How to predict Bitcoin cycle tops using GameStop and GME’s social volume

- How much correlation does GME’s rally and its social volume have with Bitcoin’s price trends?

- Impact of the same was seen on the higher timeframes during the previous cycle

Bitcoin [BTC] climbed above its short-term local resistance at $64.5k on 15 May, just two days after GameStop [GME] posted a 284% rally measured from last Friday. According to a recent post on X (formerly Twitter), Santiment claimed that the GME craze had in fact bled over into crypto.

Given the speculative nature of the crypto-market, especially in the memecoin sector, this overlap makes sense. To find out whether crowd sentiment can mark cycle tops and bottoms, AMBCrypto searched for more parallels.

Short-term top and bottom coincided with increased social activity

Source: Santiment on X

In the short term, GME/AMC social mentions did mark Bitcoin’s top and bottom over the last three days. And yet, it might not be that these social trends foreshadowed a shift in trend. It’s more likely that they merely coincided with them.

13 May was the Monday after the weekend when Roaring Kitty marked the end of a 3-year hibernation with a meme on X (formerly Twitter). On 15 May, the Consumer Price Index and inflation data came out too, and it came out lower than anticipated. This led to greater risk-taking tendencies among participants.

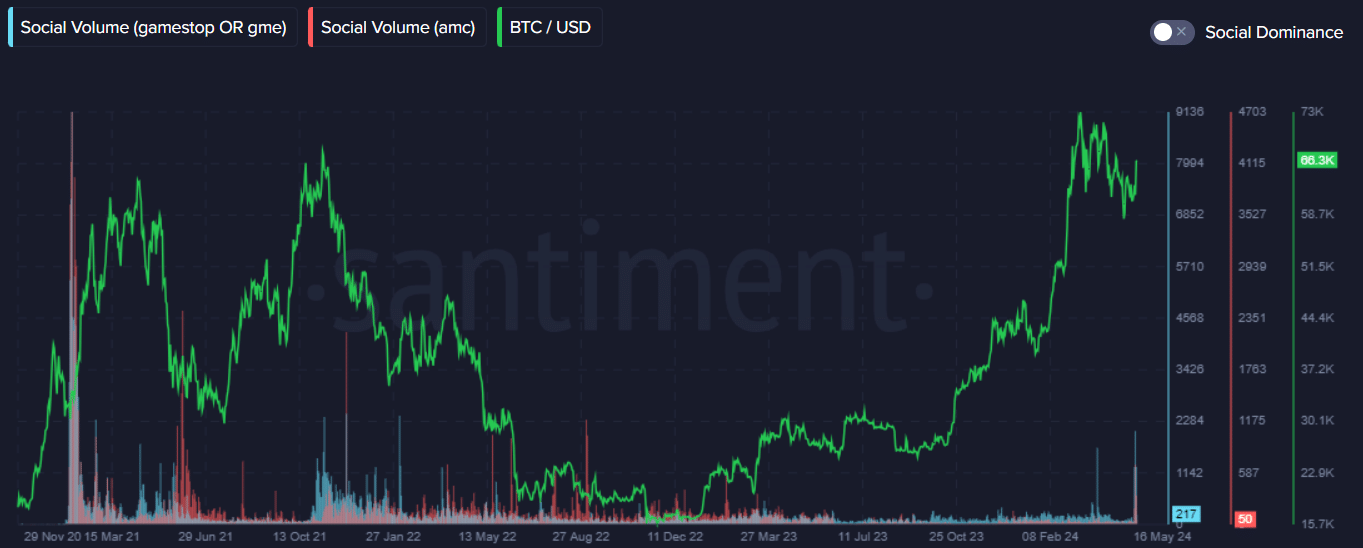

Source: Santiment

GameStop’s social volume was extraordinarily high in January and November of 2021. In January 2021, Bitcoin prices had just recovered from a deep retracement to $31k, before resuming its blistering rally.

On the other hand, November 2021’s social volume surge marked the top for the crypto, and BTC prices soon began to slump. Hence, even though the recent correlation has an explanation, there may be some substance to Santiment’s latest observations.

Traders and investors might want to keep an eye on these metrics in the future.

What about the altcoin market’s capitalization?

The January and November 2021 GME social volume spikes coincided not just with Bitcoin’s rally and tops, but also with the altcoin market’s capitalization. However, the May 2024 one did not. In fact, altcoins’ market cap has been expanding since October 2023.

Is your portfolio green? Check the Bitcoin Profit Calculator

In conclusion, the relationship appears to be that of a surge in GME social activity strengthening a prevailing bullish trend in the crypto-market. However, it will not necessarily manufacture one.