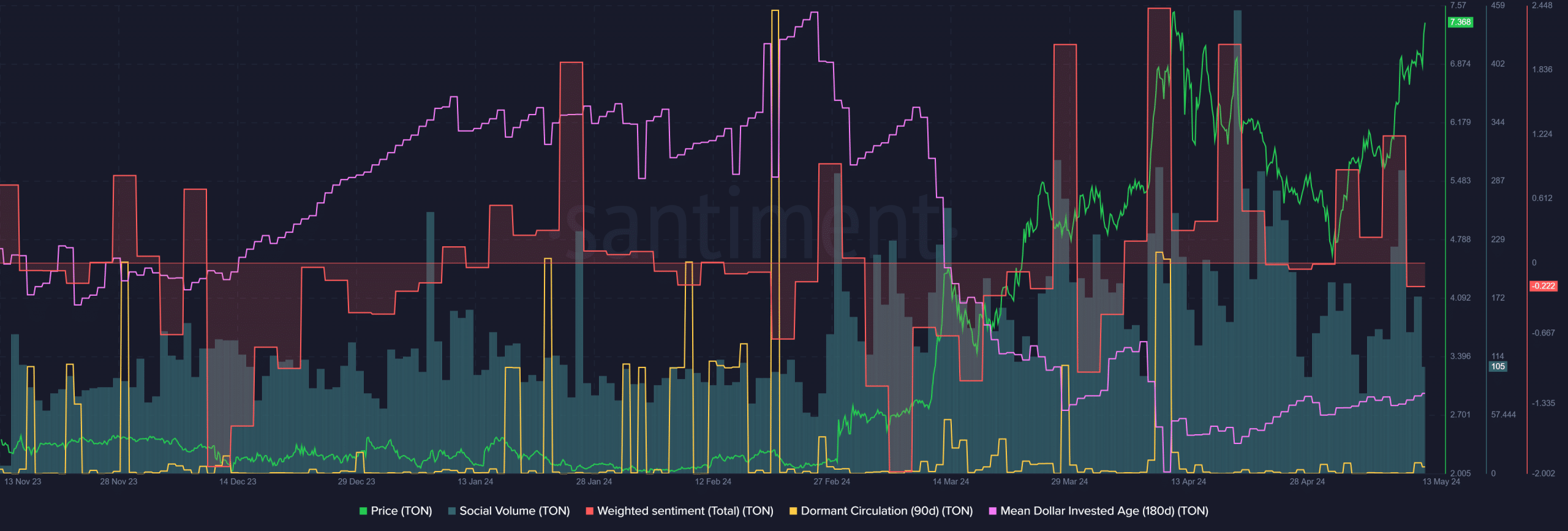

Source: Santiment

The social volume of TON fell lower from the 21st of April to the 1st of May but has been resurgent since then. The price has also performed well since the 1st of May, reversing the retracement from $7 to $4.6.

During this time, the Weighted Sentiment has been positive, but at press has fallen into negative territory. This indicated that some fear might be creeping into the Toncoin market.

The mean dollar invested age has slowly trended upward over the past month. It indicated that the tokens were starting to become more dormant gradually, which points toward accumulation.

The dormant circulation was also minimal in the past month. The metric saw a large spike on the 10th of April and nothing since then. That spike coincided with the local top for TON.

Therefore, traders and investors can keep an eye on the dormant circulation metric. A rapid, enormous spike would likely hint that a local top might be in.

Relative strength against Bitcoin is valuable, and Toncoin has plenty of it

The performance of Toncoin in May as a top 10 asset by market capitalization should invigorate buyers. While Bitcoin fell below $60k, bounced to $65.5k and faced another rejection, TON has trended higher.

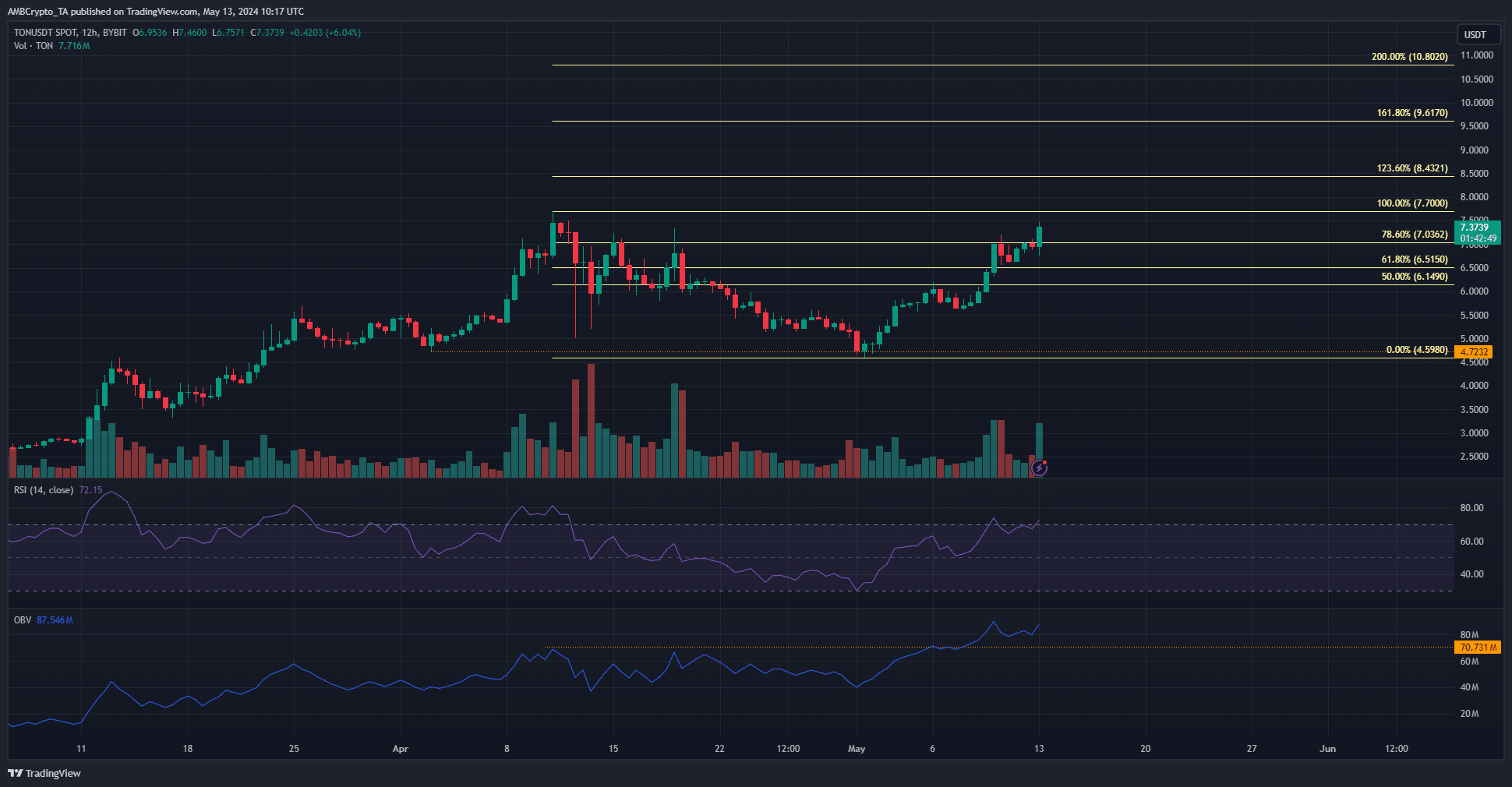

The Fibonacci levels showcased the likelihood of further gains was good.

Is your portfolio green? Check out the TON Profit Calculator

The move past the 78.6% retracement level meant that the downtrend to $4.6 might not see newer lows, but instead the price could trend toward the Fib extension levels northward.

The 161.8% and 200% extension levels at $9.61 and $10.8 were technical targets where bulls could realize profits.